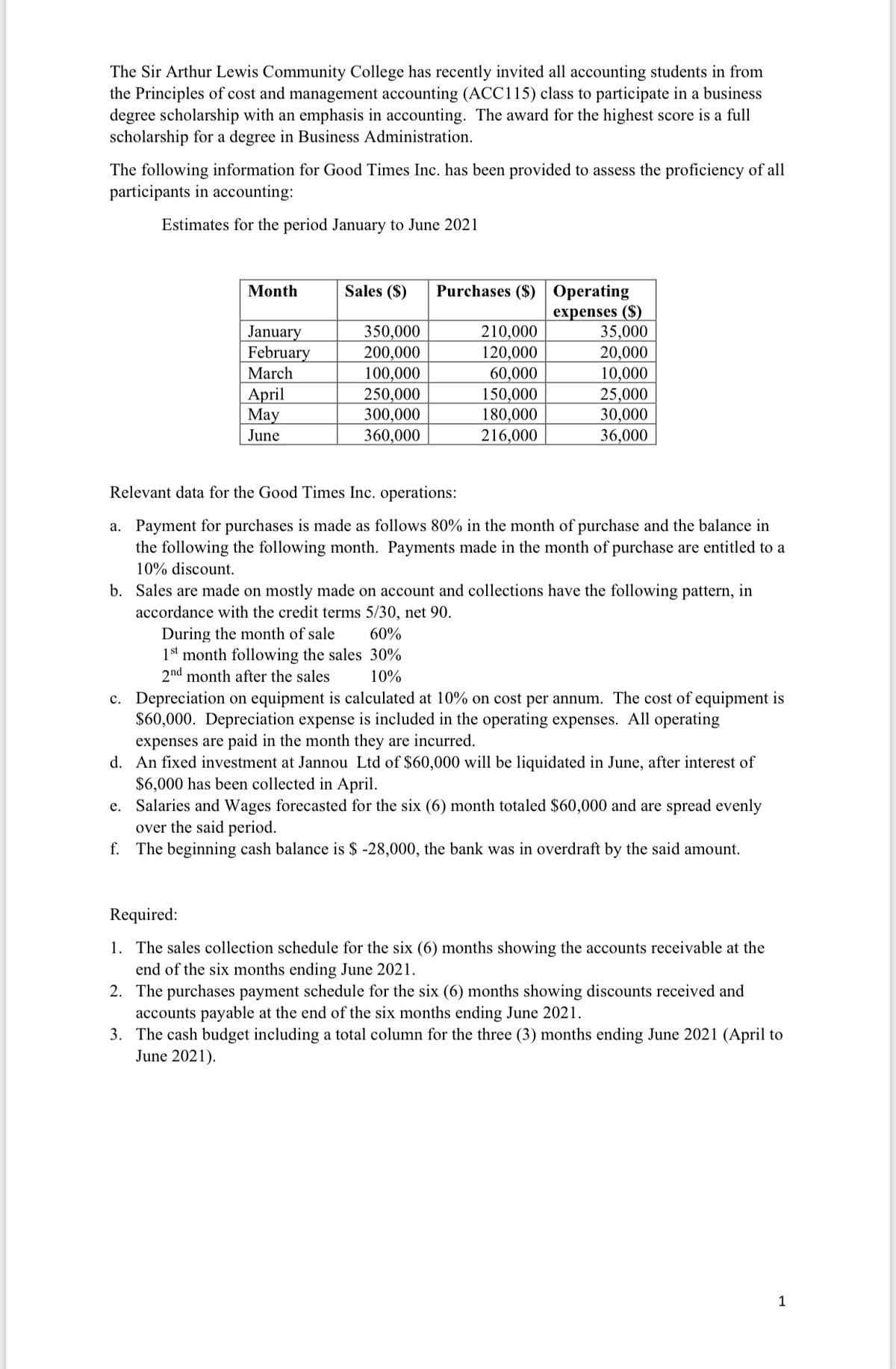

The Sir Arthur Lewis Community College has recently invited all accounting students in from the Principles of cost and management accounting (ACC115) class to participate in a business degree scholarship with an emphasis in accounting. The award for the highest score is a full scholarship for a degree in Business Administration. The following information for Good Times Inc. has been provided to assess the proficiency of all participants in accounting: Estimates for the period January to June 2021 Purchases ($) Operating expenses ($) 35,000 20,000 10,000 25,000 30,000 36,000 Month Sales ($) 350,000 200,000 100,000 250,000 300,000 360,000 January February 210,000 120,000 60,000 150,000 180,000 March April May June 216,000 Relevant data for the Good Times Inc. operations: a. Payment for purchases is made as follows 80% in the month of purchase and the balance in the following the following month. Payments made in the month of purchase are entitled to a 10% discount. b. Sales are made on mostly made on account and collections have the following pattern, in accordance with the credit terms 5/30, net 90. During the month of sale 1st month following the sales 30% 2nd month after the sales 60% 10% c. Depreciation on equipment is calculated at 10% on cost per annum. The cost of equipment is $60,000. Depreciation expense is included in the operating expenses. All operating expenses are paid in the month they are incurred. d. An fixed investment at Jannou Ltd of $60,000 will be liquidated in June, after interest of $6,000 has been collected in April. e. Salaries and Wages forecasted for the six (6) month totaled $60,000 and are spread evenly over the said period. f. The beginning cash balance is $ -28,000, the bank was in overdraft by the said amount. Required: 1. The sales collection schedule for the six (6) months showing the accounts receivable at the end of the six months ending June 2021. 2. The purchases payment schedule for the six (6) months showing discounts received and accounts payable at the end of the six months ending June 2021. 3. The cash budget including a total column for the three (3) months ending June 2021 (April to June 2021).

The Sir Arthur Lewis Community College has recently invited all accounting students in from the Principles of cost and management accounting (ACC115) class to participate in a business degree scholarship with an emphasis in accounting. The award for the highest score is a full scholarship for a degree in Business Administration. The following information for Good Times Inc. has been provided to assess the proficiency of all participants in accounting: Estimates for the period January to June 2021 Purchases ($) Operating expenses ($) 35,000 20,000 10,000 25,000 30,000 36,000 Month Sales ($) 350,000 200,000 100,000 250,000 300,000 360,000 January February 210,000 120,000 60,000 150,000 180,000 March April May June 216,000 Relevant data for the Good Times Inc. operations: a. Payment for purchases is made as follows 80% in the month of purchase and the balance in the following the following month. Payments made in the month of purchase are entitled to a 10% discount. b. Sales are made on mostly made on account and collections have the following pattern, in accordance with the credit terms 5/30, net 90. During the month of sale 1st month following the sales 30% 2nd month after the sales 60% 10% c. Depreciation on equipment is calculated at 10% on cost per annum. The cost of equipment is $60,000. Depreciation expense is included in the operating expenses. All operating expenses are paid in the month they are incurred. d. An fixed investment at Jannou Ltd of $60,000 will be liquidated in June, after interest of $6,000 has been collected in April. e. Salaries and Wages forecasted for the six (6) month totaled $60,000 and are spread evenly over the said period. f. The beginning cash balance is $ -28,000, the bank was in overdraft by the said amount. Required: 1. The sales collection schedule for the six (6) months showing the accounts receivable at the end of the six months ending June 2021. 2. The purchases payment schedule for the six (6) months showing discounts received and accounts payable at the end of the six months ending June 2021. 3. The cash budget including a total column for the three (3) months ending June 2021 (April to June 2021).

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter9: Working Capital

Section: Chapter Questions

Problem 9Q

Related questions

Question

Transcribed Image Text:The Sir Arthur Lewis Community College has recently invited all accounting students in from

the Principles of cost and management accounting (ACC115) class to participate in a business

degree scholarship with an emphasis in accounting. The award for the highest score is a full

scholarship for a degree in Business Administration.

The following information for Good Times Inc. has been provided to assess the proficiency of all

participants in accounting:

Estimates for the period January to June 2021

Purchases ($) Operating

expenses ($)

35,000

20,000

Month

Sales ($)

January

February

March

350,000

200,000

100,000

250,000

300,000

360,000

210,000

120,000

60,000

150,000

180,000

10,000

25,000

30,000

36,000

April

May

June

216,000

Relevant data for the Good Times Inc. operations:

a. Payment for purchases is made as follows 80% in the month of purchase and the balance in

the following the following month. Payments made in the month of purchase are entitled to a

10% discount.

b. Sales are made on mostly made on account and collections have the following pattern, in

accordance with the credit terms 5/30, net 90.

During the month of sale

1st month following the sales 30%

2nd month after the sales

60%

10%

c. Depreciation on equipment is calculated at 10% on cost per annum. The cost of equipment is

$60,000. Depreciation expense is included in the operating expenses. All operating

expenses are paid in the month they are incurred.

d. An fixed investment at Jannou Ltd of $60,000 will be liquidated in June, after interest of

$6,000 has been collected in April.

e. Salaries and Wages forecasted for the six (6) month totaled $60,000 and are spread evenly

over the said period.

f. The beginning cash balance is $ -28,000, the bank was in overdraft by the said amount.

Required:

1. The sales collection schedule for the six (6) months showing the accounts receivable at the

end of the six months ending June 2021.

2. The purchases payment schedule for the six (6) months showing discounts received and

accounts payable at the end of the six months ending June 2021.

3. The cash budget including a total column for the three (3) months ending June 2021 (April to

June 2021).

1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning