The Sky Blue Corporation has the following adjusted trial balance at December 31. Debit Credit Cash $ 1,260 Accounts Receivable 2,300 Prepaid Insurance 2,600 Notes Receivable (long-term) 3,300 Equipment 13,500 Accumulated Depreciation $ 3,200 Accounts Payable 5,720 Salaries and Wages Payable 1,150 Income Taxes Payable 3,200 Deferred Revenue 660 Common Stock 2,700 Retained Earnings 1,120 Dividends 330 Sales Revenue 44,730 Rent Revenue 330 Salaries and Wages Expense 22,200 Depreciation Expense 1,600 Utilities Expense 4,520 Insurance Expense 1,700 Rent Expense 6,300 Income Tax Expense 3,200 Total $ 62,810 $ 62,810 M4-17 (Algo) Required: Prepare closing journal entries on December 31. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

The Sky Blue Corporation has the following adjusted trial balance at December 31. Debit Credit Cash $ 1,260 Accounts Receivable 2,300 Prepaid Insurance 2,600 Notes Receivable (long-term) 3,300 Equipment 13,500 Accumulated Depreciation $ 3,200 Accounts Payable 5,720 Salaries and Wages Payable 1,150 Income Taxes Payable 3,200 Deferred Revenue 660 Common Stock 2,700 Retained Earnings 1,120 Dividends 330 Sales Revenue 44,730 Rent Revenue 330 Salaries and Wages Expense 22,200 Depreciation Expense 1,600 Utilities Expense 4,520 Insurance Expense 1,700 Rent Expense 6,300 Income Tax Expense 3,200 Total $ 62,810 $ 62,810 M4-17 (Algo) Required: Prepare closing journal entries on December 31. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter17: Accounting For Notes And Interest

Section: Chapter Questions

Problem 13SPA: NOTES PAYABLE ENTRIES Milo Radio Shop had the following notes payable transactions: REQUIRED Record...

Related questions

Question

M4-14 through M4-17 (Algo) Reporting an Income Statement, Reporting a Statement of Retained Earnings , Reporting a Balance Sheet and Recording Closing Journal Entries [LO 4-4, LO 4-5]

Skip to question

[The following information applies to the questions displayed below.]

The Sky Blue Corporation has the following adjusted

| Debit | Credit | |

|---|---|---|

| Cash | $ 1,260 | |

| 2,300 | ||

| Prepaid Insurance | 2,600 | |

| Notes Receivable (long-term) | 3,300 | |

| Equipment | 13,500 | |

| $ 3,200 | ||

| Accounts Payable | 5,720 | |

| Salaries and Wages Payable | 1,150 | |

| Income Taxes Payable | 3,200 | |

| Deferred Revenue | 660 | |

| Common Stock | 2,700 | |

| Retained Earnings | 1,120 | |

| Dividends | 330 | |

| Sales Revenue | 44,730 | |

| Rent Revenue | 330 | |

| Salaries and Wages Expense | 22,200 | |

| Depreciation Expense | 1,600 | |

| Utilities Expense | 4,520 | |

| Insurance Expense | 1,700 | |

| Rent Expense | 6,300 | |

| Income Tax Expense | 3,200 | |

| Total | $ 62,810 | $ 62,810 |

M4-17 (Algo)

Required:

Prepare closing journal entries on December 31. (If no entry is required for a transaction/event, select "No

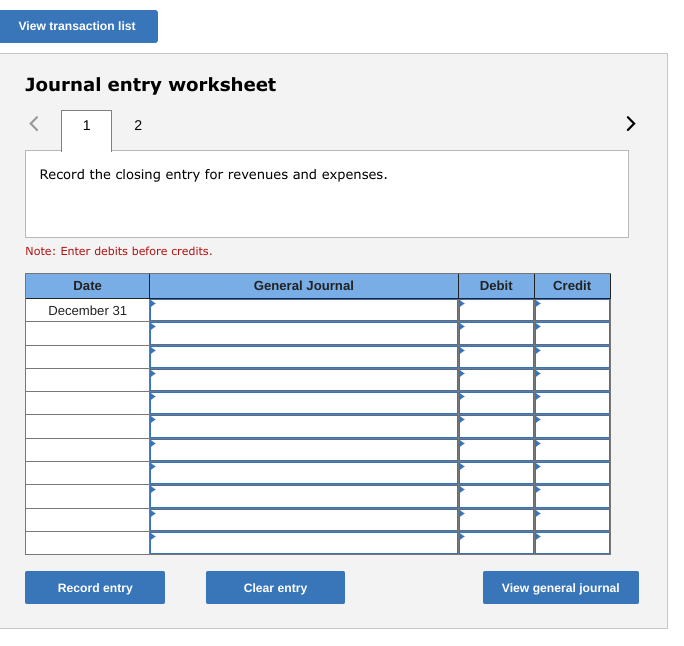

Transcribed Image Text:View transaction list

Journal entry worksheet

1

2

Record the closing entry for revenues and expenses.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

December 31

Record entry

Clear entry

View general journal

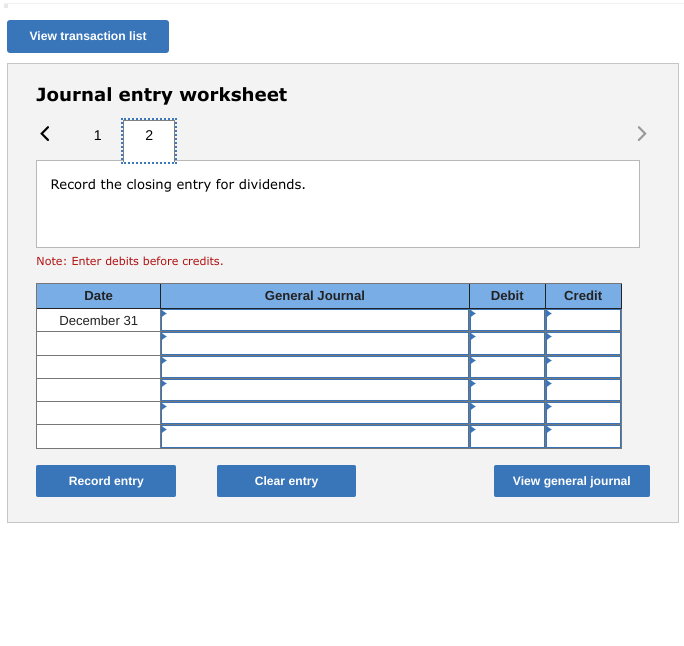

Transcribed Image Text:View transaction list

Journal entry worksheet

1

Record the closing entry for dividends.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

December 31

Record entry

Clear entry

View general journal

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,