The propensity to consume tells us by how much consumption changes for a given change in disposable income. To analyze this fact, follow these steps: 5- Go to the Federal Reserve Economic Data (FRED) https://fred.stlouisfed.org/. download the series A067RX1A020NBEA and PCECCA since 1999. Make sure all series are in real terms and in comparable units. Compile a single spreadsheet with these series. 6- In the spreadsheet, first compute the annual growth rate of disposable income and consumption for all years in the sample. Then compute the average for the period 2000-2017 for both variables. Finally, construct a demeaned measure of the annual growth rate of disposable income and consumption for all years in the sample. That is, let C t denote consumption in year t. Then, the growth rate of consumption between year t and t−1 is [(C t /C t−1 )−1], denoted by gC t. Now, let gC denote the average annual growth rate in consumption since 2000 . This number will stay fixed and not changing over time. Then the demeaned measure of the annual growth rate of consumption is gC t − gC for year t. (See Appendix 3 for more information). 7- Include a scatter plot of the demeaned measure of the annual growth rate of consumption and the demeaned measure of disposable income for the period 2000-2017. Use the x-axis for the demeaned growth rate of disposable income and the y-axis for the demeaned growth rate of consumption. Include axis titles for both variables. 8- Finally, add a linear trend line of the scatter plot and show the equation. 9- The equation that Excel produces for the trend line will have the following form: y=bx+e, where y is the growth rate of consumption, x is the growth rate of disposable income, b is a coefficient, and e will be close to zero. 10- Find b, the propensity to consume. Discuss how an increase in disposable income of $1 billion above the average is typically associated with an increase in consumption of $ b billion above the average.

The propensity to consume tells us by how much consumption changes for a given change in disposable income. To analyze this fact, follow these steps: 5- Go to the Federal Reserve Economic Data (FRED) https://fred.stlouisfed.org/. download the series A067RX1A020NBEA and PCECCA since 1999. Make sure all series are in real terms and in comparable units. Compile a single spreadsheet with these series. 6- In the spreadsheet, first compute the annual growth rate of disposable income and consumption for all years in the sample. Then compute the average for the period 2000-2017 for both variables. Finally, construct a demeaned measure of the annual growth rate of disposable income and consumption for all years in the sample. That is, let C t denote consumption in year t. Then, the growth rate of consumption between year t and t−1 is [(C t /C t−1 )−1], denoted by gC t. Now, let gC denote the average annual growth rate in consumption since 2000 . This number will stay fixed and not changing over time. Then the demeaned measure of the annual growth rate of consumption is gC t − gC for year t. (See Appendix 3 for more information). 7- Include a scatter plot of the demeaned measure of the annual growth rate of consumption and the demeaned measure of disposable income for the period 2000-2017. Use the x-axis for the demeaned growth rate of disposable income and the y-axis for the demeaned growth rate of consumption. Include axis titles for both variables. 8- Finally, add a linear trend line of the scatter plot and show the equation. 9- The equation that Excel produces for the trend line will have the following form: y=bx+e, where y is the growth rate of consumption, x is the growth rate of disposable income, b is a coefficient, and e will be close to zero. 10- Find b, the propensity to consume. Discuss how an increase in disposable income of $1 billion above the average is typically associated with an increase in consumption of $ b billion above the average.

Chapter9: Aggregate Demand

Section: Chapter Questions

Problem 1.1P

Related questions

Question

The propensity to consume tells us by how much consumption changes for a given change in disposable income. To analyze this fact, follow these steps: 5- Go to the Federal Reserve Economic Data (FRED) https://fred.stlouisfed.org/. download the series A067RX1A020NBEA and PCECCA since 1999. Make sure all series are in real terms and in comparable units. Compile a single spreadsheet with these series. 6- In the spreadsheet, first compute the annual growth rate of disposable income and consumption for all years in the sample. Then compute the average for the period 2000-2017 for both variables. Finally, construct a demeaned measure of the annual growth rate of disposable income and consumption for all years in the sample. That is, let C

t denote consumption in year t. Then, the growth rate of consumption between year t and t−1 is [(C t /C t−1 )−1], denoted by gC t. Now, let gC denote the average annual growth rate in consumption since 2000 . This number will stay fixed and not changing over time. Then the demeaned measure of the annual growth rate of consumption is gC t − gC for year t. (See Appendix 3 for more information). 7- Include a scatter plot of the demeaned measure of the annual growth rate of consumption and the demeaned measure of disposable income for the period 2000-2017. Use the x-axis for the demeaned growth rate of disposable income and the y-axis for the demeaned growth rate of consumption. Include axis titles for both variables. 8- Finally, add a linear trend line of the scatter plot and show the equation. 9- The equation that Excel produces for the trend line will have the following form: y=bx+e, where y is the growth rate of consumption, x is the growth rate of disposable income, b is a coefficient, and e will be close to zero. 10- Find b, the propensity to consume. Discuss how an increase in disposable income of $1 billion above the average is typically associated with an increase in consumption of $ b billion above the average.

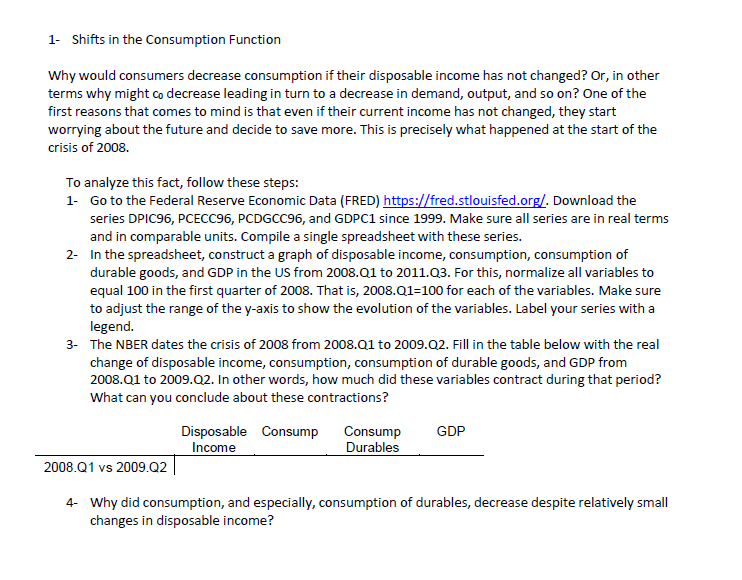

Transcribed Image Text:1- Shifts in the Consumption Function

Why would consumers decrease consumption if their disposable income has not changed? Or, in other

terms why might co decrease leading in turn to a decrease in demand, output, and so on? One of the

first reasons that comes to mind is that even if their current income has not changed, they start

worrying about the future and decide to save more. This is precisely what happened at the start of the

crisis of 2008.

To analyze this fact, follow these steps:

1-

Go to the Federal Reserve Economic Data (FRED) https://fred.stlouisfed.org/. Download the

series DPIC96, PCECC96, PCDGCC96, and GDPC1 since 1999. Make sure all series are in real terms

and in comparable units. Compile a single spreadsheet with these series.

2- In the spreadsheet, construct a graph of disposable income, consumption, consumption of

durable goods, and GDP in the US from 2008.Q1 to 2011.Q3. For this, normalize all variables to

equal 100 in the first quarter of 2008. That is, 2008.Q1=100 for each of the variables. Make sure

to adjust the range of the y-axis to show the evolution of the variables. Label your series with a

legend.

3- The NBER dates the crisis of 2008 from 2008.Q1 to 2009.Q2. Fill in the table below with the real

change of disposable income, consumption, consumption of durable goods, and GDP from

2008.Q1 to 2009.Q2. In other words, how much did these variables contract during that period?

What can you conclude about these contractions?

Disposable Consump

Income

Consump

Durables

GDP

2008.Q1 vs 2009.Q2

4- Why did consumption, and especially, consumption of durables, decrease despite relatively small

changes in disposable income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning