The U.S. federal government is one of the largest institutions in the world. It uses taxes it collects to fund various government programs in its role as manager of fiscal policy. Consider the accompanying tables which list the government revenues and expenditures by major category for 2018. 1. Consider the categories of government revenue. Calculate the percent of total revenues accounted for by corporate income taxes and individual income taxes. Round your answers to whole number percentages. a. Corporate income taxes in % : b.Individual income taxes in % :

The U.S. federal government is one of the largest institutions in the world. It uses taxes it collects to fund various government programs in its role as manager of fiscal policy. Consider the accompanying tables which list the government revenues and expenditures by major category for 2018. 1. Consider the categories of government revenue. Calculate the percent of total revenues accounted for by corporate income taxes and individual income taxes. Round your answers to whole number percentages. a. Corporate income taxes in % : b.Individual income taxes in % :

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter30: Government Budgets And Fiscal Policy

Section: Chapter Questions

Problem 40CTQ: What is the benefit of having state and local taxes on income instead of collecting all such taxes...

Related questions

Question

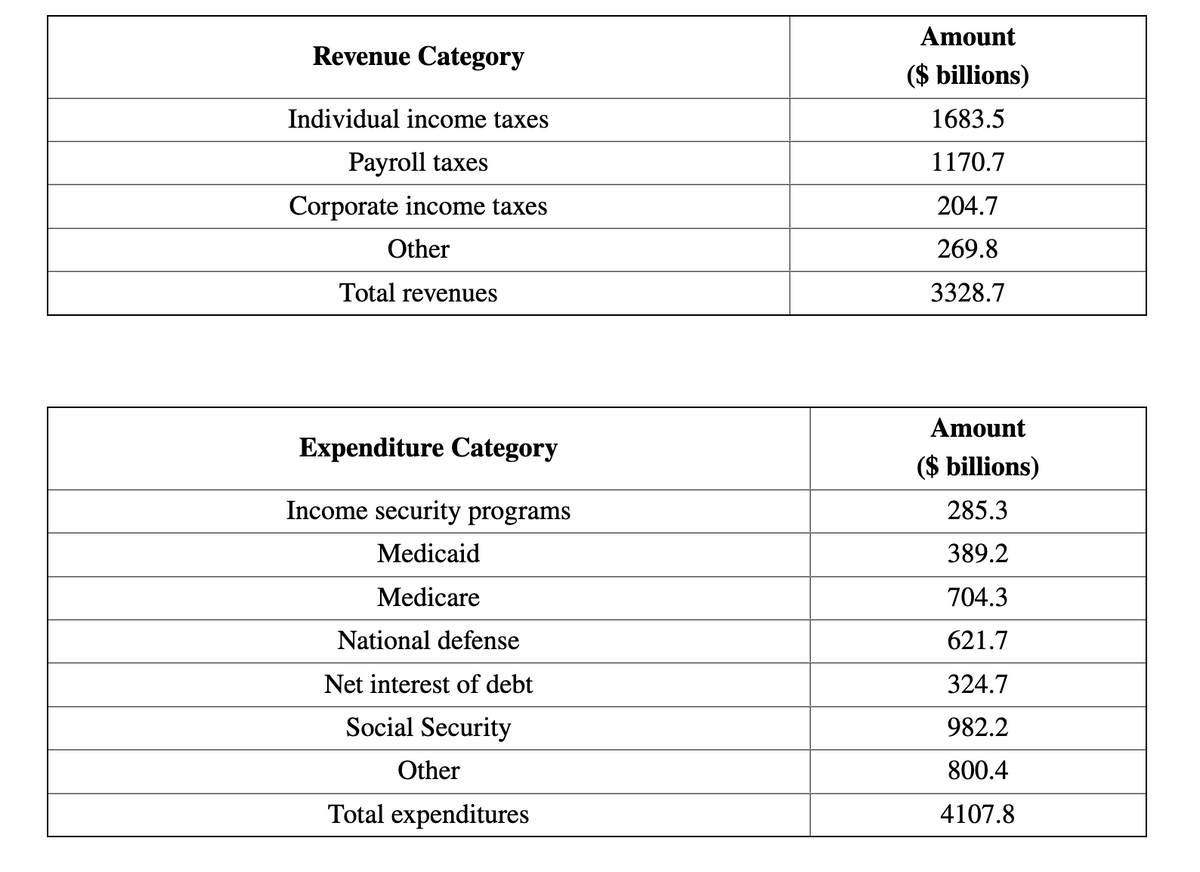

The U.S. federal government is one of the largest institutions in the world. It uses taxes it collects to fund various government programs in its role as manager of fiscal policy. Consider the accompanying tables which list the government revenues and expenditures by major category for 2018.

1. Consider the categories of government revenue. Calculate the percent of total revenues accounted for by corporate income taxes and individual income taxes. Round your answers to whole number percentages.

a. Corporate income taxes in % :

b.Individual income taxes in % :

Transcribed Image Text:Amount

Revenue Category

($ billions)

Individual income taxes

1683.5

Payroll taxes

1170.7

Corporate income taxes

204.7

Other

269.8

Total revenues

3328.7

Amount

Expenditure Category

($ billions)

Income security programs

285.3

Medicaid

389.2

Medicare

704.3

National defense

621.7

Net interest of debt

324.7

Social Security

982.2

Other

800.4

Total expenditures

4107.8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning