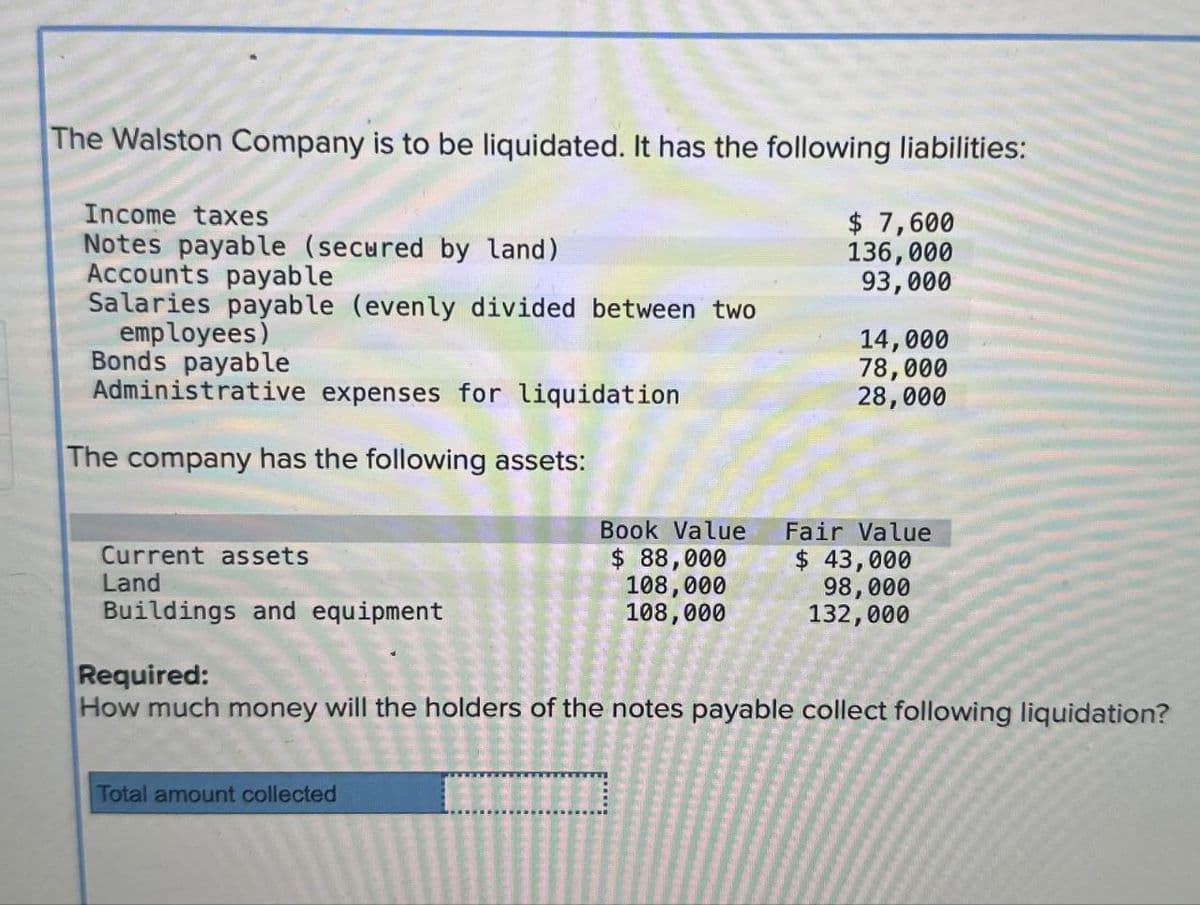

The Walston Company is to be liquidated. It has the following liabilities: Income taxes Notes payable (secured by land) Accounts payable Salaries payable (evenly divided between two employees) Bonds payable Administrative expenses for liquidation The company has the following assets: $ 7,600 136,000 93,000 14,000 78,000 28,000 Book Value Current assets $ 88,000 Land 108,000 Buildings and equipment 108,000 Fair Value $ 43,000 98,000 132,000 Required: How much money will the holders of the notes payable collect following liquidation? Total amount collected

The Walston Company is to be liquidated. It has the following liabilities: Income taxes Notes payable (secured by land) Accounts payable Salaries payable (evenly divided between two employees) Bonds payable Administrative expenses for liquidation The company has the following assets: $ 7,600 136,000 93,000 14,000 78,000 28,000 Book Value Current assets $ 88,000 Land 108,000 Buildings and equipment 108,000 Fair Value $ 43,000 98,000 132,000 Required: How much money will the holders of the notes payable collect following liquidation? Total amount collected

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 16CE

Related questions

Question

None

Transcribed Image Text:The Walston Company is to be liquidated. It has the following liabilities:

Income taxes

Notes payable (secured by land)

Accounts payable

Salaries payable (evenly divided between two

employees)

Bonds payable

Administrative expenses for liquidation

The company has the following assets:

$ 7,600

136,000

93,000

14,000

78,000

28,000

Book Value

Current assets

$ 88,000

Land

108,000

Buildings and equipment

108,000

Fair Value

$ 43,000

98,000

132,000

Required:

How much money will the holders of the notes payable collect following liquidation?

Total amount collected

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning