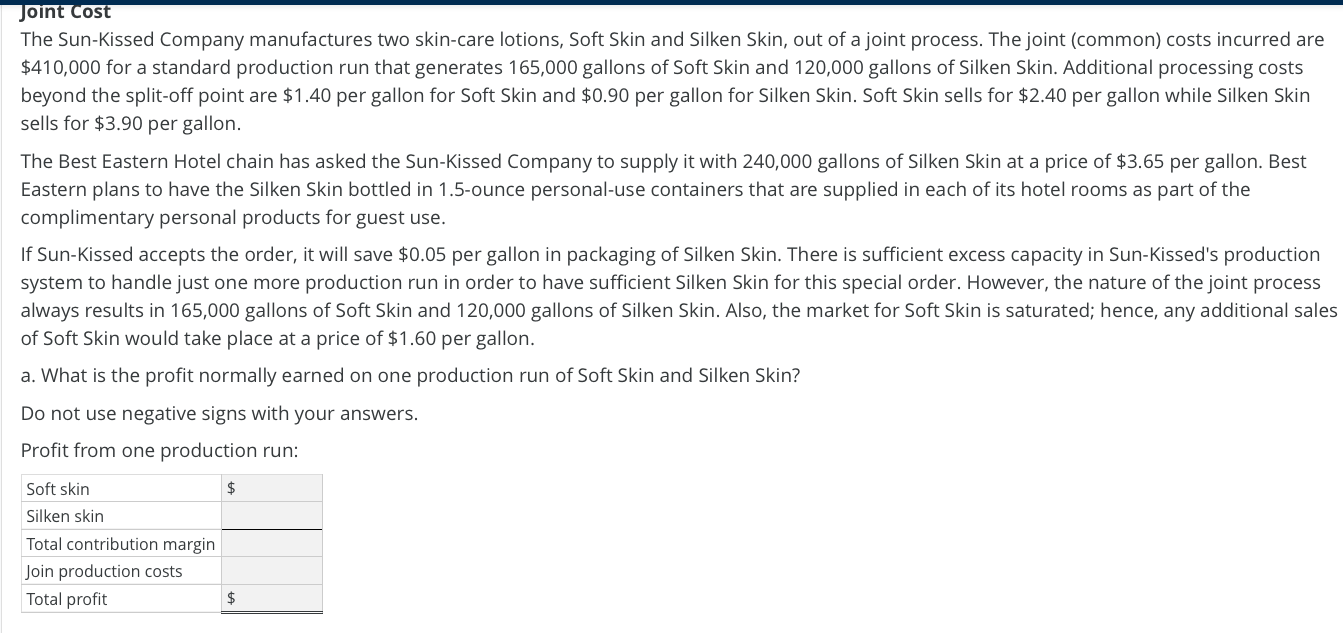

The Sun-Kissed Company manufactures two skin-care lotions, Soft Skin and Silken Skin, out of a joint process. The joint (common) costs incurred are $410,000 for a standard production run that generates 165,000 gallons of Soft Skin and 120,000 gallons of Silken Skin. Additional processing costs beyond the split-off point are $1.40 per gallon for Soft Skin and $0.90 per gallon for Silken Skin. Soft Skin sells for $2.40 per gallon while Silken Skin sells for $3.90 per gallon. The Best Eastern Hotel chain has asked the Sun-Kissed Company to supply it with 240,000 gallons of Silken Skin at a price of $3.65 per gallon. Best Eastern plans to have the Silken Skin bottled in 1.5-ounce personal-use containers that are supplied in each of its hotel rooms as part of the complimentary personal products for guest use. If Sun-Kissed accepts the order, it will save $0.05 per gallon in packaging of Silken Skin. There is sufficient excess capacity in Sun-Kissed's production system to handle just one more production run in order to have sufficient Silken Skin for this special order. However, the nature of the joint process always results in 165,000 gallons of Soft Skin and 120,000 gallons of Silken Skin. Also, the market for Soft Skin is saturated; hence, any additional sales of Soft Skin would take place at a price of $1.60 per gallon. a. What is the profit normally earned on one production run of Soft Skin and Silken Skin?

The Sun-Kissed Company manufactures two skin-care lotions, Soft Skin and Silken Skin, out of a joint process. The joint (common) costs incurred are $410,000 for a standard production run that generates 165,000 gallons of Soft Skin and 120,000 gallons of Silken Skin. Additional processing costs beyond the split-off point are $1.40 per gallon for Soft Skin and $0.90 per gallon for Silken Skin. Soft Skin sells for $2.40 per gallon while Silken Skin sells for $3.90 per gallon. The Best Eastern Hotel chain has asked the Sun-Kissed Company to supply it with 240,000 gallons of Silken Skin at a price of $3.65 per gallon. Best Eastern plans to have the Silken Skin bottled in 1.5-ounce personal-use containers that are supplied in each of its hotel rooms as part of the complimentary personal products for guest use. If Sun-Kissed accepts the order, it will save $0.05 per gallon in packaging of Silken Skin. There is sufficient excess capacity in Sun-Kissed's production system to handle just one more production run in order to have sufficient Silken Skin for this special order. However, the nature of the joint process always results in 165,000 gallons of Soft Skin and 120,000 gallons of Silken Skin. Also, the market for Soft Skin is saturated; hence, any additional sales of Soft Skin would take place at a price of $1.60 per gallon. a. What is the profit normally earned on one production run of Soft Skin and Silken Skin?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter7: Allocating Costs Of Support Departments And Joint Products

Section: Chapter Questions

Problem 27E: Pacheco, Inc., produces two products, overs and unders, in a single process. The joint costs of this...

Related questions

Question

Transcribed Image Text:The Sun-Kissed Company manufactures two skin-care lotions, Soft Skin and Silken Skin, out of a joint process. The joint (common) costs incurred are

$410,000 for a standard production run that generates 165,000 gallons of Soft Skin and 120,000 gallons of Silken Skin. Additional processing costs

beyond the split-off point are $1.40 per gallon for Soft Skin and $0.90 per gallon for Silken Skin. Soft Skin sells for $2.40 per gallon while Silken Skin

sells for $3.90 per gallon.

The Best Eastern Hotel chain has asked the Sun-Kissed Company to supply it with 240,000 gallons of Silken Skin at a price of $3.65 per gallon. Best

Eastern plans to have the Silken Skin bottled in 1.5-ounce personal-use containers that are supplied in each of its hotel rooms as part of the

complimentary personal products for guest use.

If Sun-Kissed accepts the order, it will save $0.05 per gallon in packaging of Silken Skin. There is sufficient excess capacity in Sun-Kissed's production

system to handle just one more production run in order to have sufficient Silken Skin for this special order. However, the nature of the joint process

always results in 165,000 gallons of Soft Skin and 120,000 gallons of Silken Skin. Also, the market for Soft Skin is saturated; hence, any additional sales

of Soft Skin would take place at a price of $1.60 per gallon.

a. What is the profit normally earned on one production run of Soft Skin and Silken Skin?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning