The property was transferred to shareholders on January 31 when the prevailing fair value was at P800,000. 41. The entry to record the declaration of the property dividends would include a debit to retained earnings of: a. 700,000 b. 800,000 C. 900,000 d. 1,000,000

The property was transferred to shareholders on January 31 when the prevailing fair value was at P800,000. 41. The entry to record the declaration of the property dividends would include a debit to retained earnings of: a. 700,000 b. 800,000 C. 900,000 d. 1,000,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11E: On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an...

Related questions

Question

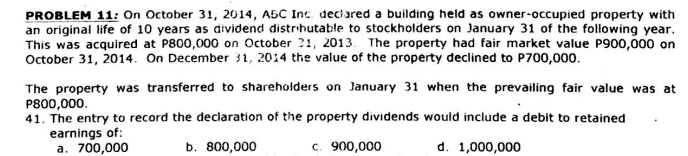

Transcribed Image Text:PROBLEM 11: On October 31, 2014, A5C Inc. deciared a building held as owner-occupied property with

an original life of 10 years as dividend distrihutable to stockholders on January 31 of the following year.

This was acquired at P800,000 on October 21, 2013. The property had fair market value P900,000 on

October 31, 2014. On December 31, 2014 the value of the property declined to P700,000.

The property was transferred to shareholders on January 31 when the prevailing fair value was at

P800,000.

41. The entry to record the declaration of the property dividends would include a debit to retained

earnings of:

a. 700,000

b. 800,000

c. 900,000

d. 1,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning