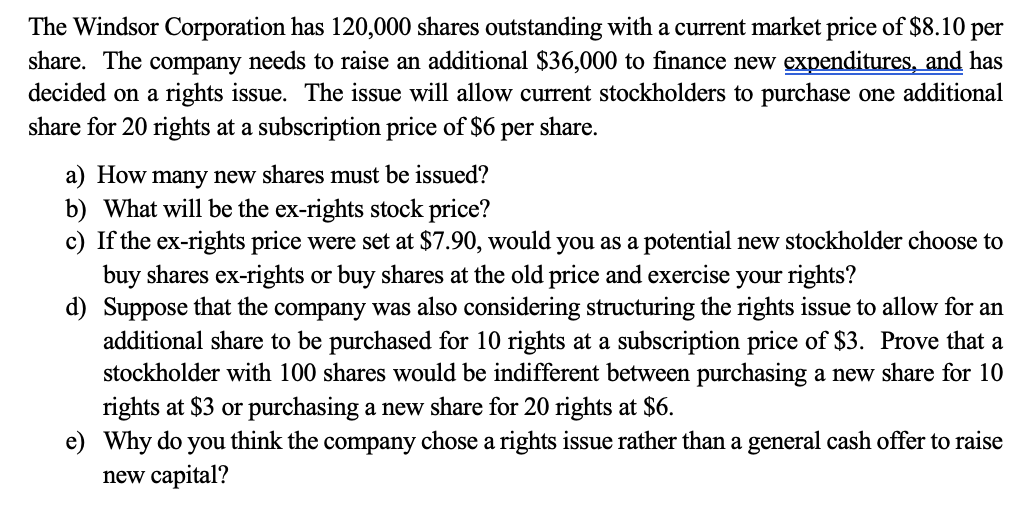

The Windsor Corporation has 120,000 shares outstanding with a current market price of $8.10 per share. The company needs to raise an additional $36,000 to finance new expenditures, and has decided on a rights issue. The issue will allow current stockholders to purchase one additional share for 20 rights at a subscription price of $6 per share. a) How many new shares must be issued? b) What will be the ex-rights stock price? c) If the ex-rights price were set at $7.90, would you as a potential new stockholder choose to buy shares ex-rights or buy shares at the old price and exercise your rights?

The Windsor Corporation has 120,000 shares outstanding with a current market price of $8.10 per share. The company needs to raise an additional $36,000 to finance new expenditures, and has decided on a rights issue. The issue will allow current stockholders to purchase one additional share for 20 rights at a subscription price of $6 per share. a) How many new shares must be issued? b) What will be the ex-rights stock price? c) If the ex-rights price were set at $7.90, would you as a potential new stockholder choose to buy shares ex-rights or buy shares at the old price and exercise your rights?

Chapter1: Role Of Accounting In Society

Section: Chapter Questions

Problem 15Q: According to a company press release, on January 5, 2012, Hansen Natural Corporation changed its...

Related questions

Question

Transcribed Image Text:The Windsor Corporation has 120,000 shares outstanding with a current market price of $8.10 per

share. The company needs to raise an additional $36,000 to finance new expenditures, and has

decided on a rights issue. The issue will allow current stockholders to purchase one additional

share for 20 rights at a subscription price of $6

per

share.

a) How many new shares must be issued?

b) What will be the ex-rights stock price?

c) If the ex-rights price were set at $7.90, would you as a potential new stockholder choose to

buy shares ex-rights or buy shares at the old price and exercise your rights?

d) Suppose that the company was also considering structuring the rights issue to allow for an

additional share to be purchased for 10 rights at a subscription price of $3. Prove that a

stockholder with 100 shares would be indifferent between purchasing a new share for 10

rights at $3 or purchasing a new share for 20 rights at $6.

e) Why do you think the company chose a rights issue rather than a general cash offer to raise

new capital?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning