8. Determine the ending balance for the Allowance for Uncollectible Accounts Determine the appropriate amount $ to record for Bad Debt expense 9. Assuming the Allowance for Uncollectible accounts had a $700 debit balance, determine the amount to record for Bad Debt expense 10. $ 11. $ After recording bad debt expense, the Net Accounts Receivable is:

8. Determine the ending balance for the Allowance for Uncollectible Accounts Determine the appropriate amount $ to record for Bad Debt expense 9. Assuming the Allowance for Uncollectible accounts had a $700 debit balance, determine the amount to record for Bad Debt expense 10. $ 11. $ After recording bad debt expense, the Net Accounts Receivable is:

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 66E: Bad Debt Expense: Percentage of Credit Sales Method Gilmore Electronics had the following data for a...

Related questions

Question

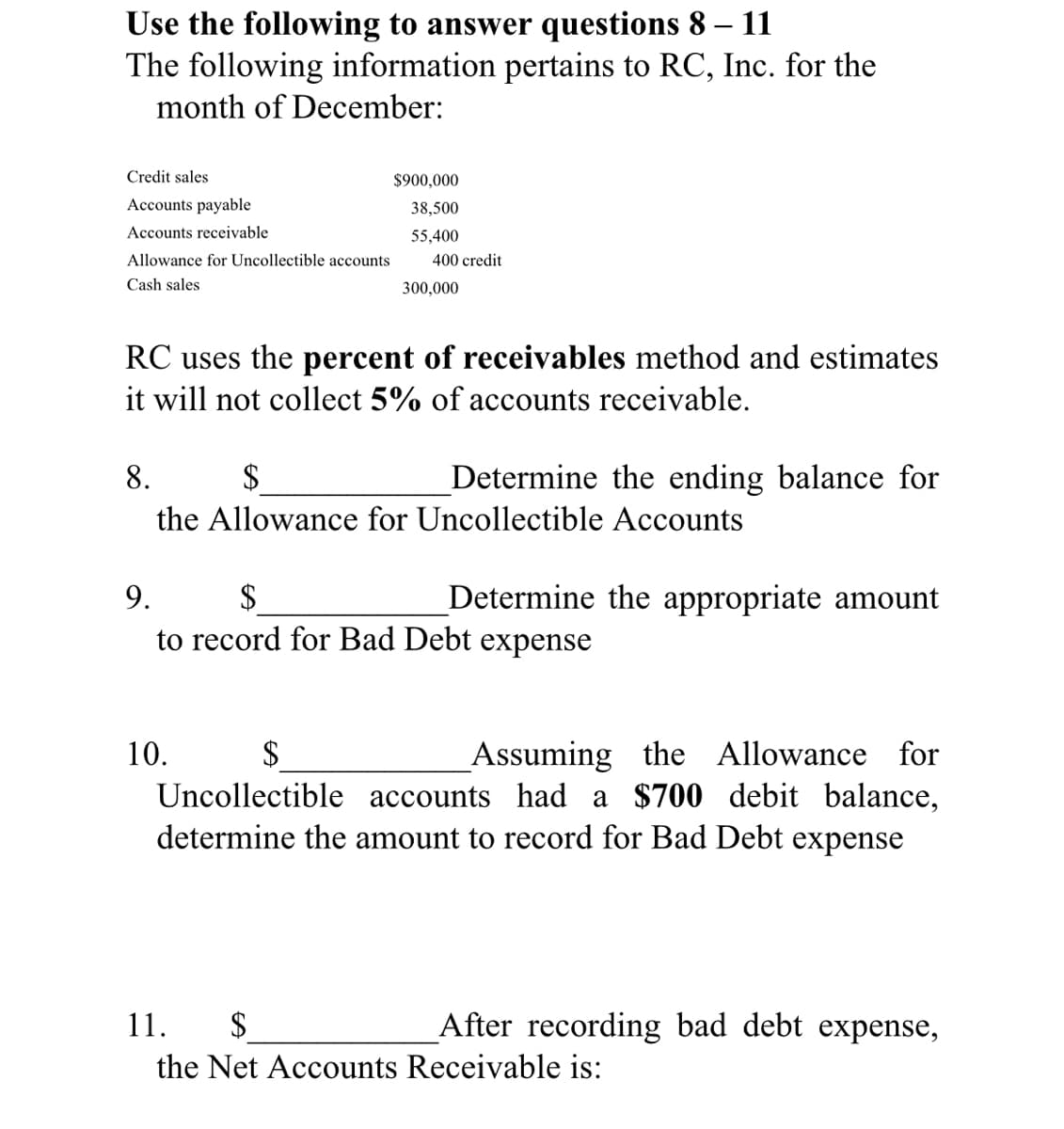

Transcribed Image Text:Use the following to answer questions 8 – 11

The following information pertains to RC, Inc. for the

month of December:

Credit sales

$900,000

Accounts payable

38,500

Accounts receivable

55,400

Allowance for Uncollectible accounts

400 credit

Cash sales

300,000

RC uses the percent of receivables method and estimates

it will not collect 5% of accounts receivable.

8.

$

Determine the ending balance for

the Allowance for Uncollectible Accounts

Determine the appropriate amount

$

to record for Bad Debt expense

9.

_Assuming the Allowance for

Uncollectible accounts had a $700 debit balance,

determine the amount to record for Bad Debt expense

10.

$

11.

$

After recording bad debt expense,

the Net Accounts Receivable is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning