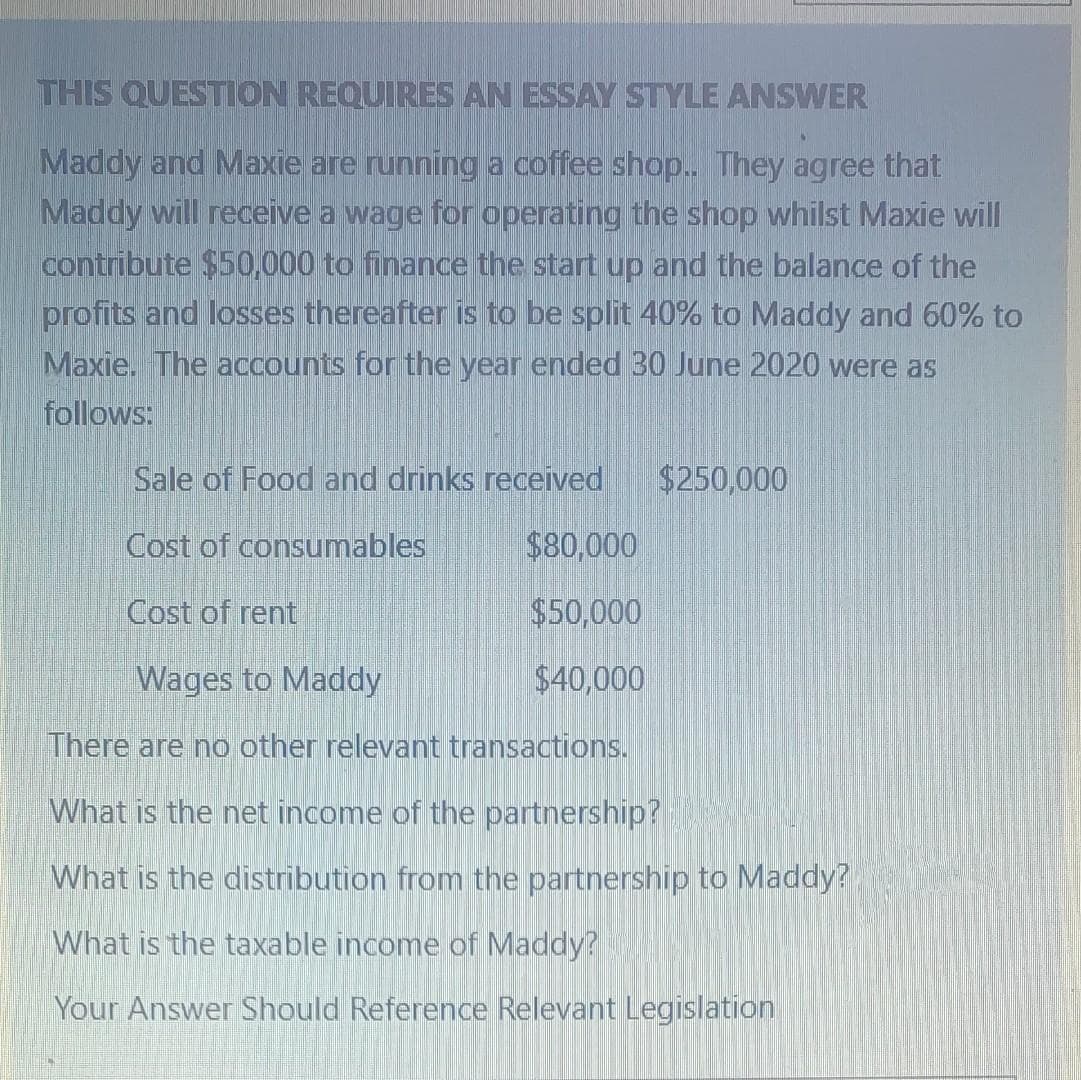

THIS QUESTION REQUIRES AN ESSAY STYLE ANSWER Maddy and Maxie are running a coffee shop.. They agree that Maddy will receive a wage for operating the shop whilst Maxie will contribute $50,000 to finance the start up and the balance of the profits and losses thereafter is to be split 40% to Maddy and 60% to Maxie. The accounts for the year ended 30 June 2020 were as follows: Sale of Food and drinks received $250,000 Cost of consumables $80,000 Cost of rent $50,000 Wages to Maddy $40,000 There are no other relevant transactions. What is the net income of the partnership? What is the distribution from the partnership to Maddy? What is the taxable income of Maddy? Your Answer Should Reference Relevant Legislation

THIS QUESTION REQUIRES AN ESSAY STYLE ANSWER Maddy and Maxie are running a coffee shop.. They agree that Maddy will receive a wage for operating the shop whilst Maxie will contribute $50,000 to finance the start up and the balance of the profits and losses thereafter is to be split 40% to Maddy and 60% to Maxie. The accounts for the year ended 30 June 2020 were as follows: Sale of Food and drinks received $250,000 Cost of consumables $80,000 Cost of rent $50,000 Wages to Maddy $40,000 There are no other relevant transactions. What is the net income of the partnership? What is the distribution from the partnership to Maddy? What is the taxable income of Maddy? Your Answer Should Reference Relevant Legislation

Chapter2: Income Tax Concepts

Section: Chapter Questions

Problem 45P

Related questions

Question

Transcribed Image Text:THIS QUESTION REQUIRES AN ESSAY STYLE ANSWER

Maddy and Maxie are running a coffee shop.. They agree that

Maddy will receive a wage for operating the shop whilst Maxie will

contribute $50,000 to finance the start up and the balance of the

profits and losses thereafter is to be split 40% to Maddy and 60% to

Maxie. The accounts for the year ended 30 June 2020 were as

follows:

Sale of Food and drinks received

$250,000

Cost of consumables

$80,000

Cost of rent

$50,000

Wages to Maddy

$40,000

There are no other relevant transactions.

What is the net income of the partnership?

What is the distribution from the partnership to Maddy?

What is the taxable income of Maddy?

Your Answer Should Reference Relevant Legislation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT