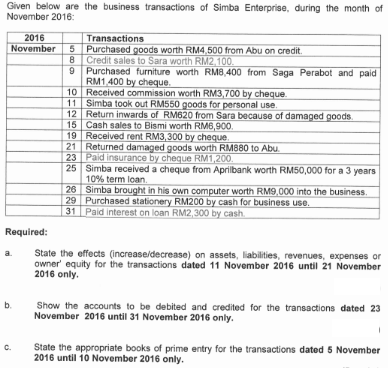

Given below are the business transactions of Simba Enterprise, during the month of November 2016: 2016 Transactions November 5 Purchased goods worth RM4,500 from Abu on credit. 8 Credit sales to Sara worth RM2,100. 9 Purchased furniture worth RM8,400 from Saga Perabot and paid RM1,400 by cheque. 10 Received commission worth RM3,700 by cheque. 11 Simba took out RM550 goods for personal use. 12 Return inwards of RM620 from Sara because of damaged goods 15 Cash sales to Bismi worth RM6,900. 19 Received rent RM3,300 by cheque. 21 Returned damaged goods worth RM880 to Abu. 23 Paid insurance by cheque RM1,200. 25 Simba received a cheque from Aprilbank worth RM50,000 for a 3 years 10% term loan, 26 Simba brought in his own computer worth RM9,000 into the business. 29 Purchased stationery RM200 by cash for business use. 31 Paid interest on loan RM2,300 by cash. Required: State the effects (increase/decrease) on assets, liabilities, revenues, expenses or owner' equity for the transactions dated 11 November 2016 until 21 November 2016 only. b. Show the accounts to be debited and credited for the transactions dated 23 November 2016 until 31 November 2016 only. State the appropriate books of prime entry for the transactions dated 5 November 2016 until 10 November 2016 only. C.

Given below are the business transactions of Simba Enterprise, during the month of November 2016: 2016 Transactions November 5 Purchased goods worth RM4,500 from Abu on credit. 8 Credit sales to Sara worth RM2,100. 9 Purchased furniture worth RM8,400 from Saga Perabot and paid RM1,400 by cheque. 10 Received commission worth RM3,700 by cheque. 11 Simba took out RM550 goods for personal use. 12 Return inwards of RM620 from Sara because of damaged goods 15 Cash sales to Bismi worth RM6,900. 19 Received rent RM3,300 by cheque. 21 Returned damaged goods worth RM880 to Abu. 23 Paid insurance by cheque RM1,200. 25 Simba received a cheque from Aprilbank worth RM50,000 for a 3 years 10% term loan, 26 Simba brought in his own computer worth RM9,000 into the business. 29 Purchased stationery RM200 by cash for business use. 31 Paid interest on loan RM2,300 by cash. Required: State the effects (increase/decrease) on assets, liabilities, revenues, expenses or owner' equity for the transactions dated 11 November 2016 until 21 November 2016 only. b. Show the accounts to be debited and credited for the transactions dated 23 November 2016 until 31 November 2016 only. State the appropriate books of prime entry for the transactions dated 5 November 2016 until 10 November 2016 only. C.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:Given below are the business transactions of Simba Enterprise, during the month of

November 2016:

2016

Transactions

November 5 Purchased goods worth RM4,500 from Abu on credit.

8 Credit sales to Sara worth RM2,100.

9 Purchased furniture worth RM8,400 from Saga Perabot and paid

RM1,400 by cheque.

10 Received commission worth RM3,700 by cheque.

11 Simba took out RM550 goods for personal use.

12 Return inwards of RM620 from Sara because of damaged goods

15 Cash sales to Bismi worth RM6,900.

19 Received rent RM3,300 by cheque.

21 Returned damaged goods worth RM880 to Abu.

23 Paid insurance by cheque RM1,200.

25 Simba received a cheque from Aprilbank worth RM50,000 for a 3 years

10% term loan,

26 Simba brought in his own computer worth RM9,000 into the business.

29 Purchased stationery RM200 by cash for business use.

31 Paid interest on loan RM2,300 by cash.

Required:

State the effects (increase/decrease) on assets, liabilities, revenues, expenses or

owner' equity for the transactions dated 11 November 2016 until 21 November

2016 only.

b.

Show the accounts to be debited and credited for the transactions dated 23

November 2016 until 31 November 2016 only.

State the appropriate books of prime entry for the transactions dated 5 November

2016 until 10 November 2016 only.

C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education