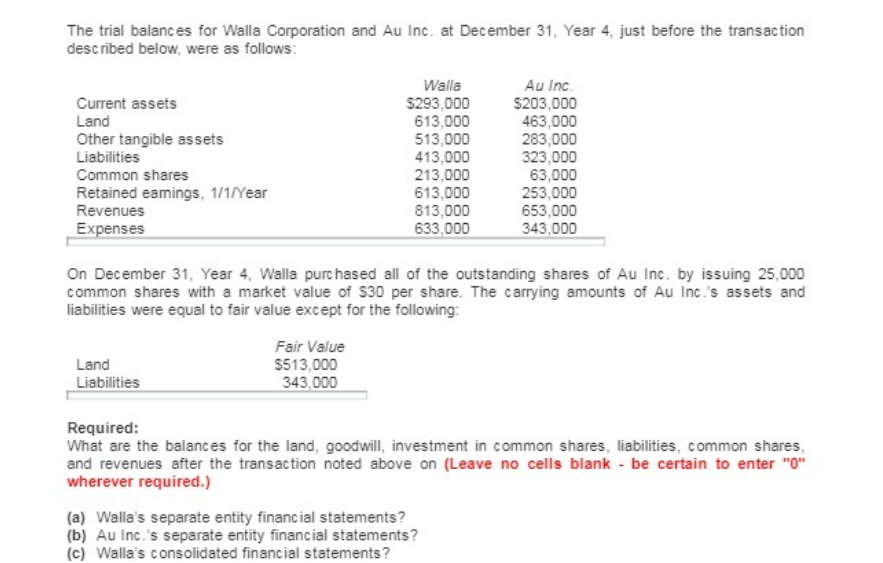

The trial balances for Walla Corporation and Au Inc. at December 31, Year 4, just befo described below, were as follows: Current assets Land Other tangible assets Liabilities Common shares Retained eamings, 1/1/Year Revenues Walla $293,000 613,000 513,000 413,000 213,000 613,000 813,000 633,000 Au Inc. $203,000 463,000 283,000 323,000 63,000 253,000 653,000 Expenses 343,000 On December 31, Year 4, Walla purc hased all of the outstanding shares of Au Inc. common shares with a market value of $30 per share. The carrying amounts of Au liabilities were equal to fair value except for the following: Fair Value $513,000 343,000 Land Liabilities Required: What are the balances for the land, goodwill, investment in common shares, liabilities and revenues after the transaction noted above on (Leave no cells blank - be cer wherever required.)

The trial balances for Walla Corporation and Au Inc. at December 31, Year 4, just befo described below, were as follows: Current assets Land Other tangible assets Liabilities Common shares Retained eamings, 1/1/Year Revenues Walla $293,000 613,000 513,000 413,000 213,000 613,000 813,000 633,000 Au Inc. $203,000 463,000 283,000 323,000 63,000 253,000 653,000 Expenses 343,000 On December 31, Year 4, Walla purc hased all of the outstanding shares of Au Inc. common shares with a market value of $30 per share. The carrying amounts of Au liabilities were equal to fair value except for the following: Fair Value $513,000 343,000 Land Liabilities Required: What are the balances for the land, goodwill, investment in common shares, liabilities and revenues after the transaction noted above on (Leave no cells blank - be cer wherever required.)

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 59P

Related questions

Question

100%

Please included a brief explanation thank you

Transcribed Image Text:The trial balances for Walla Corporation and Au Inc. at December 31, Year 4, just before the transaction

described below, were as follows:

Walla

$293,000

613,000

513,000

413,000

213,000

613,000

813,000

Au Inc.

Current assets

$203,000

463,000

283,000

323,000

63,000

253,000

653,000

343,000

Land

Other tangible assets

Liabilities

Common shares

Retained eamings, 1/1/Year

Revenues

Expenses

633,000

On December 31, Year 4, Walla purc hased all of the outstanding shares of Au Inc. by issuing 25,000

common shares with a market value of $30 per share. The carrying amounts of Au Inc.'s assets and

liabilities were equal to fair value except for the following:

Fair Value

Land

$513,000

Liabilities

343,000

Required:

What are the balances for the land, goodwill, investment in common shares, liabilities, common shares,

and revenues after the transaction noted above on (Leave no cells blank - be certain to enter "0"

wherever required.)

(a) Walla's separate entity financ ial statements?

(b) Au Inc.'s separate entity financial statements?

(c) Walla's consolidated financial statements?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT