The problem requires you to use File C03 on the computer problem spreadsheet. Diction Publishing estimates that it needs $500,000 to support its expected growth. The underwriting fees charged by the investment banking firm for which you work are 6.5% for such issue sizes. In addition, it is estimated that Diction will incur $4,900 in other expenses related to the IPO. If your analysis indicates that Diction's stock can be sold for $40 per share, how many shares must be issued to net the company the $500,000 it needs? b. Suppose that Diction's investment banker charges 10% rather than 6.5%. Assuming that all other information given earlier is the same, how many shares must Diction issue in this situation to net the company the $500,000 it needs? C. Suppose that Diction's investment banker charges 8.2% rather than 6.5%. Assuming that all other information given earlier is the same, how many shares

The problem requires you to use File C03 on the computer problem spreadsheet. Diction Publishing estimates that it needs $500,000 to support its expected growth. The underwriting fees charged by the investment banking firm for which you work are 6.5% for such issue sizes. In addition, it is estimated that Diction will incur $4,900 in other expenses related to the IPO. If your analysis indicates that Diction's stock can be sold for $40 per share, how many shares must be issued to net the company the $500,000 it needs? b. Suppose that Diction's investment banker charges 10% rather than 6.5%. Assuming that all other information given earlier is the same, how many shares must Diction issue in this situation to net the company the $500,000 it needs? C. Suppose that Diction's investment banker charges 8.2% rather than 6.5%. Assuming that all other information given earlier is the same, how many shares

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

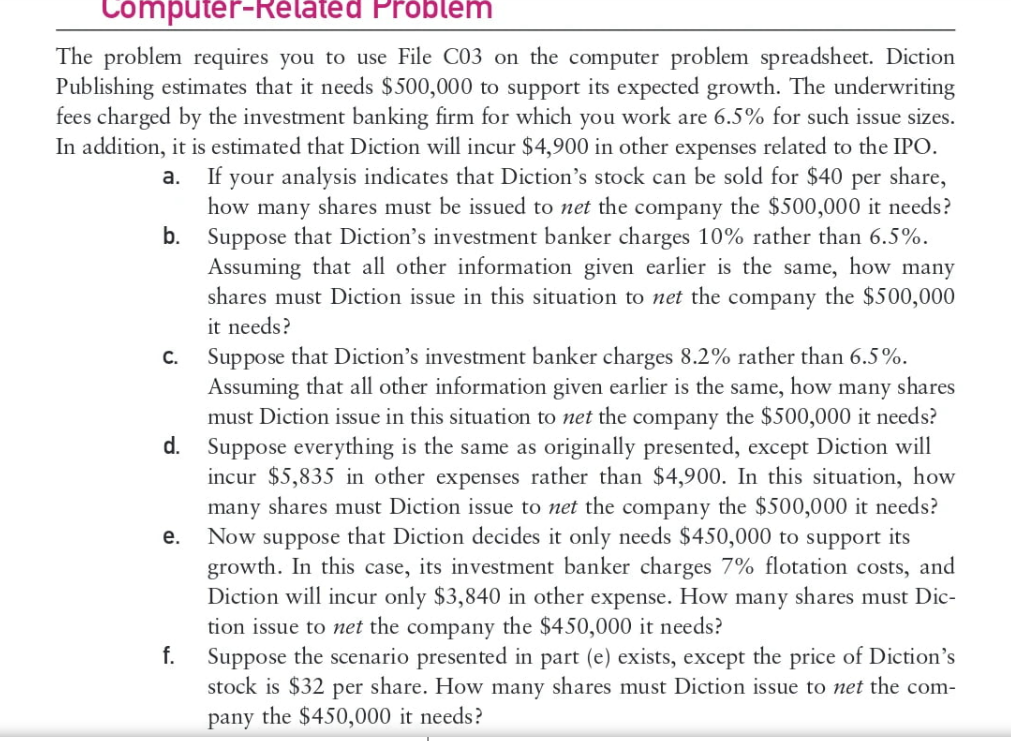

Transcribed Image Text:Computer-Related Problem

The problem requires you to use File C03 on the computer problem spreadsheet. Diction

Publishing estimates that it needs $500,000 to support its expected growth. The underwriting

fees charged by the investment banking firm for which you work are 6.5% for such issue sizes.

In addition, it is estimated that Diction will incur $4,900 in other expenses related to the IPO.

If your analysis indicates that Diction's stock can be sold for $40 per share,

how many shares must be issued to net the company the $500,000 it needs?

b. Suppose that Diction's investment banker charges 10% rather than 6.5%.

Assuming that all other information given earlier is the same, how many

shares must Diction issue in this situation to net the company the $500,000

a.

it needs?

Suppose that Diction's investment banker charges 8.2% rather than 6.5%.

Assuming that all other information given earlier is the same, how many shares

must Diction issue in this situation to net the company the $500,000 it needs?

d. Suppose everything is the same as originally presented, except Diction will

incur $5,835 in other expenses rather than $4,900. In this situation, how

many shares must Diction issue to net the company the $500,000 it needs?

Now suppose that Diction decides it only needs $450,000 to support its

growth. In this case, its investment banker charges 7% flotation costs, and

Diction will incur only $3,840 in other expense. How many shares must Dic-

tion issue to net the company the $450,000 it needs?

C₁

e.

f.

Suppose the scenario presented in part (e) exists, except the price of Diction's

stock is $32 per share. How many shares must Diction issue to net the com-

pany the $450,000 it needs?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education