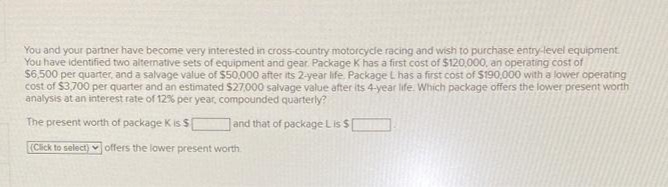

You and your partner have become very interested in cross-country motorcycle racing and wish to purchase entry-level equipment You have identified two alternative sets of equipment and gear. Package K has a first cost of $120,000, an operating cost of $6,500 per quarter, and a salvage value of $50,000 after its 2-year life. Package L has a first cost of $190,000 with a lower operating cost of $3.700 per quarter and an estimated $27000 salvage value after its 4-year life. Which package offers the lower present worth analysis at an interest rate of 12% per year, compounded quarterly? The present worth of package Kis $ and that of package Lis $ (Cick to select) v offers the lower present worth.

You and your partner have become very interested in cross-country motorcycle racing and wish to purchase entry-level equipment You have identified two alternative sets of equipment and gear. Package K has a first cost of $120,000, an operating cost of $6,500 per quarter, and a salvage value of $50,000 after its 2-year life. Package L has a first cost of $190,000 with a lower operating cost of $3.700 per quarter and an estimated $27000 salvage value after its 4-year life. Which package offers the lower present worth analysis at an interest rate of 12% per year, compounded quarterly? The present worth of package Kis $ and that of package Lis $ (Cick to select) v offers the lower present worth.

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 18P

Related questions

Concept explainers

Question

Please solve in 1/2 hour it's urgent

Transcribed Image Text:You and your partner have become very interested in cross-country motorcycle racing and wish to purchase entry-level equipment

You have identified two alternative sets of equipment and gear. Package K has a first cost of $120,000, an operating cost of

$6,500 per quarter, and a salvage value of $50,000 after its 2-year life. Package L has a first cost of $190,000 with a lower operating

cost of $3.700 per quarter and an estimated $27.000 salvage value after its 4-year life. Which package offers the lower present worth

analysis at an interest rate of 12% per year, compounded quarterly?

The present worth of package K is $

and that of package Lis $

(Click to select) offers the lower present worth

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning