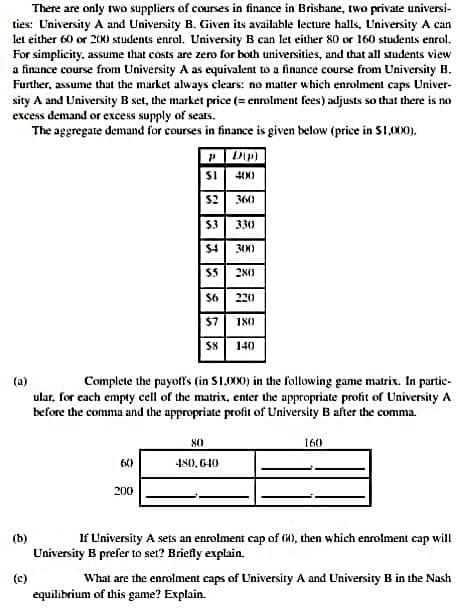

There are only two suppliers of courses in finance in Brisbane, two private universi- ties: University A and University B. Given its available lecture halls, University A can let either 60 or 200 students enrol. University B can let either 80 or 160 students enrol. For simplicity, assume that costs are zero for both universities, and that all students view a finance course from University A as equivalent to a finance course from University B. Further, assume that the market always clears: no matter which enrolment caps Univer- sity A and University B set, the market price (= enrolment fees) adjusts so that there is no excess demand or excess supply of seats. The aggregate demand for courses in finance is given below (price in $1,000). PDip) SI 400 $2 360) $3 330 $4 300) $5 280 56 220 $7 180 58 140 (a) Complete the payoffs (in $1,000) in the following game matrix. In partic- ular, for each empty cell of the matrix, enter the appropriate profit of University A before the comma and the appropriate profit of University B after the comma. 80 160 60 480, 640 200 (b) If University A sets an enrolment cap of (), then which enrolment cap will University B prefer to set? Briefly explain. What are the enrolment caps of University A and University B in the Nash equilibrium of this game? Explain.

There are only two suppliers of courses in finance in Brisbane, two private universi- ties: University A and University B. Given its available lecture halls, University A can let either 60 or 200 students enrol. University B can let either 80 or 160 students enrol. For simplicity, assume that costs are zero for both universities, and that all students view a finance course from University A as equivalent to a finance course from University B. Further, assume that the market always clears: no matter which enrolment caps Univer- sity A and University B set, the market price (= enrolment fees) adjusts so that there is no excess demand or excess supply of seats. The aggregate demand for courses in finance is given below (price in $1,000). PDip) SI 400 $2 360) $3 330 $4 300) $5 280 56 220 $7 180 58 140 (a) Complete the payoffs (in $1,000) in the following game matrix. In partic- ular, for each empty cell of the matrix, enter the appropriate profit of University A before the comma and the appropriate profit of University B after the comma. 80 160 60 480, 640 200 (b) If University A sets an enrolment cap of (), then which enrolment cap will University B prefer to set? Briefly explain. What are the enrolment caps of University A and University B in the Nash equilibrium of this game? Explain.

Chapter18: Asymmetric Information

Section: Chapter Questions

Problem 18.7P

Related questions

Question

Transcribed Image Text:There are only two suppliers of courses in finance in Brisbane, two private universi-

ties: University A and University B. Given its available lecture halls, University A can

let either 60 or 200 students enrol. University B can let either 80 or 160 students enrol.

For simplicity, assume that costs are zero for both universities, and that all students view

a finance course from University A as equivalent to a finance course from University B.

Further, assume that the market always clears: no matter which enrolment caps Univer-

sity A and University B set, the market price (= enrolment fees) adjusts so that there is no

excess demand or excess supply of seats.

The aggregate demand for courses in finance is given below (price in $1,000).

pDip)

$I 400

$2 360

$3 330

300

280

220

$7 180

58 140

(a)

Complete the payoffs (in $1,000) in the following game matrix. In partic-

ular, for each empty cell of the matrix, enter the appropriate profit of University A

before the comma and the appropriate profit of University B after the comma.

80

160

60

480,640

200

(b)

If University A sets an enrolment cap of 6), then which enrolment cap will

University B prefer to set? Briefly explain.

(c)

What are the enrolment caps of University A and University B in the Nash

equilibrium of this game? Explain.

19355 6 7

54

56

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you