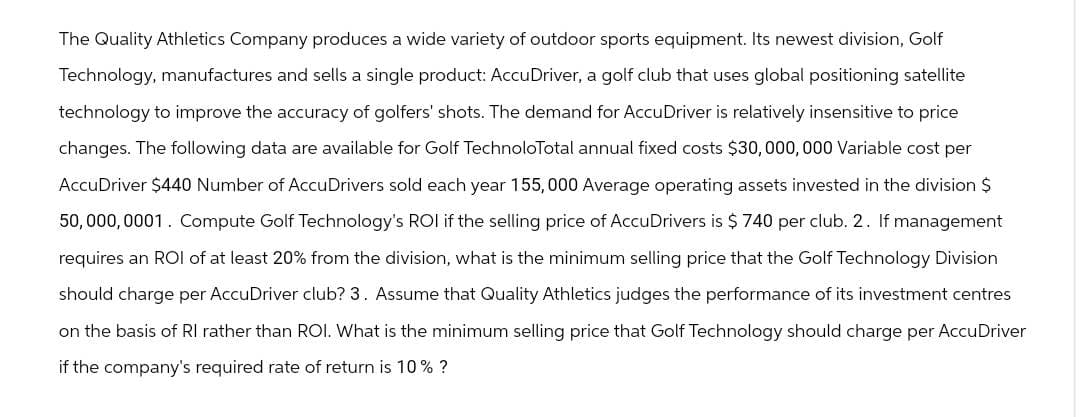

The Quality Athletics Company produces a wide variety of outdoor sports equipment. Its newest division, Golf Technology, manufactures and sells a single product: AccuDriver, a golf club that uses global positioning satellite technology to improve the accuracy of golfers' shots. The demand for AccuDriver is relatively insensitive to price changes. The following data are available for Golf TechnoloTotal annual fixed costs $30,000,000 Variable cost per AccuDriver $440 Number of AccuDrivers sold each year 155,000 Average operating assets invested in the division $ 50,000,0001. Compute Golf Technology's ROI if the selling price of AccuDrivers is $ 740 per club. 2. If management requires an ROI of at least 20% from the division, what is the minimum selling price that the Golf Technology Division should charge per AccuDriver club? 3. Assume that Quality Athletics judges the performance of its investment centres on the basis of RI rather than ROI. What is the minimum selling price that Golf Technology should charge per AccuDriver if the company's required rate of return is 10% ?

The Quality Athletics Company produces a wide variety of outdoor sports equipment. Its newest division, Golf Technology, manufactures and sells a single product: AccuDriver, a golf club that uses global positioning satellite technology to improve the accuracy of golfers' shots. The demand for AccuDriver is relatively insensitive to price changes. The following data are available for Golf TechnoloTotal annual fixed costs $30,000,000 Variable cost per AccuDriver $440 Number of AccuDrivers sold each year 155,000 Average operating assets invested in the division $ 50,000,0001. Compute Golf Technology's ROI if the selling price of AccuDrivers is $ 740 per club. 2. If management requires an ROI of at least 20% from the division, what is the minimum selling price that the Golf Technology Division should charge per AccuDriver club? 3. Assume that Quality Athletics judges the performance of its investment centres on the basis of RI rather than ROI. What is the minimum selling price that Golf Technology should charge per AccuDriver if the company's required rate of return is 10% ?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter10: Decentralization: Responsibility Accounting, Performance Evaluation, And Transfer Pricing

Section: Chapter Questions

Problem 4CE

Related questions

Question

Transcribed Image Text:The Quality Athletics Company produces a wide variety of outdoor sports equipment. Its newest division, Golf

Technology, manufactures and sells a single product: AccuDriver, a golf club that uses global positioning satellite

technology to improve the accuracy of golfers' shots. The demand for AccuDriver is relatively insensitive to price

changes. The following data are available for Golf TechnoloTotal annual fixed costs $30,000,000 Variable cost per

AccuDriver $440 Number of AccuDrivers sold each year 155,000 Average operating assets invested in the division $

50,000,0001. Compute Golf Technology's ROI if the selling price of AccuDrivers is $ 740 per club. 2. If management

requires an ROI of at least 20% from the division, what is the minimum selling price that the Golf Technology Division

should charge per AccuDriver club? 3. Assume that Quality Athletics judges the performance of its investment centres

on the basis of RI rather than ROI. What is the minimum selling price that Golf Technology should charge per AccuDriver

if the company's required rate of return is 10% ?

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning