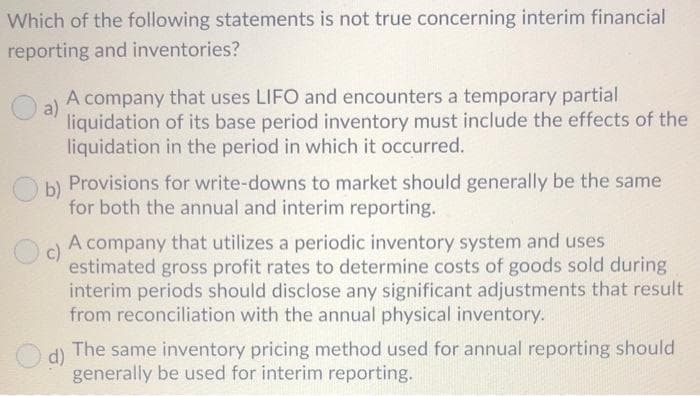

Which of the following statements is not true concerning interim financial reporting and inventories? A company that uses LIFO and encounters a temporary partial a) liquidation of its base period inventory must include the effects of the liquidation in the period in which it occurred. b) Provisions for write-downs to market should generally be the same for both the annual and interim reporting. A company that utilizes a periodic inventory system and uses c) estimated gross profit rates to determine costs of goods sold during interim periods should disclose any significant adjustments that result from reconciliation with the annual physical inventory. d) The same inventory pricing method used for annual reporting should generally be used for interim reporting.

Which of the following statements is not true concerning interim financial reporting and inventories? A company that uses LIFO and encounters a temporary partial a) liquidation of its base period inventory must include the effects of the liquidation in the period in which it occurred. b) Provisions for write-downs to market should generally be the same for both the annual and interim reporting. A company that utilizes a periodic inventory system and uses c) estimated gross profit rates to determine costs of goods sold during interim periods should disclose any significant adjustments that result from reconciliation with the annual physical inventory. d) The same inventory pricing method used for annual reporting should generally be used for interim reporting.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 36E: The following data were extracted from the accounting records of Harkins Company for the year ended...

Related questions

Question

Transcribed Image Text:Which of the following statements is not true concerning interim financial

reporting and inventories?

A company that uses LIFO and encounters a temporary partial

a)

liquidation of its base period inventory must include the effects of the

liquidation in the period in which it occurred.

b)

Provisions for write-downs to market should generally be the same

for both the annual and interim reporting.

A company that utilizes a periodic inventory system and uses

c)

estimated gross profit rates to determine costs of goods sold during

interim periods should disclose any significant adjustments that result

from reconciliation with the annual physical inventory.

d)

The same inventory pricing method used for annual reporting should

generally be used for interim reporting.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College