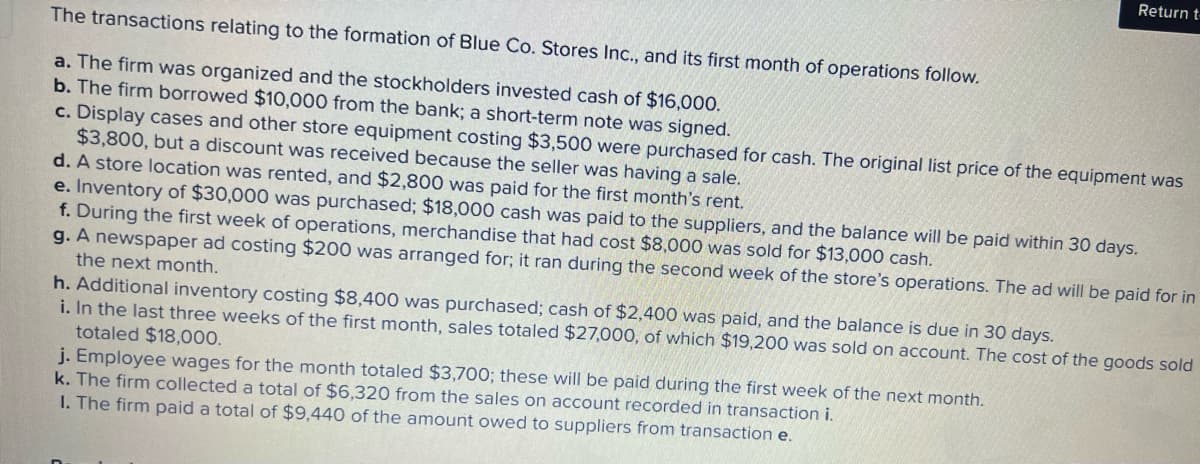

The transactions relating to the formation of Blue Co. Stores Inc., and its first month of operations follow. a. The firm was organized and the stockholders invested cash of $16,000. b. The firm borrowed $10,000 from the bank; a short-term note was signed. c. Display cases and other store equipment costing $3,500 were purchased for cash. The original list price of the equipment was $3,800, but a discount was received because the seller was having a sale. d. A store location was rented, and $2,800 was paid for the first month's rent. Return e. Inventory of $30,000 was purchased; $18,000 cash was paid to the suppliers, and the balance will be paid within 30 days. f. During the first week of operations, merchandise that had cost $8,000 was sold for $13,000 cash. g. A newspaper ad costing $200 was arranged for; it ran during the second week of the store's operations. The ad will be paid for in the next month. h. Additional inventory costing $8,400 was purchased; cash of $2,400 was paid, and the balance is due in 30 days. i. In the last three weeks of the first month, sales totaled $27,000, of which $19,200 was sold on account. The cost of the goods sola totaled $18,000. j. Employee wages for the month totaled $3,700; these will be paid during the first week of the next month. k. The firm collected a total of $6,320 from the sales on account recorded in transaction i. I. The firm paid a total of $9,440 of the amount owed to suppliers from transaction e.

The transactions relating to the formation of Blue Co. Stores Inc., and its first month of operations follow. a. The firm was organized and the stockholders invested cash of $16,000. b. The firm borrowed $10,000 from the bank; a short-term note was signed. c. Display cases and other store equipment costing $3,500 were purchased for cash. The original list price of the equipment was $3,800, but a discount was received because the seller was having a sale. d. A store location was rented, and $2,800 was paid for the first month's rent. Return e. Inventory of $30,000 was purchased; $18,000 cash was paid to the suppliers, and the balance will be paid within 30 days. f. During the first week of operations, merchandise that had cost $8,000 was sold for $13,000 cash. g. A newspaper ad costing $200 was arranged for; it ran during the second week of the store's operations. The ad will be paid for in the next month. h. Additional inventory costing $8,400 was purchased; cash of $2,400 was paid, and the balance is due in 30 days. i. In the last three weeks of the first month, sales totaled $27,000, of which $19,200 was sold on account. The cost of the goods sola totaled $18,000. j. Employee wages for the month totaled $3,700; these will be paid during the first week of the next month. k. The firm collected a total of $6,320 from the sales on account recorded in transaction i. I. The firm paid a total of $9,440 of the amount owed to suppliers from transaction e.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 19EB: A business has the following transactions: A. The business is started by receiving cash from an...

