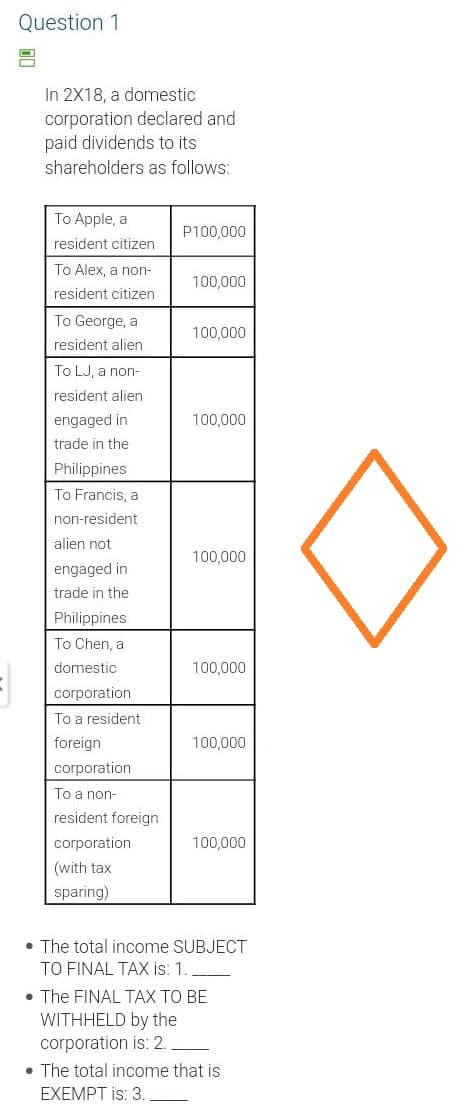

2X18, a domestic orporation declared an aid dividends to its hareholders as follows

Q: PROBLEMS: 1. Make a formula at cell C17 to C22 given the condition: It will display GOOD if INCOME…

A: Microsoft Excel- Microsoft Excel is a MS office program, used to calculate numerical values in a…

Q: Diana Mark is the president of ServicePro, Incorporated, a company that provides temporary employees…

A: Journal Entries: Simple journal entries are a form of accounting entry used in double-entry…

Q: Compute the amount of deduction that Mr. J can claim in relation to: a. 2016 lease; b. 2017 lease;…

A: Lease rent

Q: 1) The profits of the last five years were: OMR 32,500, OMR 25,500, OMR 32,000, OMR 15,525 (Loss)…

A: Introduction: Goodwill: Goodwill is an intangible asset. To be shown in Balance sheet , asset item.

Q: Silver Company makes a product that is very popular as a Mother’s Day gift. Thus, peak sales occur…

A: Cash Collection from Accounts Receivables: The process of cash collecting is within the purview of…

Q: What are the measurement focuses and basis of accounting of governmental funds? What is the…

A: It is necessary that every government agency and department maintain accurate financial accounting…

Q: Deductions from Gross Income Classify the items for deduction in the following scenarios. 3. A…

A: Contribution to domestic charitable organization is subject to limit unless the organization is an…

Q: Entries for Factory Costs and Jobs Completed Collegiate Publishing Inc began printing operations on…

A: The direct costs incurred are debited to work in process and indirect costs are debited to…

Q: Find the annual depreciation using the double-increasing balance method for years: 4 and 5

A: Straight Line Rate = (1/Useful Life)×100 = (1/6)×100 = 16.67 % Double Increasing Rate = 2×Straight…

Q: [The following information applies to the questions displayed below.] Hillside issues $4,000,000 of…

A: The bonds payable are issued at premium when market rate is lower than the coupon rate of bonds…

Q: Mutual Inc, a 10 million dollar company, bought a domain subscription for $70 using a credit card.…

A: The depreciation is related to a decrease in the value of fixed assets. The tangible assets are…

Q: What is Vertical Analysis in Financial Analysis?

A: Financial Statement- Financial statements describe an entity's financial activity and condition. At…

Q: Rardin Corporation makes a product with the following standard costs: Standard Quantity or Hours…

A: Material price variance is the difference between actual cost of direct material purchased and…

Q: 53. Tea Tree Ltd has acquired some government bonds on 1 July 2022. The government bonds will…

A: Note: Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Lopez and Gonzales started a partnership with initial cash investments of $700,000 and $650,000,…

A: A partnership is an agreement between two or more partners where partners are agreed to work…

Q: Under the corporate form of business organization, Group of answer choices a)ownership rights are…

A: Owners of a corporate (company) are the stockholders. Shockholders hold shares of the corporate…

Q: Nel Corporation's general ledger accounts show among others, the following: 6Y69 pits uzzi yd bi P…

A: No of Ordinary shares issued = Ordinary share capital / Par value of share No of Ordinary shares…

Q: 9th deposit is m

A: Given Information: Amount Deposited each year is P10,000 Time period is 9 years Interest rate is 14…

Q: a cash priority program would show that the loss absorption potential for Joker would amount to? if…

A: A cash priority program is the program which shows how the cash which are available to the partners…

Q: chedule X-Single taxable income is over: But not over: $ 0 $ 9,950 S 40,525 $ 9,950 $ 40,525 $…

A: Taxes are progressive types there are lower taxes for lower income group and higher taxes for higher…

Q: The tax rates are as shown below: Taxable Income Tax Rate 15% $0 - 50,000 50,00175,000 25% 75,001…

A: Revised taxable income = $80900 + $22100 = $103000

Q: 4. What would be the effect of the transaction on the total Share Premium FIARES RE account? a. PO.…

A: Capital of a company dividend into small units which is known as stocks/shares of the company.…

Q: Coronado's Boards sells a snowboard, Xpert, that is popular with snowboard enthusiasts. Information…

A: In the context of the given question, we are required to compute the ending inventory under the FIFO…

Q: A cement manufacturer has supplied the following data: 220,000 Tons of cement produced and sold…

A: Increase in sales volume is increase in number of units. 220000 tons + 5℅ = 231000 tons

Q: TYPEWRITTEN ONLY PLEASE. ILL UPVOTE ONLY IF TYPEWRITTEN, COMPLETE, AND CORRECT. DONT ANSWER IF YOU…

A: Here discuss about the details of deductible charitable contribution which are applicable in…

Q: Cash Short-term Investments Current receivables Inventory Prepaid expenses Total current assets…

A: As requested to answer acid test ratio for Camaro so we are answering only for Camaro

Q: Compute the amount of deduction that Mr. J can claim in relation to: a. 2016 lease; b. 2017 lease;…

A:

Q: Question 2 Kris Inc. sold its vacant lot to Moca Corporation for P10,000,000, which it acquired at a…

A: Tax is the payment made to the applicable authority by those parties who have generated some sort of…

Q: Sales (30,000 balls) ..... Variable expenses Contribution margin.... Fixed expenses Net operating…

A: Degree of operating leverage (DOL): DOL reflects the variable and fixed cost relationship of an…

Q: On November 3, the Milwaukee Bucks sold a six-game pack of advance tickets for $300 cash. On…

A: On receipt of an advance from the customer for the service or sales to be made in the future, the…

Q: ear 1 lan (a) et Income (loss) alance allocated in proportion to nitial investments Balance of…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: Prepare a basic income statement forecast for the subsequent fiscal year, using a percentage of…

A: Income Statement The purpose of preparing the income statement is to know the net income which are…

Q: What is Trend Analysis in Financial Analysis?

A: Examining sales patterns to see if sales are declining because of specific customers or products or…

Q: Louis files as a single taxpayer. In April of this year he received a $980 refund of state income…

A: Gross income refers to the income of individual or person which comprises of income from wages and…

Q: it for 12 days during the year. They provided fresh linen and prepared a hot breaskfast each…

A: Schedule E shows rental real estate income and loss, royalties, partnerships, S corporations,…

Q: Prove in four (and only four, no more, no less) logical steps that the following expression is TRUE…

A: EOQ (Economic Order Quantity): - Economic Order Quantity is calculated to ascertain the ideal order…

Q: 120 $7,665,000 3,285,000 10,050,000 1010 8,250,000

A: You have posted multiple-part questions so only the first three sub-parts are answered. If any other…

Q: Scenario Much like the decision to start a business, the decision to attend college is fraught with…

A: Answer is True

Q: PA3-3 (Algo) Analyzing the Effects of Transactions Using T-Accounts, Preparing an Unadjusted Trial…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: For the price per 200 gram, why its total cost is still 528.72?

A: Item Inclusion (kg) Unit Cost Per Kg (PhP) Total Cost (PhP) 1. Raw Milk 10.00 35.00 350.00 2.…

Q: QUESTION #1: GIVE COMPLETE SOLUTIONS

A: * Ferrari Sales Return A/C Dr 30,000 Dr…

Q: Bean Corp

A: These are the accounting transactions that are having a monetary impact on the financial statement…

Q: The management of Mecca Copy, a photocopying center located on University Avenue, has compiled the…

A: The balance sheet is a summary of permanent accounts prepared at the end of the accounting period.…

Q: The Income statement for the year ended 31st December, 1998 and the balance sheet of R Ltd., as on…

A: Under the CPP method [Current Purchasing Power Method] the financial statements of the companies…

Q: THIS QUESTION REQUIRES AN ESSAY STYLE ANSWER Maddy and Maxie are running a coffee shop.. They agree…

A: partnership is the business that two or more person agree in order to start a business to share…

Q: Markham Company has completed its sales budget for the first quarter of Year 2. Projected credit…

A: A cash budget is prepared to estimate the total cash received and total cash disbursement. It is…

Q: On January 1, 2020, Sitra Company leased equipment from National Corporation. Lease payments are…

A: Lease is an arrangement under which lessor gives right of use of the leased asset to the lessee for…

Q: rchased 300 shares of OXG stock on August 2, 2020, for $1,500. In October 2021, OXG issued a 10%…

A: Basis is the value of assets held by the person for accounting and taxation purposes and assets can…

Q: Chana contributed $6000 for 50% interest in a mobile boutique. She also contributed a point of sale…

A: A partnership is a kind of agreement between two or more partners where partners are agreed to work…

Q: In 2021, the Westgate Construction Company entered into a contract to construct a road for Santa…

A: Requirement 1 2021 2022 2023 Revenue $0 $0 $10,000,000…

Typewritten for an upvote. No upvote for handwritten. Please skip if you have already done this. Thank you

Step by step

Solved in 2 steps

- 29. the assets and liabilities of R were stated at their fair values when A acquired it's 80% interest and the fair value method was used to initially measure the NCI. A uses the cost method to account for its investment in R. Net income and dividends for 2021 for the affiliated companies were: A Corp. R Corp. Net Income P105,000 P31,500 Dividends paid 63,000 17,500 Dividends Payable, 1/1 20,000 9,250 Dividends Payable 12/31 31,500 8,750 Retained Earnings of A Corp. in the separate FS at the beginning of the year is P420,000. End of the year evaluation indicates P3,000 impairment in goodwill. The consolidated retained earnings at December 31, 2021 is:Question 2:The following is the trial balance of Muti Tech Limited as at December 31, 2006.Paid-up share capital10,00,0005,00,000Share premiumNet income January 1, 200610% Debentures payable 20107,00,0006,00,000Piant and assets39,00,000Accumulated DepreciationMerchandise inventory4,60,0008,80,000Accounts receivableAccounts payable4,20,0003,60,000Purchases and sales36,50,00065,40,0005,00,00070,000Administrative salariesSales salariesDirectors remunerationAdvertising expensesCarriage outwardsUtility expenses1,60,0002,80,0001,00,0003,00,000Bank overdraft1,00,0001,02,60,000 1,02,60,000Additional Information:The paid-up share capital consists of 100,000 shares of Rs. 10 each.Merchandise inventory at December 31, 2006 was Rs. 500,000.Estimated tax on the profit of the company for the year is Rs. 1,50,000. The directorsa.b.have proposed final dividend of 10% on the ordinary share capital.d. Depreciation is provided at 10 percent per annum on plant and assets. Allowance forbad debts is to be…N4 common stockholders of a business enterprise are said to be the residual owners which mean that they a. have thr rights to specific assets of the business b. are entitled to a dividend every year in which the business earns profit c. can negotiate individual comtrscts on behalf of the enterprise d. bear the ultimate risks and uncertainties and recieve the benefits if enterprise ownership.

- 1. S1: In the statement of changes in equity, the effect of the correction of aprior period error is presented separately for each component of equity.S2: Preference share dividend appear under the retained earnings sectionof the statement of changes in equity A. True, TrueB. False, FalseC. True, FalseD. False True 2.The entity classified a building as held for sale on January 1, 2020. However, the company decided to use it for a product line expansion on December 31, 2020. Which of the following statements are true? The company will record depreciation expense for the year 2020. The company will recognize an impairment loss on January 1, 2020, if applicable. I only II only Both I and II None of the above 3.Which statement is incorrect? Revenues are income that arises from the ordinary course of business activities. Revenues may arise from decrease in liability from primary operations. Generally, revenue is recognized when the earning process is complete and a valid promise of…Hw.67. Determine the amount of the dividends received deduction in each of the following instances. In all cases, the net income figure includes the full dividend. Use Dividends deduction table. Required: Dividend of $14,000 from a 45% owned corporation; taxable income before DRD of $62,000. Dividend of $21,400 from a 15% owned corporation; taxable income before DRD of $83,000. Dividend of $15,500 from a 60% owned corporation; taxable income before DRD of $8,500. Dividend of $4,750 from a 10% owned corporation; taxable income before DRD of $3,910.Q3 PART A Sail Sail Ltd has the following results for the year ended 31 March 2020. It has one wholly owned subsidiary company. Trading profit 380,000 Interest receivable 9,000 Property Income 12,000 Chargeable gains 21,000 Dividends received from non-subsidiary UK companies 50,000 Qualifying charitable donations 22,000 PART A REQUIREMENT: Calculate the amount of corporation tax payable by Sail Ltd for the year ended 31 March 2020 and state giving reasons the due date for payment. PART B QUESTION Swish Ltd has the following results for the year ended 31 March 2020. £Net loss per Accounts (Note (1))…

- Q3 PART A Sail Sail Ltd has the following results for the year ended 31 March 2020. It has one wholly owned subsidiary company. Trading profit 380,000 Interest receivable 9,000 Property Income 12,000 Chargeable gains 21,000 Dividends received from non-subsidiary UK companies 50,000 Qualifying charitable donations 22,000 PART A REQUIREMENT: Calculate the amount of corporation tax payable by Sail Ltd for the year ended 31 March 2020 and state giving reasons the due date for payment. PART B QUESTION Swish Ltd has the following results for the year ended 31 March 2020. £Net loss per Accounts (Note (1))…If ABC Co. sold everything it owned and paid off all the company owed, the amount left over would represent ABC's ______. Question 42 options: A) revenue B) owners' equity C) liabilities D) goodwill E) assetsTRUE OR FALSE: Indicate whether the statements are true or false. 1. Worksheet elimination 1 will include only the subsidiary’s stock (par value and additional paid-in capital), Retained Earnings, and the parent’s Investment in Subsidiary account when the parent has acquired 100 percent of the subsidiary’s stock at book value at the beginning of the period. 2.

- 2. The records of Alamo Corporation showed the following data: (see attached image for the given. Please answer it. Thank you so much!) (someone already answer the first 3 subparts which is letter a to c, please anwwer letter d to f. thank you again.) Direction. From the following independent cases, journalize the dividend declaration and the dividend payment: d) The Board declared a property dividend of 2 SMB shares for one Alamo share. SMB shares are selling at P15 but were acquired by Alamo Corporation @ P10. Use PAS 39. SMC shares are considered available for sale securities. e) The Board declared a 22% stock dividend. Stocks are selling at P105 per share. f) The Board declared a 12% stock dividend. Market value of stock is P120.Case 2: the Investment Held for Trading Securities account in the book of Tatay (acquired in 2020) represents 30% ownership interest in Walanay, Inc. Walanay subsequently reacquires 50% of its outstanding shares from other investors. The previously held equity of Tatay have a fair value of three times its book value now. Tatay elected to measure NCI at ‘proportionate share’.With the stated facts, answer the following:1.How much is the Consideration Transferred?a. P 1,350,000.00b. P 1,900,000.00c. P 1,750,000.00d. P 1,800,000.002.How much is the Non-Controlling Interest in the acquiree?a. P 0.00b. P 150,000.00c. P 684,000.00d. P 1,200,000.003.How much is the Fair Value of the previously held equity interest in the acquiree?a. P 0.00b. P 540,000.00c. P 450,000.00d. P 500,000.00Q) The Daddy Group has the following group structure: Daddy ltd 80% 80% 27% Son 1 Ltd Son 2 Ltd Son 3 Ltd 70% 55% 30% Son 4 Ltd Son 5 Ltd 10% 5% 45% 95% Son 6 Ltd Son 7 Ltd (a) Reproduce and complete the following controlling and noncontrolling table. Also, show the calculations for consolidated adjustment. (b) What percentage of voting in Son 7 Ltd will be controlled by Daddy Ltd? (c) What percentage of dividend declared by Son 7 Ltd will be received by Daddy Ltd? Daddy Interest Son 1 Son 4 Son 2 Son 5 Son 7 Son 6 Son 3 Direct% Indirect% Non-controlling Interest Direct% Indirect% Total