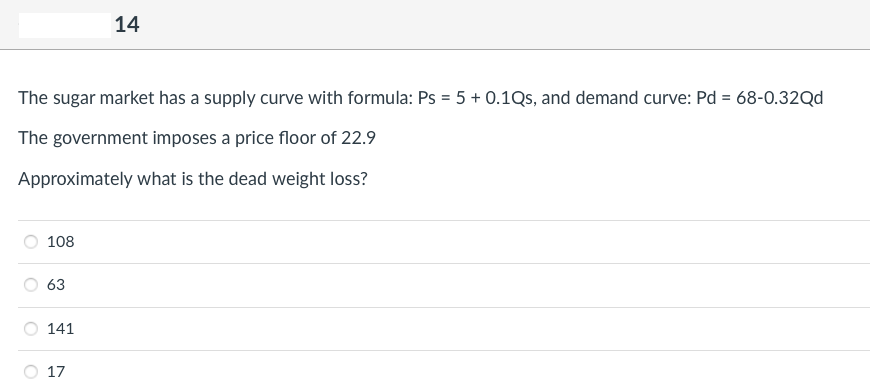

The sugar market has a supply curve with formula: Ps= 5 + 0.1Qs, and demand curve: Pd = 68-0.32Qd The government imposes a price floor of 22.9 Approximately what is the dead weight loss? 108 63

Q: Suppose there are two airlines, A and B, competing for the market of route from New York to…

A: Introduction Oligopoly is sometime referred as competition among the two. We can simply defined…

Q: So9.

A: CI x f fx x (x-x) (x-x)2 f(x-x)2 10-14 12 5 60 23.25 -11.25 126.56 632.8 15-19 17 20 340…

Q: What you understand by Business Cycles.

A: Economics refers to the social science that studies the production, distribution, and consumption of…

Q: Question 3 A regressive tax is one where those with higher incomes pay a higher share of taxes out…

A: Hi! Thank you for the question As per the honor code, We’ll answer the first question since the…

Q: A government finances all of its debt through 1-year treasury bonds. This government is able to…

A: The debt-to-GDP ratio is the percentage of a country's debt to its GDP. It is used to measure a…

Q: The basic difference between macroeconomics and microeconomics is: O microeconomics concentrates on…

A: Microeconomics and macroeconomics are two branches of economics

Q: Ideally, a tax system would require equal sacrifice, not of dollars, but of utility from each…

A: Taxation refers to the practice of governments levying mandatory financial obligations on private…

Q: Which of the following situations illustrate the problem of unmeasured quality change in the…

A: The measure that depicts the change in consumer prices based on a basket of services and goods over…

Q: For the cost function C(Q) = 500+12Q+4Q2+Q3, what is the marginal cost of producing the eighth unit…

A: Cost is a function of the quantity produced. It measures the cost incurred in the production of…

Q: Social Security benefits are increased each year in proportion to the increase in the CPI, even…

A: The measure that depicts the change in consumer prices based on a basket of goods and services over…

Q: buyer and seller are haggling over what price will be paid. If the seller is the better negotiator,…

A: 1. Equilibrium is the point where demand is equal to supply. When both buyer and sellers agree on…

Q: 6. A firm's long-run total cost function is given by LTC = 115.000Q-500Q2 + G where Q is the…

A: Gradually in simple words we can say that the economies of scale are determined to be as the cost…

Q: 5. Problems and Applications Q9 A farmer grows wheat, which she sells to a miller for $70. The…

A: "GDP or Gross domestic product in an economy represents the monetary value of all the final…

Q: Assume no change in the labour force. In the 2030s, physical capital increased by 20% and GDP…

A: The marginal product of capital refers to an increase in the total product because of an additional…

Q: Production Year1 Year 2 Year 3 50 50 60 140 Good X Good Y 100 120 Prices Year 1 Year 2 Year $1.00…

A: The GDP deflator, is a proportion of inflation. It is the proportion of the worth of goods and…

Q: The accompanying graph shows the short-run demand and cost situation for a price searcher in a…

A: A perfectly competitive firm is characterized by three factors: - Infinite number of buyers and…

Q: Fill in the missing data in the following table. Year 2012 2013 2014 $260,000 2015 $290,000 Nominal…

A: GDP Deflator The (GDP) gross domestic product price deflator estimates changes in the prices of all…

Q: Suppose that Country A and Country B have unit labour requirements for producing one tonne of steel…

A: Note:- “Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: On January 1, 2026, each of Boblandia's 100 workers has $2 in physical capital. Over the course of…

A:

Q: Distinguish between IMF and Word Bank?

A: The Bretton Woods Conference in July 1994 led to the creation of the World Bank and the…

Q: Criticize Keynes in two points on the equality between savings and investment.

A: The Keynesian model assumes that in the short run the prices of the goods are constant and the…

Q: Leisure Times, Inc., employs skilled workers and capital to install hot tubs. The capital includes…

A: Given information: Leisure Times Inc., employs skilled workers and capital to install hot tubs. The…

Q: 1. GDP Computations Year 2020 2021 2022 The following table shows some data for an economy that…

A: "GDP represents the money value of all finished goods and services produced in a nation at a given…

Q: Policies that provide subsidies to domestic producers to encourage the production of goods for…

A: In an open economy, people make import and export of goods and services. Higher exports will improve…

Q: A monopolist's maximized rate of economic profits is $400 per week. Its weekly output is 200 units,…

A: Average total cost is referred to as the sum total of all production costs divided by the total…

Q: Question 2 [Soalan 2] Draw a graph with the exchange rate (RM/S) on the Y-axis and the quantity of…

A: The exchange rate is the rate at which one currency can be exchanged for another currency. A…

Q: Question 3: Contrast the actions a central bank should take when an economy is in recession with…

A: A recession is a situation when the demand for goods and services goes down and the producers are…

Q: Firm A operates in perfect competition, and the price the firm faces is greater than its average…

A: Since you asked multiple questions, we will solve first question for you. In case you want any other…

Q: Use the following information to answer the question which immediately follows Ý 2,000 GT= 200, Cd…

A: IS curve depicts the combination of interest rate and output level that clears the goods market. LM…

Q: If the United States adopts a law that every good imported from another country must be visually…

A: A government bureaucracy is developed to implement, administer, and control the authority's laws.…

Q: Question 4 First, what are the primary determinants of growth? And second, how and to what extent…

A: The Solow Growth Model dissects changes in the level of result in an economy over the long haul…

Q: T4

A: Demand Curve: - demand curve is the graphical way of showing the relationship between the quantity…

Q: If the reserve ratio is 50%, what is the deposit multiplier?

A: Deposit multiplier is a factor by which maximum money supply changes when there is a change in…

Q: 13. Suppose Becky is starting a grocery delivery company, which takes grocery orders from customers,…

A: Given; Amount paid for telephone services= $5 Rent of delivery van= $75 Wages of each worker= $100…

Q: Consult the table below, and answer the following questions: Schooling Salary $18500 9 10 11 12 13…

A: Schooling Salary 9 18500 10 21000 11 23000 12 24800 13 26200 14 27000

Q: 1 2 3 4 Year Actual budget deficit (–) or surplus (+) Standardized budget deficit (–) or…

A: INTRODUCTION The central bank mainly uses two types of monetary policies: expansionary and…

Q: Suppose total reserve=40, MC=20, MB=70-2Q. In a two-period model, which of the following (ql, q2)…

A: As per the guidelines we are allowed to answer the first question only. Please post the remaining…

Q: You decide to repay a small loan of P1,000,500.00. What would be the size of the amount to be repaid…

A: The amount of loan = P1000500 Time period = 20 years Interest rate = 2%

Q: Graph the Average Total Costs, Average Variable Costs, and Marginal Costs on the same graph.

A: Average total cost is total cost divided by quantity. ATC = TC / Q ------------------- Average…

Q: Let’s assume that the Federal Reserve bank requires the Oxnard County Bank to maintain 20% of…

A: Given reserve ratio = 20 % Purchases of bonds by Fed = 310 Million $ Money multiplier = 1 / reserve…

Q: 1) In the subgame perfect equilibrium, Janie begins by taking Answer coins. 2) Suppose Janie makes a…

A: INTRODUCTION: There are two players Jesse and Janie. The total no of coins is 50. The condition is…

Q: n the United States, imposing a tariff on imported vitamin D3 would: Group of answer choices…

A: When the country impose the tariff on the imported product, then it raises the price of product in…

Q: The profit maximizing quantity for this firm it is 2. The profit maximizing price for this firm…

A: The Monopolist refers to the single firm in the market or entire market is served by the single…

Q: Refer to the graph below to answer questions 2 and 3: Interest Rate Quantity of Loanable Funds On…

A: At the marketplace, rate of return refers to the proportion of principal amount that an investor…

Q: Assume that country A can use its resources to produce 320 computers or 320,000 books, while country…

A: Since you have posted a question with multiple sub parts, we will solve first three subparts for…

Q: The inverse demand function for a commodity is given by p=41-0.33q and the cost of producing that…

A: Introduction The technique of maxima and minima can be used to determined the level of output at…

Q: 9. All else equal (including their discount rates), if Albert now has a higher level of innate…

A: Q9. If a person has higher innate ability would we expect them to have less years of schooling or…

Q: 1

A: We know that Harrod given his growth model in his book "towards a dynamic equilibrium". The main…

Q: 1. An example of a market where supply and demand are both inelastic. 2. An example of a market…

A: At the marketplace, there are numerous of goods and services with elastic or inelastic demand and…

Q: 3. Supply and Demand Shifts Read the article at the end of this exam entitled “Gen Z Isn't That Into…

A: Here, the given paragraph explains the market condition of restaurants. It can be seen that there is…

Step by step

Solved in 4 steps with 1 images

- Market demand for Mandrake roots is given by Q=325-4P and market supply is given by Q=5P. The government imposes a price ceiling of $10. What is the minimum Deadweight Loss, in absolute terms, because of the price ceiling? Assume competitive markets.Market demand for Mandrake roots is given by Q=305-2P and marketsupply is given by Q=5P. The market is initially in equilibrium.The government imposes a price ceiling of $9. What is the CHANGE in Producer Surplus due to the price ceiling?Assume competitive markets.Market demand for Mandrake roots is given by Q=477-5P and market supply is given by Q=5P. The government imposes a price ceiling of $20. What is the Consumer Surplus in the market with the price ceiling?

- Market demand for Mandrake roots is given by 261-2P and market supply is given by Q = 4P. The government imposes a price ceiling of $23. What is the consumer surplus in the market with the price ceiling?Market demand for Mandrake roots is given by Q=419-3P and marketsupply is given by Q=3P. The government imposes a price ceiling of $10. What is the Consumer Surplus in the market with the price ceiling? Assume competitive markets.Consider a market where supply and demand are given by QXS = -14 + PX and QXd = 82 - 2PX. Suppose the government imposes a price floor of $37, and agrees to purchase and discard any and all units consumers do not buy at the floor price of $37 per unit. Instructions: Enter your responses rounded to the nearest penny (two decimal places). a. Determine the cost to the government of buying firms’ unsold units.$ b. Compute the lost social welfare (deadweight loss) that stems from the $37 price floor.

- GIVEN THE FOLLOWING QD=240-5P QS=P WHERE QD IS THE QUANTITY DEMANDED, QS IS THE QUANTITY SUPPLIED AND P IS THE PRICE. SUPPOSE THAT THE GOVERNMENT DECIDES TO IMPOSE A TAX OF $12 PER UNIT ON SELLERS IN THIS MARKET DETERMINE: PRODUCER SURPLUS AFTER TAX QUANTITY AFTER TAX SELLER’S PRICE AFTER TAX BUYER’S PRICE AFTER TAX PLEASE ANSWER ALL QUESTIONS! THANKSConsider a market where supply and demand are given by QXS = −14 + PX and QXd = 91 − 2PX. Suppose the government imposes a price floor of $42, and agrees to purchase and discard any and all units consumers do not buy at the floor price of $42 per unit. Instructions: Enter your responses rounded to the nearest penny (two decimal places). a. Determine the cost to the government of buying firms’ unsold units.b. Compute the lost social welfare (deadweight loss) that stems from the $42 price floor.Consider a market where supply and demand are given by QS =P-20 and QD =130-2P, respectively. Suppose the government imposes a price ceiling of £44. Calculate the deadweight loss as a result of this price ceiling.

- Consider a market where supply and demand are given by Qxs = −16 + Px and Qxd = 92 − 2Px . Suppose the government imposes a price floor of $40 and agrees to purchase and discard any and all units consumers do not buy at the floor price of $40 per unit. a. Determine the cost to the government of buying firms’ unsold units. b. Compute the lost social welfare (deadweight loss) that stems from the $40 price floorSuppose the following demand and supply function of a commodity. 15 Qd = 55 - 5P Qs = -50 + 10P After imposing tax, the new supply function is Qs = -60 + 10P Find out the equilibrium price and quantity before tax.Consider a market where supply and demand are given by QXS = −16 + PX and QXd = 83 − 2PX. Suppose the government imposes a price floor of $36, and agrees to purchase and discard any and all units consumers do not buy at the floor price of $36 per unit. Instructions: Enter your responses rounded to the nearest penny (two decimal places). a. Determine the cost to the government of buying firms’ unsold units.$ b. Compute the lost social welfare (deadweight loss) that stems from the $36 price floor.$