In its first vear Tapka gener ted 84 fnet

Q: Pete’s Petroleum, Inc., an SEC registrant with a calendar year-end, is in the business of…

A: 1. Expected Future Expenditure Expenditure Probability Amount…

Q: During 2020, a construction company changed from the completed-contract method to the…

A:

Q: What is the impact to Liabilities when a business purchases $1,500 supplies on account? O Supplies…

A: Introduction: Balance sheet: All Assets and liabilities are shown in Balance sheet. It tells the net…

Q: This year, the Tastee Partnership reported income before guaranteed payments of $263,000. Stella…

A: The question is related to the Partnership Accounting. The details are given regarding the same.

Q: Problem 7. Consider the following data about Rock N' Roses Corp: Current ratio, 0.50; Quick ratio,…

A: Current ratio = Current Assets Current liabilities 0.5 = Current Assets…

Q: Question 28 X operates a standard marginal costing system. The following budgeted and standard cost…

A: The direct material price variance would be one of two variances being used to evaluate direct…

Q: The Irwin Batting Company manufactures wood baseball bats. Irwin's two primary products are a…

A: The question is related to Budgetory Control. The Sales Budget, Production Budget and direct…

Q: Dividends Per Share Seventy-Two Inc., a developer of radiology equipment, has stock outstanding as…

A: when company earns the profit then it was dividend to its shareholders as a reward for their…

Q: ) The selling price should be reduced by $100. This reduction in selling price will allow 1000 units…

A: The question is related to Marginal Costing and Budgetory Control The details are given regarding…

Q: Garcia Company has 11,500 units of its product that were produced at a cost of $172,500. The units…

A: In decision-making questions of Scrap or Rework analysis, the decision will be made on the basis of…

Q: Required information Exercise 7-24 (Algo) Central Station Enterprise Fund (LO 7-5] [The following…

A: Journal entry is the primary step to record the transaction in the books of account. The nominal…

Q: Mary's Baskets Company expects to manufacture and sell 23,000 baskets in 2019 for $6 each. There are…

A: Amount of sales revenue that will be reported in 2019 Budgeted income statement = Budgeted sales…

Q: Suppose the Fed conducts an open market purchase by buying $10 million in Treasury bonds from Acme…

A: An open-market transaction seems to be essentially an order issued by an insider to purchase or sell…

Q: 2-Olaf Inc. received a check from its underwriters for $83 million. This was for the issue of one…

A: In a fresh stock offering, the underwriter acts as a middleman between the company intending to…

Q: Amber Wison owner ot Canyon Canoe Company decides to start a new company that wil be operated as a…

A: When cash dividend is declared to the shareholders then it becomes current liability of the company…

Q: Depreciation Method

A: In this question, we have to calculate depreciation by three method straight-line, production method…

Q: Sales variance is the difference between sales price and ---------- Labour rate variance Sales…

A: Sales variance =Actual sales - budgeted sales = Actual quantity * actual price - budgeted quantity *…

Q: Bob Night opened "The General's Favorite Fishing Hole." The fishing camp is open from April through…

A: The closing entries are prepared at year end to close the temporary accounts of the business…

Q: Let's Work It Out operates several retail stores that specialize in products for a healthy…

A: The Financial income of the fiscal year March 31 , 2019. Multi step Income…

Q: Hope Inc. has the following information: Beginning inventory P 56,000 Purchases 148,000…

A: The question is based on the concept of Cost Accounting. Cost of sales = Beginning inventory +…

Q: apital (P25 par value, 100,000 shares) 2,500,000 Share premium 3,000,000 Retained earnings…

A: Heaven Inc discovered late in 2021 that 2020 depreciation expense was overstated by 500,000.…

Q: Question Content Area Steven Company has fixed costs of $271,352. The unit selling price, variable…

A: The break even point for the entire company can be calculated as ratio of fixed costs and weighted…

Q: Showtime Company's ending inventory at

A: The inventory should be recorded in the books at the lower of its cost or net realizable value.…

Q: Ltd produces 3000 units of a single product in the period under review . Direct labour per unit $17,…

A: Solution: Variable cost includes direct materials, direct labor and variable overhead. Prime cost is…

Q: By looking at these real life samples of Financial Statements prepared in accordance to PAS/IAS:…

A: Answer:- Biological assets definition:- Biological assets are those assets which are live assets,…

Q: Chow Industries' projected sales budget for the next four months is as follows: Units January 70,700…

A: Production in February = Projected sales for February + Ending inventory - Beginning inventory…

Q: Journalize the following transactions ( the company is using a perpetual system). 1. On June 1,…

A: Total purchase value = purchased units × price per unit

Q: 2019 2020 Ending Inventory: LIFO 120000 150000 Net Income: LIFO basis 175000 190000 Effective Tax…

A: Inventory:- The items and supplies that a firm retains for the purpose of resale, manufacturing, or…

Q: Makati Inc. acquires a building on February 1, 2020 at a cost of 5,500,000. The building has an…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Use the following to answer questions 6 – 12 J&TR, Inc., has two classes of stock authorized:…

A: The shareholder's equity comprises of total shares issued, retained earnings and dividend…

Q: rue or False Cash dividends are declared by the majority of the quorum of the board of directors…

A: Dividends are the appropriation of the current year profits or retained earnings by the corporation…

Q: On January 1, 20x1 Plaka Co. acquired goods for sale in the ordinary course of business for…

A: Given information, Purchase price = P250,000 Refundable purchase taxes included in above = 5000…

Q: Asset Turnover = 0.90 Payout Ratio = 0.60 Price Earnings Ratio = 12.0 What is the dividend yield…

A: Dividend yield ratio is a financial ratio that measures percentage return earned from dividend…

Q: How much is the total cash outflows from investing activities?

A: Total cash outflows from investing activities -15200000 (Option A)

Q: Allowance for Uncollectible Accounts is a contra asset account, which means that its normal balance…

A: The questions here pertain to contra asset accounts. Note that contra asset accounts are those…

Q: not at all. Consider each situation independently. Situation Impact on audit risk In year…

A: Audit refers to reviewing and evaluating of companies accounts to determine the accuracy and…

Q: Reporting Stockholders' Equity Using the following accounts and balances, prepare the…

A: The stockholder's equity includes common stockholder's equity and preferred stock. but it excludes…

Q: A B You will prepare a static master budget, budgeted financial statements and a flexible…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first3. Please resubmit the question…

Q: Widmer Company had gross wages of $155,000 during the week ended June 17. The amount of wages…

A: Social Security tax payable = wages subject to social security tax ×6% = $139,500 × 6% = $8370

Q: Sarasota Corp. purchased Machine no. 201 on May 1, 2020. The following information relating to…

A: All expenses incurred to bring an asset to a condition where it can be used are capitalized as…

Q: Additional Information for Journal Entries Brian Burns records accruals for utilities expense as…

A: LIFO (last in, first out) is an inventory management system. Under LIFO, the costs of the most…

Q: An entity purchased 4-year debt instruments with a face value of P10,000,000 on January 1, 2019 to…

A: Note:- Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: The purpose of costing are as follows EXCEPT: Price products Make decisions record cost Formulate…

A: The purpose of costing 1. To fix the price of the product 2. For decision making 3. For…

Q: During 2019, Ryel Company’s controller asked you to prepare correcting journal entries for the…

A: Solution: The double-declining method is the process of calculating depreciation in which the…

Q: Myers Corporation has the following data related to direct materials costs for November: actual…

A: Direct material price variance = Actual quantity ×(Standard price - Actual price)

Q: Pompeii's Pizza has a delivery car that it uses for pizza deliveries. The transmission needs to be…

A: NPV for present Car: $ 55,582 NPV of new Car: $ 68,253 Detailed explanation Given Below: PV @ 12 %…

Q: Provide the missing data in the following table for a distributor of martial arts products: (Enter…

A: The ratio is the representation of the relation between the two numbers. In accounting, ratios' are…

Q: The beginning balance of supplies is $4000. On December 31st, the physical count of remaining…

A: Journals: Recording of a business transactions in a chronological order. First step in the…

Q: Aztec Inc. produces soft drinks. Mixing is the first department, and its output is measured in…

A: Cost accounting is the one that is widely used by cost accountants to determine the cost of the…

Q: Answer by True or False 1.person issued with corporate bond is a creditor to the corporation…

A: stock corporation are those profit organisation that issues talk to shareholder for raising their…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

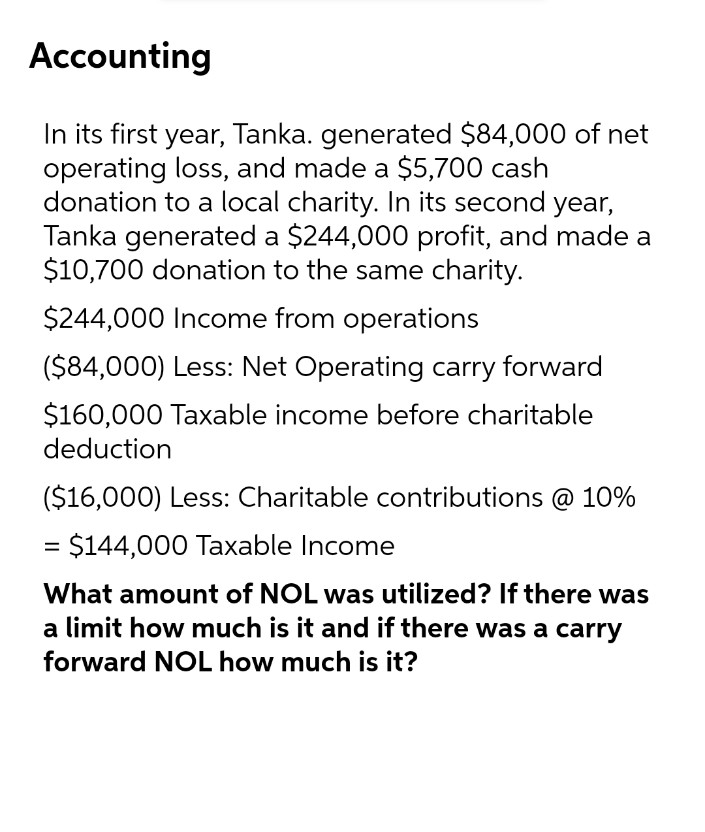

- In its first year (2021), Camco Incorporated generated a $92,000 net operating loss, and it made a $5,000 cash donation to a local charity. In its second year (2022), Camco generated a $210,600 profit, and it made a $10,000 donation to the same charity. Required: Compute Camco's taxable income for its second year.Donor Corporation had the following income and deductions for last year: Sales $5,000,000; Cost of goods sold $3,500,000; Other operating expenses $800,000; Dividends (from 5 percent owned domestic corporations) $100,000. Donor Corporation also made contributions (not included above) to qualifying charitable organizations of $175,000. Determine Donor Corporation’s taxable income for the year.A private not-for-profit entity receives three large cash donations: *One gift of $85,000 is restricted by the donor so that it can't be spent for four years *One gift of $105,000 is restricted to pay the salaries of the entity's workers *One gift of $135,000 must be held forever with the income to be used to provide food for needy families. In the current year, income of $25,000 was earned by not spent. WHat is the increase in the current year in net assets with donor restrictions? 220,000 240,000 350,000

- Compute the charitable contribution deduction (ignoring the percentage limitation) for each of the following C corporations. If required, round your answers to nearest dollar. a. Amber Corporation donated inventory of clothing (basis of $131,000, fair market value of $163,750) to a qualified charitable organization that operates homeless shelters.$ b. Brass Corporation donated stock held as an investment to Western College (a qualified organization). Brass acquired the stock three years ago for $73,200, and the fair market value on the date of the contribution is $117,120. Western College plans on selling the stock.$ c. Ruby Corporation donates a sculpture held as an investment and worth $245,600 to a local museum (a qualified organization), which exhibits the sculpture. Ruby acquired the sculpture four years ago for $98,240.$A private not-for-profit entity is working to create a cure for a deadly disease. The charity starts the year with cash of $709,000. Of this amount, unrestricted net assets total $403,000, temporaril restricted net assets total $203,000, and permanenetly restricted net assets total $103,000. Within the temporarily restricted net assets, the entity must use 80 percent for equipment and the rest for salaries . No implied time restriction has been designated for the equipment when purchased. For the permanently restricted net assets, 70 percent of resulting income must be used to cover the purchase of advertising for fund-raising purposes and the rest is unrestricted. During the current year, the organization has the following transactions: 1. Received unrestricted cash gifts of $213,000. 2. Paid salaries of $83,000 with $23,000 of that amount coming from restricted funds. Of the total salaries, 40 percent is for administrative personnel and the remainder is evenly divided among…Aquamarine Corporation, a calendar year C corporation, makes the following donations to qualified charitable organizations during the current year: Adjusted Basis Fair Market Value Painting held four years as an investment, to a church, which sold it immediately $6,000 $10,000 Apple stock held two years as an investment, to United Way, which sold it immediately 15,750 35,000 Canned groceries held one month as inventory, to Catholic Meals for the Poor 2,520 4,200 Determine the amount of Aquamarine Corporation's charitable deduction for the current year. (Ignore the taxable income limitation.) Painting: The amount of the contribution is . Stock: The amount of the contribution is . Groceries: The amount of the contribution is . Therefore, the total charitable contribution is $fill in the blank 4. Feedback Area please do not provide solution in image format thank you!

- The Pooch Corporation is a regular corporation that contributes $15,000 cash to qualified charitable organizationsduring the current year. The corporation has net taxable income of $160,000 before deducting the contributions.a. What is the amount of Pooch Corporation's allowable deduction for charitable contributions forthe current year?b. What may the corporation do with any excess amount of contributions?INVOLVE was incorporated as a not-for-profit organization on January 1, 2023. During the fiscal year ended December 31, 2023, the following transactions occurred. A business donated rent-free office space to the organization that would normally rent for $35,000 a year. A fund drive raised $185,000 in cash and $100,000 in pledges that will be paid next year. A state government grant of $150,000 was received for program operating costs related to public health education. Salaries and fringe benefits paid during the year amounted to $208,560. At year-end, an additional $16,000 of salaries and fringe benefits were accrued. A donor pledged $100,000 for construction of a new building, payable over five fiscal years, commencing in 2025. The discounted value of the pledge is expected to be $94,260. Office equipment was purchased for $12,000. The useful life of the equipment is estimated to be five years. Office furniture with a fair value of $9,600 was donated by a local office supply…Fish, Inc., an exempt organization, reports unrelated business income of $500,000 (before any charitable contribution deduction). During the year, Fish makes charitable contributions to other organizations of $54,000, of which $38,000 is associated with the unrelated trade or business. Calculate Fish’s unrelated business taxable income (UBTI). Express your computation in part (a) as a Microsoft Excel formula. Assume instead that the charitable contributions are $41,000, of which $38,000 is associated with the unrelated trade or business. Calculate any UBTI.