Related questions

Topic Video

Question

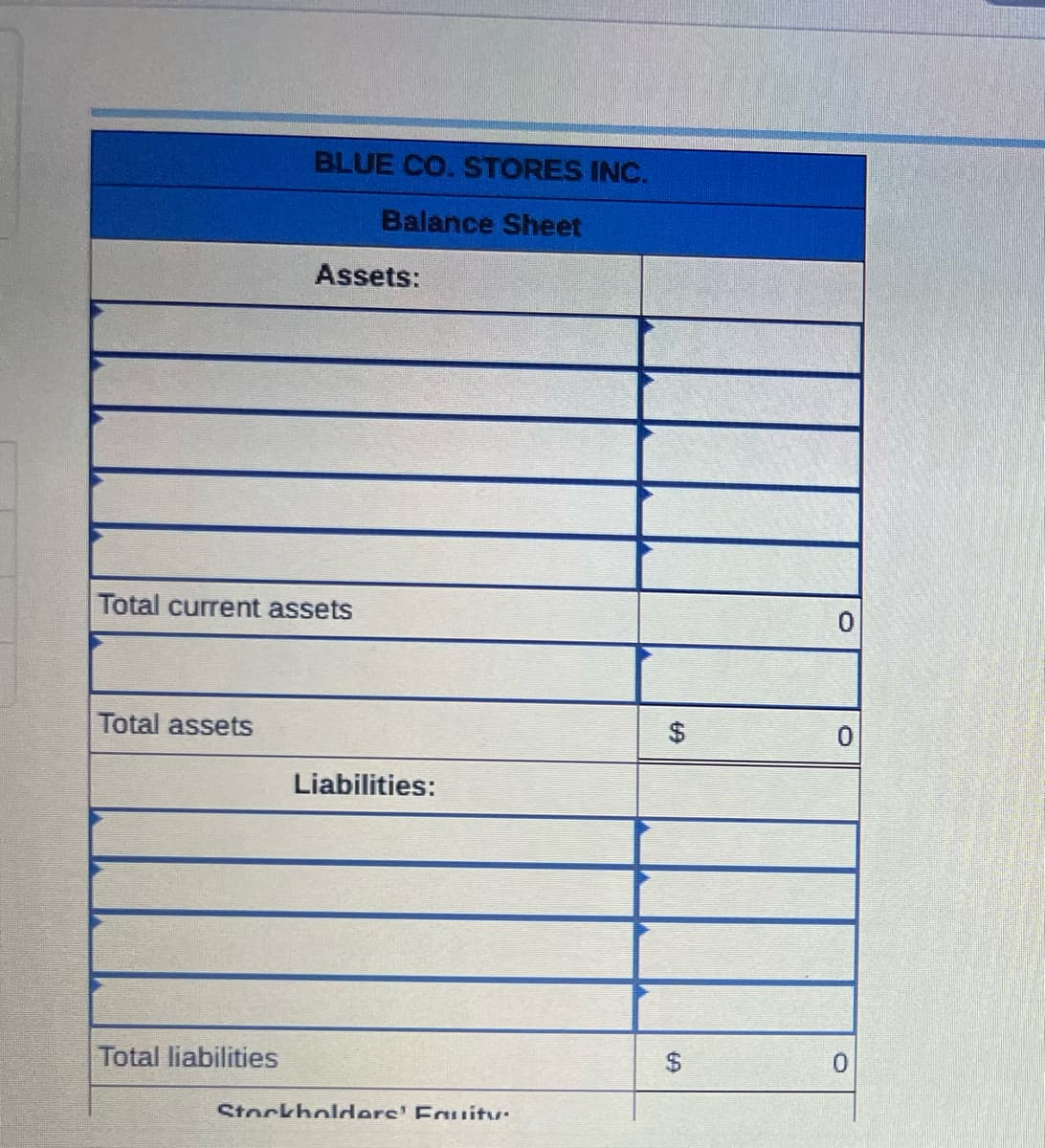

Transcribed Image Text:Total assets

BLUE CO. STORES INC.

Balance Sheet

Total current assets

Total liabilities

Assets:

Liabilities:

Stockholders' Fauity:

$

69

69

$

0

0

0

Transcribed Image Text:The transactions relating to the formation of Blue Co. Stores Inc., and its first month of operations follow.

a. The firm was organized and the stockholders invested cash of $16,000.

b. The firm borrowed $10,000 from the bank; a short-term note was signed.

c. Display cases and other store equipment costing $3,500 were purchased for cash. The original list price of the equipment was

$3,800, but a discount was received because the seller was having a sale.

d. A store location was rented, and $2,800 was paid for the first month's rent.

e. Inventory of $30,000 was purchased; $18,000 cash was paid to the suppliers, and the balance will be paid within 30 days.

f. During the first week of operations, merchandise that had cost $8,000 was sold for $13,000 cash.

Return t

g. A newspaper ad costing $200 was arranged for; it ran during the second week of the store's operations. The ad will be paid for in

the next month.

h. Additional inventory costing $8,400 was purchased; cash of $2,400 was paid, and the balance is due in 30 days.

i. In the last three weeks of the first month, sales totaled $27,000, of which $19,200 was sold on account. The cost of the goods sold

totaled $18,000.

j. Employee wages for the month totaled $3,700; these will be paid during the first week of the next month.

k. The firm collected a total of $6,320 from the sales on account recorded in transaction i.

1. The firm paid a total of $9,440 of the amount owed to suppliers from transaction e.

Expert Solution

Step 1

A balance sheet is an accounting report that shows a corporation's assets liabilities, and stockholders' equity at a given moment in time, as well as providing a basis for calculating rates of return and assessing its capital structure.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning