The Susan Company is debating if they should purchase a new machine for its factory operations at a cost of $745,200. The investment is expected to generate $150,000 in annual cash flows for a period of eight years. The required rate of return is 10%. The old machine has a remaining life of eight years. The new machine is expected to have zero value at the end of the eightminus-year period. The disposal value of the old machine at the time of replacement is zero. (Click the icon to view the Future Value of $1 factors.) (Click the icon to view the Future Value of Annuity of $1 factors.) E(Click the icon to view the Present Value of $1 factors.) (Click the icon to view the Present Value of Annuity of $1 factors.) Requirement 1: What is the Internal Rate of Return of this investment that Susan Company is making? O A. 14% O B. 8% Oc. 10% O D. 12% Requirement 2: Should Susan Company purchase the new machine? Why? O A. Yes, as the internal rate of return is more than their required rate of return O B. There is no way to tell if they should make this investment just based on the Internal Rate of Return OC. No, as the internal rate of return is less than their required rate of return O D. Yes, as the internal rate of return is the same as their required rate of return

The Susan Company is debating if they should purchase a new machine for its factory operations at a cost of $745,200. The investment is expected to generate $150,000 in annual cash flows for a period of eight years. The required rate of return is 10%. The old machine has a remaining life of eight years. The new machine is expected to have zero value at the end of the eightminus-year period. The disposal value of the old machine at the time of replacement is zero. (Click the icon to view the Future Value of $1 factors.) (Click the icon to view the Future Value of Annuity of $1 factors.) E(Click the icon to view the Present Value of $1 factors.) (Click the icon to view the Present Value of Annuity of $1 factors.) Requirement 1: What is the Internal Rate of Return of this investment that Susan Company is making? O A. 14% O B. 8% Oc. 10% O D. 12% Requirement 2: Should Susan Company purchase the new machine? Why? O A. Yes, as the internal rate of return is more than their required rate of return O B. There is no way to tell if they should make this investment just based on the Internal Rate of Return OC. No, as the internal rate of return is less than their required rate of return O D. Yes, as the internal rate of return is the same as their required rate of return

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 4P

Related questions

Question

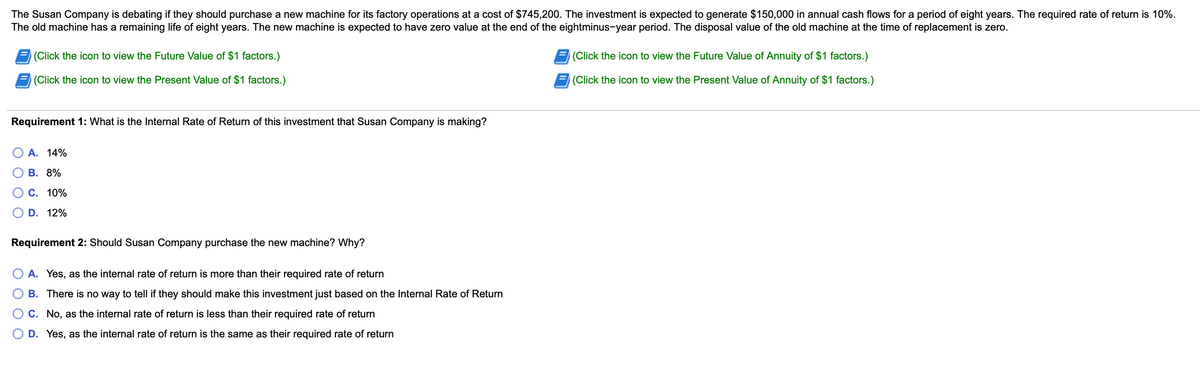

Transcribed Image Text:The Susan Company is debating if they should purchase a new machine for its factory operations at a cost of $745,200. The investment is expected to generate $150,000 in annual cash flows for a period of eight years. The required rate of return is 10%.

The old machine has a remaining life of eight years. The new machine is expected to have zero value at the end of the eightminus-year period. The disposal value of the old machine at the time of replacement is zero.

(Click the icon to view the Future Value of $1 factors.)

(Click the icon to view the Future Value of Annuity of $1 factors.)

(Click the icon to view the Present Value of $1 factors.)

(Click the icon to view the Present Value of Annuity of $1 factors.)

Requirement 1: What is the Internal Rate of Return of this investment that Susan Company is making?

O A. 14%

В. 8%

С. 10%

D. 12%

Requirement 2: Should Susan Company purchase the new machine? Why?

O A. Yes, as the internal rate of return is more than their required rate

return

B. There is no way to tell if they should make this investment just based on the Internal Rate of Return

C. No, as the internal rate of return is less than their required rate of return

D. Yes, as the internal rate of return is the same as their required rate of return

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning