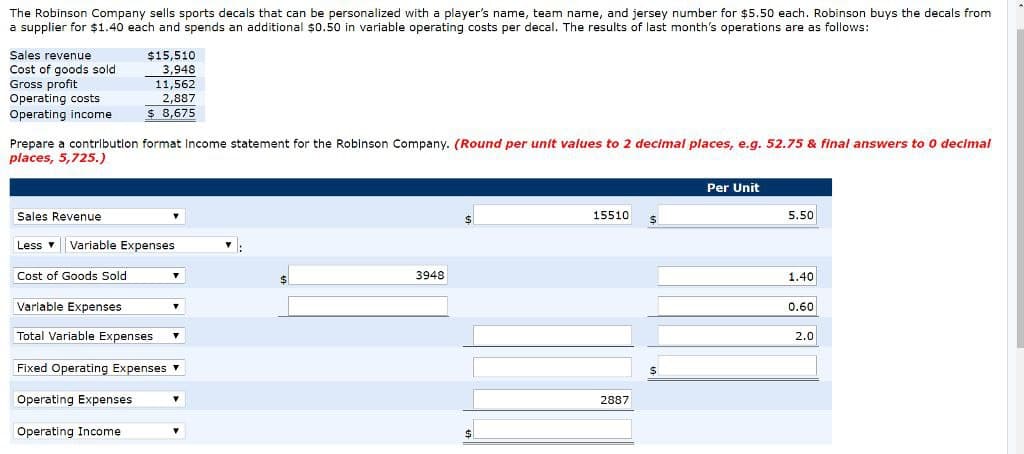

The Robinson Company sells sports decals that can be personalized with a player's name, team name, and jersey number for $5.50 each. Robinson buys the decals from a supplier for $1.40 each and spends an additional $0.50 in variable operating costs per decal. The results of last month's operations are as follows: Sales revenue Cost of goods sold Gross profit Operating costs Operating income $15,510 3,948 11,562 2,887 $ 8,675 Prepare a contribution format Income statement for the Robinson Company. (Round per unit values to 2 decimal places, e.g. 52.75 & final answers to 0 decimal places, 5,725.)

The Robinson Company sells sports decals that can be personalized with a player's name, team name, and jersey number for $5.50 each. Robinson buys the decals from a supplier for $1.40 each and spends an additional $0.50 in variable operating costs per decal. The results of last month's operations are as follows: Sales revenue Cost of goods sold Gross profit Operating costs Operating income $15,510 3,948 11,562 2,887 $ 8,675 Prepare a contribution format Income statement for the Robinson Company. (Round per unit values to 2 decimal places, e.g. 52.75 & final answers to 0 decimal places, 5,725.)

Chapter3: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 4PB: West Island distributes a single product. The companys sales and expenses for the month of June are...

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:The Robinson Company sells sports decals that can be personalized with a player's name, team name, and jersey number for $5.50 each. Robinson buys the decals from

a supplier for $1.40 each and spends an additional $0.50 in variable operating costs per decal. The results of last month's operations are as follows:

Sales revenue

Cost of goods sold.

Gross profit

Operating costs

Operating income

$15,510

3,948

11,562

2,887

$ 8,675

Prepare a contribution format Income statement for the Robinson Company. (Round per unit values to 2 decimal places, e.g. 52.75 & final answers to 0 decimal

places, 5,725.)

Sales Revenue

Less Variable Expenses

Cost of Goods Sold

Variable Expenses

Total Variable Expenses ▼

Fixed Operating Expenses

Operating Expenses

Operating Income

:

3948

15510

2887

$

$

Per Unit

5.50

1.40

0.60

2.0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning