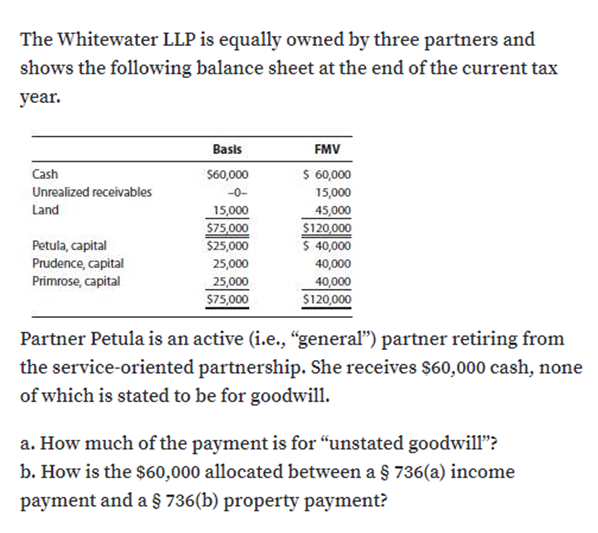

The Whitewater LLP is equally owned by three partners ar shows the following balance sheet at the end of the curren year. Basis FMV Cash S60,000 $6,000 Unrealized receivables Land -0- 15,000 15,000 $75,000 $25,000 45,000 $120,000 $ 40,000 40,000 40,000 $120,000 Petula, capital Prudence, capital Primrose, capital 25,000 25,000 $75,000

The Whitewater LLP is equally owned by three partners ar shows the following balance sheet at the end of the curren year. Basis FMV Cash S60,000 $6,000 Unrealized receivables Land -0- 15,000 15,000 $75,000 $25,000 45,000 $120,000 $ 40,000 40,000 40,000 $120,000 Petula, capital Prudence, capital Primrose, capital 25,000 25,000 $75,000

Chapter21: Partnerships

Section: Chapter Questions

Problem 44P

Related questions

Question

See the attached image. I need help with b)

Transcribed Image Text:The Whitewater LLP is equally owned by three partners and

shows the following balance sheet at the end of the current tax

year.

Basis

FMV

Cash

S60,000

$ 60,000

Unrealized receivables

-0-

15,000

Land

15,000

S75,000

45,000

$120,000

$ 40,000

Petula, capital

Prudence, capital

Primrose, capital

$25,000

25,000

40,000

25,000

$75,000

40,000

$120,000

Partner Petula is an active (i.e., "general") partner retiring from

the service-oriented partnership. She receives $60,000 cash, none

of which is stated to be for goodwill.

a. How much of the payment is for "unstated goodwill"?

b. How is the $60,000 allocated between a § 736(a) income

payment and a § 736(b) property payment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you