The table below depicts the maximum buying prices and minimum selling prices that potential buyers and sellers have for a horse. Assume that a horse is considered to be a good of the first order. Potential Buyer $300 $280 $260 $240 $220 $210 $200 Al A2 A3 A4 AS A6 A7 Potential Seller $100 $110 $150 $170 $200 $215 $250 B1 B2 B3 B4 B5 B6 B7

The table below depicts the maximum buying prices and minimum selling prices that potential buyers and sellers have for a horse. Assume that a horse is considered to be a good of the first order. Potential Buyer $300 $280 $260 $240 $220 $210 $200 Al A2 A3 A4 AS A6 A7 Potential Seller $100 $110 $150 $170 $200 $215 $250 B1 B2 B3 B4 B5 B6 B7

Principles of Economics, 7th Edition (MindTap Course List)

7th Edition

ISBN:9781285165875

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter22: Frontiers Of Microeconomics

Section: Chapter Questions

Problem 4PA

Related questions

Question

Transcribed Image Text:Q3.

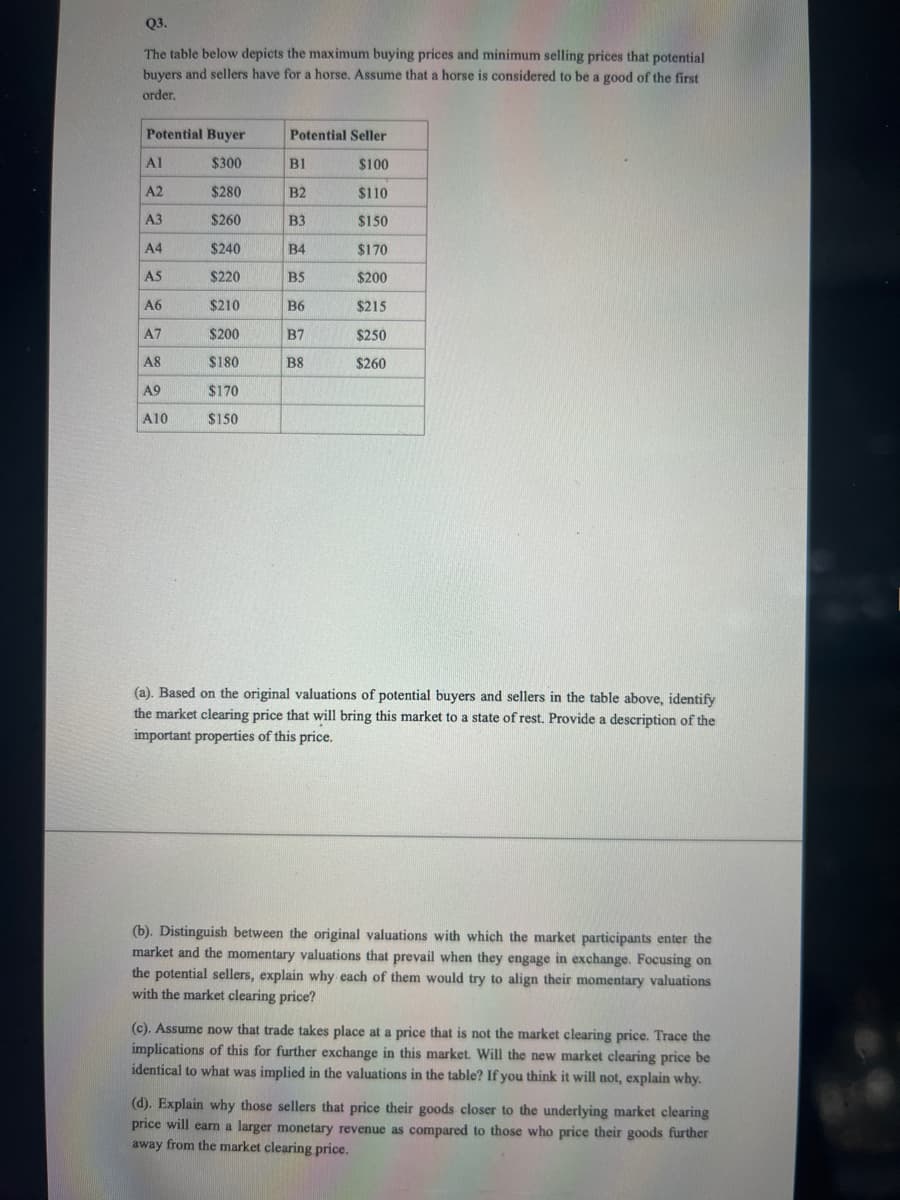

The table below depicts the maximum buying prices and minimum selling prices that potential

buyers and sellers have for a horse. Assume that a horse is considered to be a good of the first

order.

Potential Buyer

$300

$280

$260

$240

$220

$210

$200

$180

$170

$150

Al

A2

A3

A4

AS

A6

A7

A8

A9

A10

Potential Seller

$100

$110

$150

$170

$200

$215

$250

$260

Bl

B2

B3

B4

B5

B6

B7

B8

(a). Based on the original valuations of potential buyers and sellers in the table above, identify

the market clearing price that will bring this market to a state of rest. Provide a description of the

important properties of this price.

(b). Distinguish between the original valuations with which the market participants enter the

market and the momentary valuations that prevail when they engage in exchange. Focusing on

the potential sellers, explain why each of them would try to align their momentary valuations

with the market clearing price?

(c). Assume now that trade takes place at a price that is not the market clearing price. Trace the

implications of this for further exchange in this market. Will the new market clearing price be

identical to what was implied in the valuations in the table? If you think it will not, explain why.

(d). Explain why those sellers that price their goods closer to the underlying market clearing

price will earn a larger monetary revenue as compared to those who price their goods further

away from the market clearing price.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning