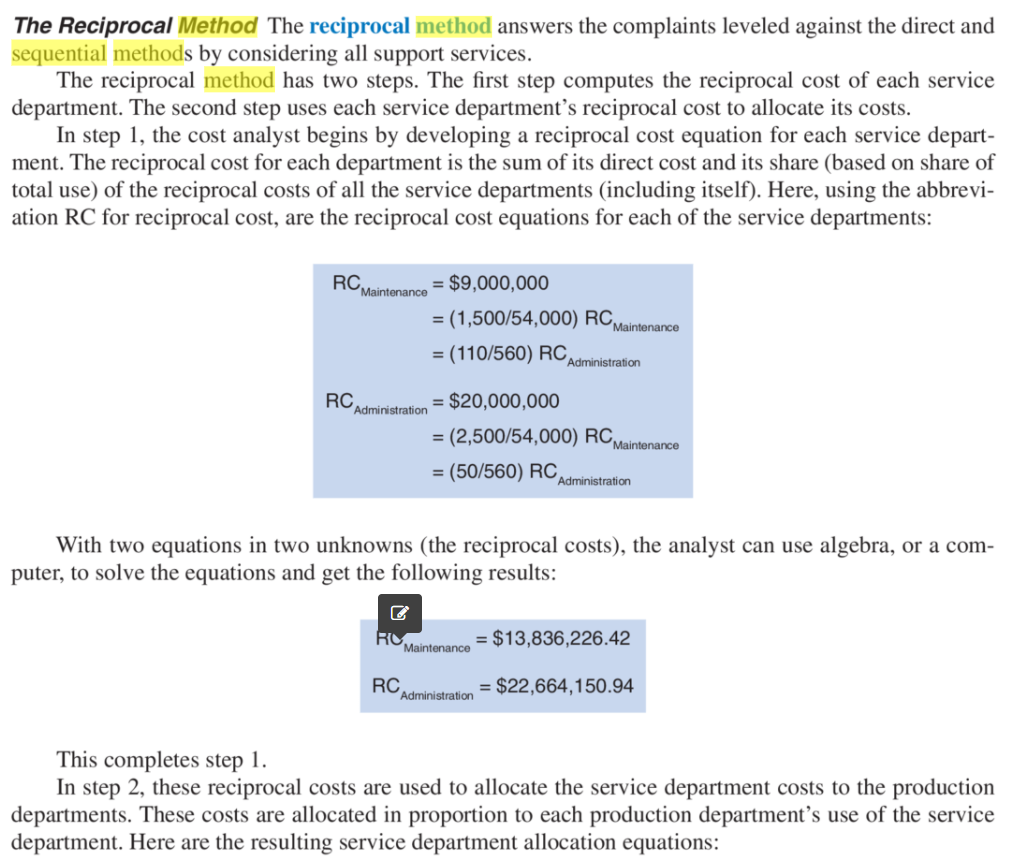

The Reciprocal Method The reciprocal method answers the complaints leveled against the direct and sequential methods by considering all support services. The reciprocal method has two steps. The first step computes the reciprocal cost of each service department. The second step uses each service department's reciprocal cost to allocate its costs. In step 1, the cost analyst begins by developing a reciprocal cost equation for each service depart- ment. The reciprocal cost for each department is the sum of its direct cost and its share (based on share of total use) of the reciprocal costs of all the service departments (including itself). Here, using the abbrevi- ation RC for reciprocal cost, are the reciprocal cost equations for each of the service departments: RC, Maintenance = $9,000,000 = (1,500/54,000) RC, Maintenance = (110/560) RC, Administration RC Administration = $20,000,000 = (2,500/54,000) RC, Maintenance = (50/560) RC, Administration With two equations in two unknowns (the reciprocal costs), the analyst can use algebra, or a com- puter, to solve the equations and get the following results: RO Maintenance = $13,836,226.42 RC Administration = $22,664,150.94 This completes step 1. In step 2, these reciprocal costs are used to allocate the service department costs to the production departments. These costs are allocated in proportion to each production department's use of the service department. Here are the resulting service department allocation equations:

The Reciprocal Method The reciprocal method answers the complaints leveled against the direct and sequential methods by considering all support services. The reciprocal method has two steps. The first step computes the reciprocal cost of each service department. The second step uses each service department's reciprocal cost to allocate its costs. In step 1, the cost analyst begins by developing a reciprocal cost equation for each service depart- ment. The reciprocal cost for each department is the sum of its direct cost and its share (based on share of total use) of the reciprocal costs of all the service departments (including itself). Here, using the abbrevi- ation RC for reciprocal cost, are the reciprocal cost equations for each of the service departments: RC, Maintenance = $9,000,000 = (1,500/54,000) RC, Maintenance = (110/560) RC, Administration RC Administration = $20,000,000 = (2,500/54,000) RC, Maintenance = (50/560) RC, Administration With two equations in two unknowns (the reciprocal costs), the analyst can use algebra, or a com- puter, to solve the equations and get the following results: RO Maintenance = $13,836,226.42 RC Administration = $22,664,150.94 This completes step 1. In step 2, these reciprocal costs are used to allocate the service department costs to the production departments. These costs are allocated in proportion to each production department's use of the service department. Here are the resulting service department allocation equations:

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter7: Allocating Costs Of Support Departments And Joint Products

Section: Chapter Questions

Problem 5CE: Refer to Cornerstone Exercise 7.3. Now assume that Valron Company uses the reciprocal method to...

Related questions

Question

Sorry! I need the reciprocal method step.I need to be able to do this algebra equation

Transcribed Image Text:The Reciprocal Method The reciprocal method answers the complaints leveled against the direct and

sequential methods by considering all support services.

The reciprocal method has two steps. The first step computes the reciprocal cost of each service

department. The second step uses each service department's reciprocal cost to allocate its costs.

In step 1, the cost analyst begins by developing a reciprocal cost equation for each service depart-

ment. The reciprocal cost for each department is the sum of its direct cost and its share (based on share of

total use) of the reciprocal costs of all the service departments (including itself). Here, using the abbrevi-

ation RC for reciprocal cost, are the reciprocal cost equations for each of the service departments:

RC,

Maintenance

= $9,000,000

= (1,500/54,000) RC,

Maintenance

= (110/560) RC,

Administration

RC

Administration

= $20,000,000

= (2,500/54,000) RC,

Maintenance

= (50/560) RC,

Administration

With two equations in two unknowns (the reciprocal costs), the analyst can use algebra, or a com-

puter, to solve the equations and get the following results:

RO

Maintenance

= $13,836,226.42

RC

Administration

= $22,664,150.94

This completes step 1.

In step 2, these reciprocal costs are used to allocate the service department costs to the production

departments. These costs are allocated in proportion to each production department's use of the service

department. Here are the resulting service department allocation equations:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,