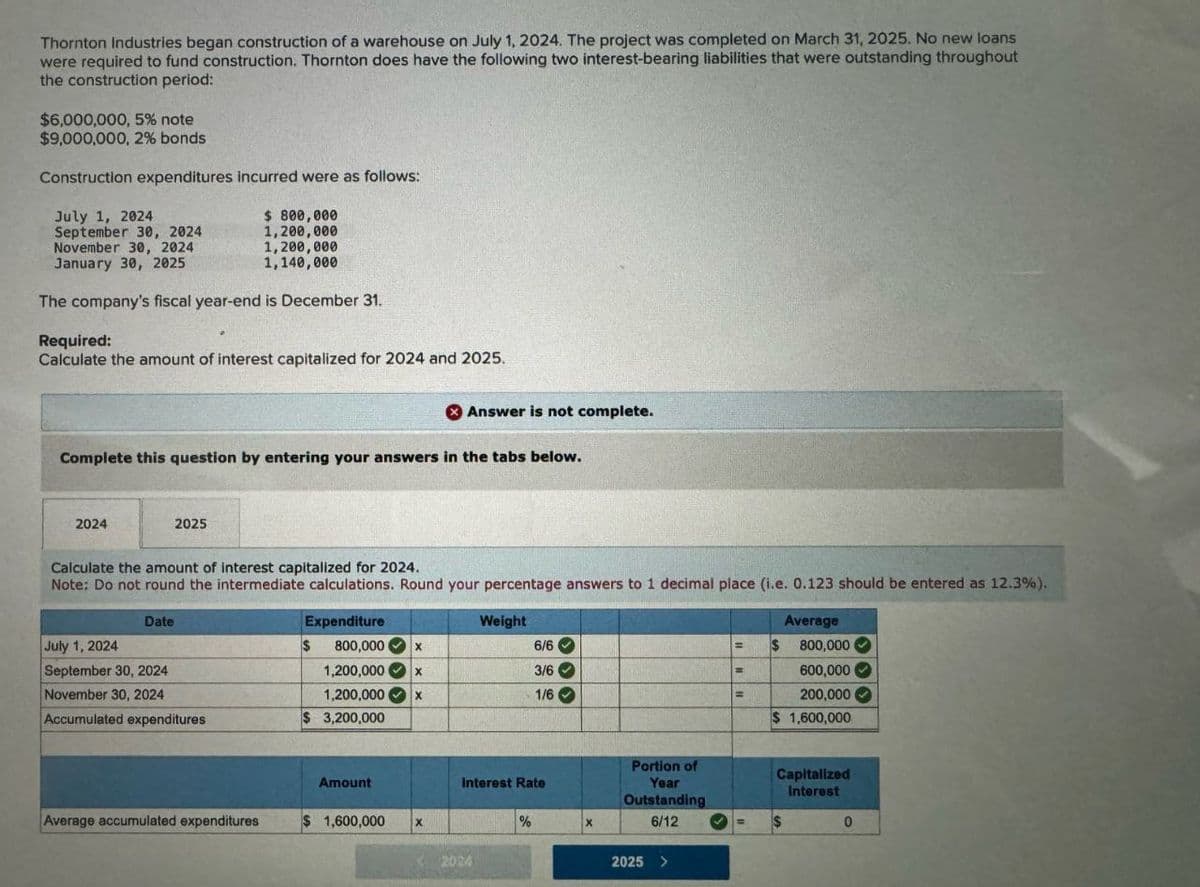

Thornton Industries began construction of a warehouse on July 1, 2024. The project was completed on March 31, 2025. No new loans were required to fund construction. Thornton does have the following two interest-bearing liabilities that were outstanding throughout the construction period: $6,000,000, 5% note $9,000,000, 2% bonds Construction expenditures incurred were as follows: July 1, 2024 September 30, 2024 November 30, 2024 January 30, 2025 $ 800,000 1,200,000 1,200,000 1,140,000 The company's fiscal year-end is December 31. Required: Calculate the amount of interest capitalized for 2024 and 2025. Answer is not complete. Complete this question by entering your answers in the tabs below. 2024 2025 Calculate the amount of interest capitalized for 2024. Note: Do not round the intermediate calculations. Round your percentage answers to 1 decimal place (i.e. 0.123 should be entered as 12.3%). Date July 1, 2024 September 30, 2024 November 30, 2024 Accumulated expenditures Expenditure 800,000 X Weight 6/6 1,200,000 X 3/6 1,200,000 X 1/6 $ 3,200,000 Amount Average accumulated expenditures $ 1,600,000 x Interest Rate Portion of Year Outstanding Average $ 800,000 600,000 200,000 $ 1,600,000 Capitalized Interest % X 6/12 $ 2024 2025 > 0

Thornton Industries began construction of a warehouse on July 1, 2024. The project was completed on March 31, 2025. No new loans were required to fund construction. Thornton does have the following two interest-bearing liabilities that were outstanding throughout the construction period: $6,000,000, 5% note $9,000,000, 2% bonds Construction expenditures incurred were as follows: July 1, 2024 September 30, 2024 November 30, 2024 January 30, 2025 $ 800,000 1,200,000 1,200,000 1,140,000 The company's fiscal year-end is December 31. Required: Calculate the amount of interest capitalized for 2024 and 2025. Answer is not complete. Complete this question by entering your answers in the tabs below. 2024 2025 Calculate the amount of interest capitalized for 2024. Note: Do not round the intermediate calculations. Round your percentage answers to 1 decimal place (i.e. 0.123 should be entered as 12.3%). Date July 1, 2024 September 30, 2024 November 30, 2024 Accumulated expenditures Expenditure 800,000 X Weight 6/6 1,200,000 X 3/6 1,200,000 X 1/6 $ 3,200,000 Amount Average accumulated expenditures $ 1,600,000 x Interest Rate Portion of Year Outstanding Average $ 800,000 600,000 200,000 $ 1,600,000 Capitalized Interest % X 6/12 $ 2024 2025 > 0

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 6P

Related questions

Question

None

Transcribed Image Text:Thornton Industries began construction of a warehouse on July 1, 2024. The project was completed on March 31, 2025. No new loans

were required to fund construction. Thornton does have the following two interest-bearing liabilities that were outstanding throughout

the construction period:

$6,000,000, 5% note

$9,000,000, 2% bonds

Construction expenditures incurred were as follows:

July 1, 2024

September 30, 2024

November 30, 2024

January 30, 2025

$ 800,000

1,200,000

1,200,000

1,140,000

The company's fiscal year-end is December 31.

Required:

Calculate the amount of interest capitalized for 2024 and 2025.

Answer is not complete.

Complete this question by entering your answers in the tabs below.

2024

2025

Calculate the amount of interest capitalized for 2024.

Note: Do not round the intermediate calculations. Round your percentage answers to 1 decimal place (i.e. 0.123 should be entered as 12.3%).

Date

July 1, 2024

September 30, 2024

November 30, 2024

Accumulated expenditures

Expenditure

800,000 X

Weight

6/6

1,200,000 X

3/6

1,200,000

X

1/6

$ 3,200,000

Amount

Average accumulated expenditures

$ 1,600,000

x

Interest Rate

Portion of

Year

Outstanding

Average

$ 800,000

600,000

200,000

$ 1,600,000

Capitalized

Interest

%

X

6/12

$

2024

2025 >

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College