The quantity demanded of salt decreases when the price of pepper increases. This is an example of * O own-price elasticity. O supply elasticity. O income elasticity. O rubber band elasticity. cross-price elasticity. If the government wants to put a per unit tax on a product so that it can raise revenue to support local schools, it would most likely accomplish this goal by doing which of the following? * O placing a tax on a good with an elastic demand. O placing a tax on a good that has many substitutes. O placing a tax on a good with an inelastic demand. O placing a tax on a good with a perfectly elastic demand. O relying of the goodness of mankind and simply ask for donations.

The quantity demanded of salt decreases when the price of pepper increases. This is an example of * O own-price elasticity. O supply elasticity. O income elasticity. O rubber band elasticity. cross-price elasticity. If the government wants to put a per unit tax on a product so that it can raise revenue to support local schools, it would most likely accomplish this goal by doing which of the following? * O placing a tax on a good with an elastic demand. O placing a tax on a good that has many substitutes. O placing a tax on a good with an inelastic demand. O placing a tax on a good with a perfectly elastic demand. O relying of the goodness of mankind and simply ask for donations.

Microeconomics: Principles & Policy

14th Edition

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:William J. Baumol, Alan S. Blinder, John L. Solow

Chapter6: Demand And Elasticity

Section: Chapter Questions

Problem 3TY

Related questions

Question

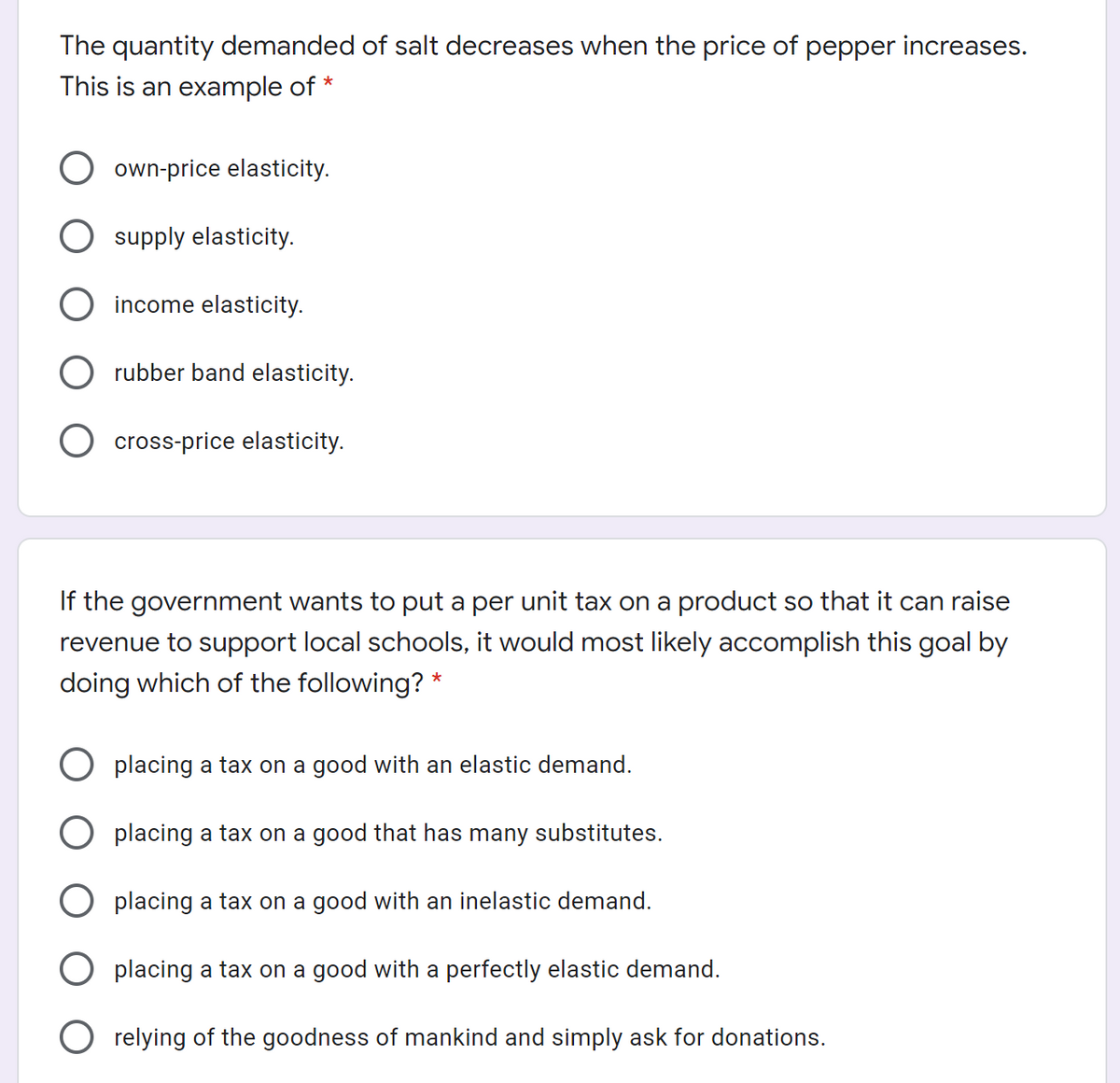

Transcribed Image Text:The quantity demanded of salt decreases when the price of pepper increases.

This is an example of *

own-price elasticity.

supply elasticity.

income elasticity.

O rubber band elasticity.

cross-price elasticity.

If the government wants to put a per unit tax on a product so that it can raise

revenue to support local schools, it would most likely accomplish this goal by

doing which of the following? *

O placing a tax on a good with an elastic demand.

placing a tax on a good that has many substitutes.

placing a tax on a good with an inelastic demand.

placing a tax on a good with a perfectly elastic demand.

O relying of the goodness of mankind and simply ask for donations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning