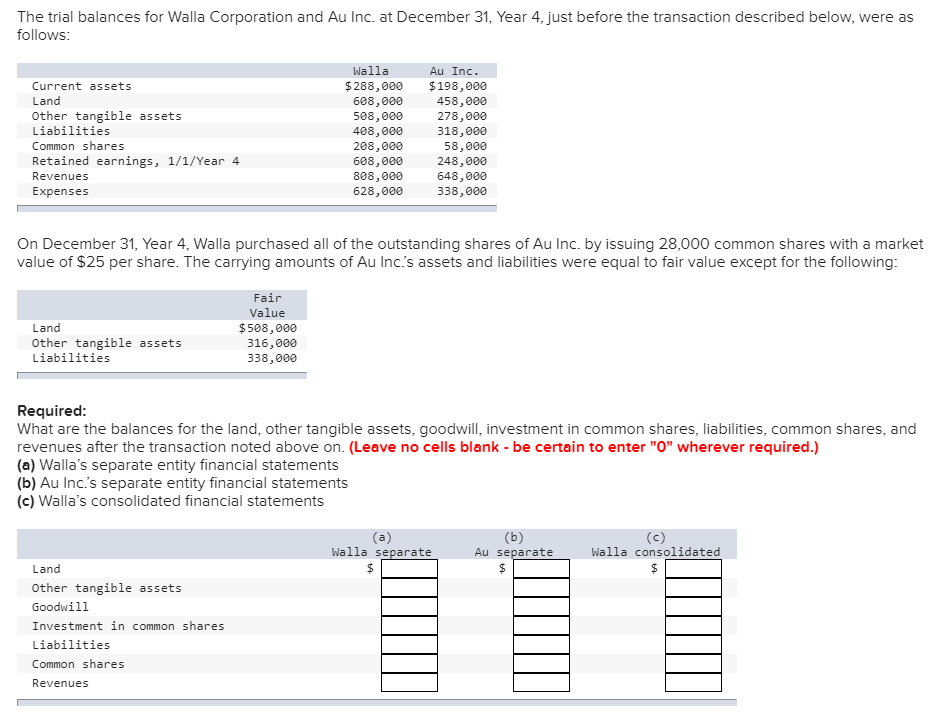

The trial balances for Walla Corporation and Au Inc. at December 31, Year 4, just before the transaction described below, were as follows: Walla Au Inc. $288,000 608,000 Current assets $198,000 Land Other tangible assets Liabilities 458,000 278,000 318,000 508,000 408,000 208,000 608,000 808,000 628,000 Common shares 58,000 248,000 648,000 338,000 Retained earnings, 1/1/Year 4 Revenues Expenses On December 31, Year 4, Walla purchased all of the outstanding shares of Au Inc. by issuing 28,000 common shares with a market value of $25 per share. The carrying amounts of Au Inc.'s assets and liabilities were equal to fair value except for the following: Fair Value Land $508,000 Other tangible assets 316,000 338,000 Liabilities

The trial balances for Walla Corporation and Au Inc. at December 31, Year 4, just before the transaction described below, were as follows: Walla Au Inc. $288,000 608,000 Current assets $198,000 Land Other tangible assets Liabilities 458,000 278,000 318,000 508,000 408,000 208,000 608,000 808,000 628,000 Common shares 58,000 248,000 648,000 338,000 Retained earnings, 1/1/Year 4 Revenues Expenses On December 31, Year 4, Walla purchased all of the outstanding shares of Au Inc. by issuing 28,000 common shares with a market value of $25 per share. The carrying amounts of Au Inc.'s assets and liabilities were equal to fair value except for the following: Fair Value Land $508,000 Other tangible assets 316,000 338,000 Liabilities

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

Transcribed Image Text:The trial balances for Walla Corporation and Au Inc. at December 31, Year 4, just before the transaction described below, were as

follows:

Walla

Au Inc.

$288,000

$198,000

458,000

278,000

318,000

58,000

248,000

648,000

338,000

Current assets

Land

Other tangible assets

Liabilities

608,000

508,000

408,000

Common shares

208,000

608,000

Retained earnings, 1/1/Year 4

Revenues

808,000

628,000

Expenses

On December 31, Year 4, Walla purchased all of the outstanding shares of Au Inc. by issuing 28,000 common shares with a market

value of $25 per share. The carrying amounts of Au Inc's assets and liabilities were equal to fair value except for the following:

Fair

Value

$508,000

Land

Other tangible assets

Liabilities

316,000

338,000

Required:

What are the balances for the land, other tangible assets, goodwill, investment in common shares, liabilities, common shares, and

revenues after the transaction noted above on. (Leave no cells blank - be certain to enter "0" wherever required.)

(a) Walla's separate entity financial statements

(b) Au Inc.'s separate entity financial statements

(c) Walla's consolidated financial statements

(a)

Walla separate

(b)

Au separate

(c)

Walla consolidated

Land

Other tangible assets

Goodwill

Investment in common shares

Liabilities

Common shares

Revenues

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning