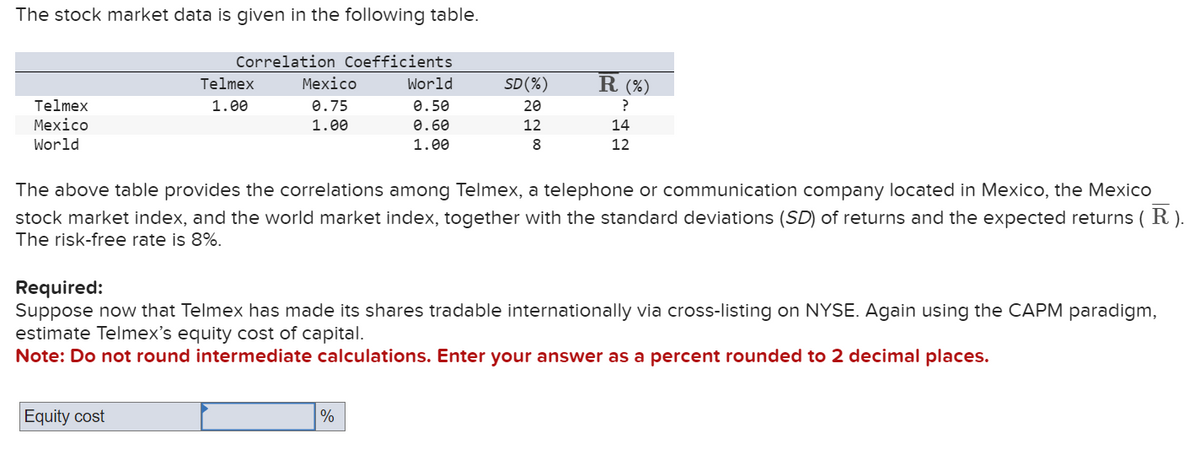

The stock market data is given in the following table. The above table provides the correlations among Telmex, a telephone or communication company located in Mexico, the Mexico stock market index, and the world market index, together with the standard deviations (SD) of returns and the expected returns ( /bar (R) ). The risk-free rate is 8%. Required: Suppose now that Telmex has made its shares tradable internationally via cross-listing on NYSE. Again using the CAPM paradigm, estimate Telmex's equity cost of capital. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal place

The stock market data is given in the following table. The above table provides the correlations among Telmex, a telephone or communication company located in Mexico, the Mexico stock market index, and the world market index, together with the standard deviations (SD) of returns and the expected returns ( /bar (R) ). The risk-free rate is 8%. Required: Suppose now that Telmex has made its shares tradable internationally via cross-listing on NYSE. Again using the CAPM paradigm, estimate Telmex's equity cost of capital. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal place

Chapter13: Direct Foreign Investment

Section: Chapter Questions

Problem 1IEE

Related questions

Question

The stock market data is given in the following table. The above table provides the correlations among Telmex, a telephone or communication company located in Mexico, the Mexico stock market index, and the world market index, together with the standard deviations (SD) of returns and the expected returns ( /bar (R) ). The risk-free rate is 8%. Required: Suppose now that Telmex has made its shares tradable internationally via cross-listing on NYSE. Again using the

Transcribed Image Text:The stock market data is given in the following table.

Correlation Coefficients

Telmex

Telmex

Mexico

World

1.00

Mexico

0.75

World

SD(%)

R (%)

0.50

20

?

1.00

0.60

12

1.00

8

14

12

The above table provides the correlations among Telmex, a telephone or communication company located in Mexico, the Mexico

stock market index, and the world market index, together with the standard deviations (SD) of returns and the expected returns ( R ).

The risk-free rate is 8%.

Required:

Suppose now that Telmex has made its shares tradable internationally via cross-listing on NYSE. Again using the CAPM paradigm,

estimate Telmex's equity cost of capital.

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.

Equity cost

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning