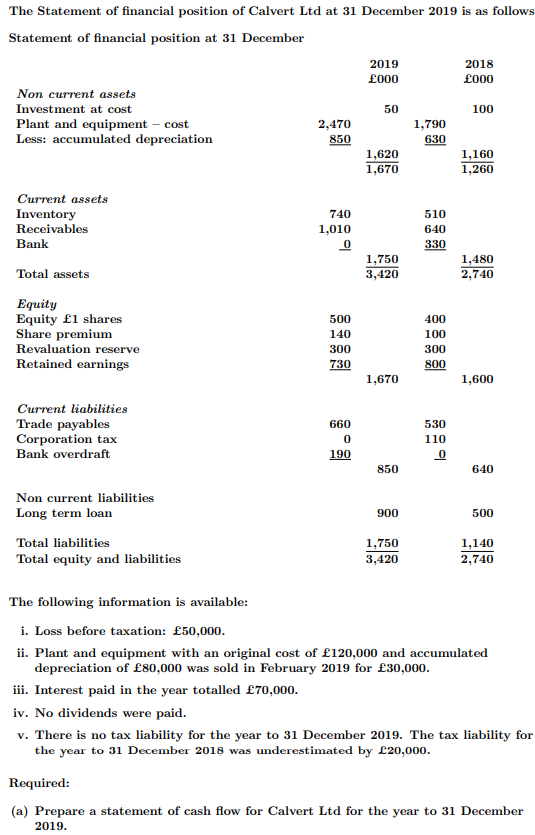

The Statement of financial position of Calvert Ltd at 31 December 2019 is as follow Statement of financial position at 31 December 2019 2018 £000 £000 Non current assets 50 1,790 Investment at cost 100 Plant and equipment – cost Less: accumulated depreciation 2,470 850 1,620 1,670 630 1,160 1,260 Current assets Inventory 740 510 Receivables 1,010 640 Bank 330 1,750 3,420 1,480 2,740 Total assets Equity Equity £1 shares Share premium Revaluation reserve Retained earnings 500 400 140 100 300 300 730 800 1,670 1,600 Current liabilities Trade payables Corporation tax 660 530 110 Bank overdraft 190 850 640 Non current liabilities Long term loan 900 500 Total liabilities 1,750 3,420 1,140 Total equity and liabilities 2,740 The following information is available: i. Loss before taxation: £50,000. ii. Plant and equipment with an original cost of £120,000 and accumulated depreciation of £80,000 was sold in February 2019 for £30,000. iii. Interest paid in the year totalled £70,000. iv. No dividends were paid. v. There is no tax liability for the year to 31 December 2019. The tax liability fo the year to 31 December 2018 was underestimated by £20,000. Required: (a) Prepare a statement of cash flow for Calvert Ltd for the year to 31 December

The Statement of financial position of Calvert Ltd at 31 December 2019 is as follow Statement of financial position at 31 December 2019 2018 £000 £000 Non current assets 50 1,790 Investment at cost 100 Plant and equipment – cost Less: accumulated depreciation 2,470 850 1,620 1,670 630 1,160 1,260 Current assets Inventory 740 510 Receivables 1,010 640 Bank 330 1,750 3,420 1,480 2,740 Total assets Equity Equity £1 shares Share premium Revaluation reserve Retained earnings 500 400 140 100 300 300 730 800 1,670 1,600 Current liabilities Trade payables Corporation tax 660 530 110 Bank overdraft 190 850 640 Non current liabilities Long term loan 900 500 Total liabilities 1,750 3,420 1,140 Total equity and liabilities 2,740 The following information is available: i. Loss before taxation: £50,000. ii. Plant and equipment with an original cost of £120,000 and accumulated depreciation of £80,000 was sold in February 2019 for £30,000. iii. Interest paid in the year totalled £70,000. iv. No dividends were paid. v. There is no tax liability for the year to 31 December 2019. The tax liability fo the year to 31 December 2018 was underestimated by £20,000. Required: (a) Prepare a statement of cash flow for Calvert Ltd for the year to 31 December

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 24CE

Related questions

Question

Statement of cash flow, information attached.

Transcribed Image Text:The Statement of financial position of Calvert Ltd at 31ı December 2019 is as follows

Statement of financial position at 31 December

2019

2018

£000

£000

Non current assets

Investment at cost

50

100

Plant and equipment – cost

Less: accumulated depreciation

2,470

1,790

850

630

1,620

1,670

1,160

1,260

Current assets

Inventory

Receivables

740

510

1,010

640

Bank

330

1,750

3,420

1,480

2,740

Total assets

Equity

Equity £1 shares

Share premium

Revaluation reserve

Retained earnings

500

400

140

100

300

300

730

800

1,670

1,600

Current liabilities

Trade payables

Corporation tax

Bank overdraft

660

530

110

190

850

640

Non current liabilities

Long term loan

900

500

Total liabilities

1,750

1,140

Total equity and liabilities

3,420

2,740

The following information is available:

i. Loss before taxation: £50,000.

ii. Plant and equipment with an original cost of £120,000 and accumulated

depreciation of £80,000 was sold in February 2019 for £30,000.

iii. Interest paid in the year totalled £70,000.

iv. No dividends were paid.

v. There is no tax liability for the year to 31 December 2019. The tax liability for

the year to 31 December 2018 was underestimated by £20,000.

Required:

(a) Prepare a statement of cash flow for Calvert Ltd for the year to 31 December

2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning