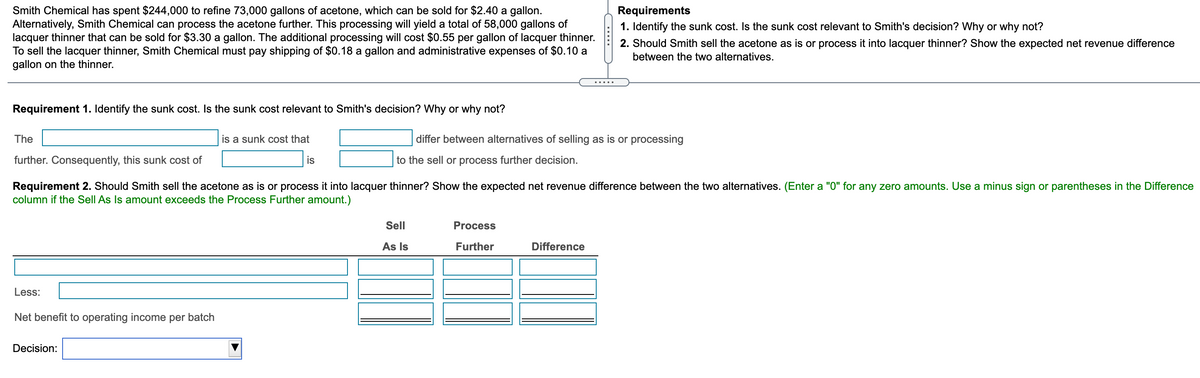

Smith Chemical has spent $244,000 to refine 73,000 gallons of acetone, which can be sold for $2.40 a gallon. Alternatively, Smith Chemical can process the acetone further. This processing will yield a total of 58,000 gallons of lacquer thinner that can be sold for $3.30 a gallon. The additional processing will cost $0.55 per gallon of lacquer thinner. To sell the lacquer thinner, Smith Chemical must pay shipping of $0.18 a gallon and administrative expenses of $0.10 a gallon on the thinner Requirements 1. Identify the sunk cost. Is the sunk cost relevant to Smith's decision? Why or why not? 2. Should Smith sell the acetone as is or process it into lacquer thinner? Show the expected net revenue difference between the two alternatives.

Smith Chemical has spent $244,000 to refine 73,000 gallons of acetone, which can be sold for $2.40 a gallon. Alternatively, Smith Chemical can process the acetone further. This processing will yield a total of 58,000 gallons of lacquer thinner that can be sold for $3.30 a gallon. The additional processing will cost $0.55 per gallon of lacquer thinner. To sell the lacquer thinner, Smith Chemical must pay shipping of $0.18 a gallon and administrative expenses of $0.10 a gallon on the thinner Requirements 1. Identify the sunk cost. Is the sunk cost relevant to Smith's decision? Why or why not? 2. Should Smith sell the acetone as is or process it into lacquer thinner? Show the expected net revenue difference between the two alternatives.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter15: Lean Accounting And Productivity Measurement

Section: Chapter Questions

Problem 28P

Related questions

Question

Transcribed Image Text:Smith Chemical has spent $244,000 to refine 73,000 gallons of acetone, which can be sold for $2.40 a gallon.

Alternatively, Smith Chemical can process the acetone further. This processing will yield a total of 58,000 gallons of

lacquer thinner that can be sold for $3.30 a gallon. The additional processing will cost $0.55 per gallon of lacquer thinner.

To sell the lacquer thinner, Smith Chemical must pay shipping of $0.18 a gallon and administrative expenses of $0.10 a

gallon on the thinner.

Requirements

1. Identify the sunk cost. Is the sunk cost relevant to Smith's decision? Why or why not?

2. Should Smith sell the acetone as is or process it into lacquer thinner? Show the expected net revenue difference

between the two alternatives.

.....

Requirement 1. Identify the sunk cost. Is the sunk cost relevant to Smith's decision? Why or why not?

The

is a sunk cost that

differ between alternatives of selling as is or processing

further. Consequently, this sunk cost of

is

to the sell or process further decision.

Requirement 2. Should Smith sell the acetone as is or process it into lacquer thinner? Show the expected net revenue difference between the two alternatives. (Enter a "0" for any zero amounts. Use a minus sign or parentheses in the Difference

column if the Sell As Is amount exceeds the Process Further amount.)

Sell

Process

As Is

Further

Difference

Less:

Net benefit to operating income per batch

Decision:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning