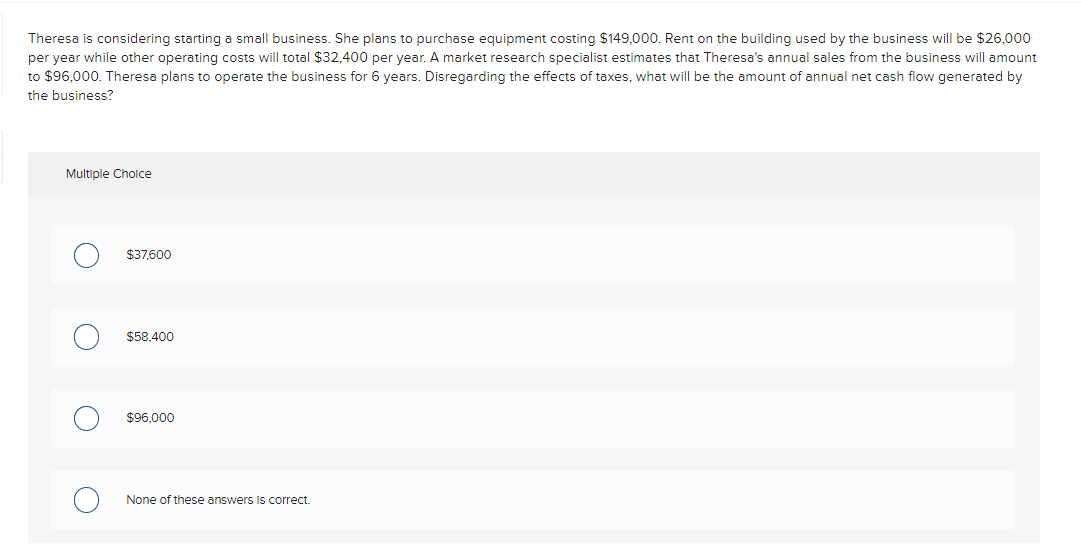

Theresa is considering starting a small business. She plans to purchase equipment costing $149,000. Rent on the building used by the business will be $26,000 per year while other operating costs will total $32,400 per year. A market research specialist estimates that Theresa's annual sales from the business will amount to $96,000. Theresa plans to operate the business for 6 years. Disregarding the effects of taxes, what will be the amount of annual net cash flow generated by the business? Multiple Cholce $37,600 $58,400 $96.000 None of these answers Is correct.

Theresa is considering starting a small business. She plans to purchase equipment costing $149,000. Rent on the building used by the business will be $26,000 per year while other operating costs will total $32,400 per year. A market research specialist estimates that Theresa's annual sales from the business will amount to $96,000. Theresa plans to operate the business for 6 years. Disregarding the effects of taxes, what will be the amount of annual net cash flow generated by the business? Multiple Cholce $37,600 $58,400 $96.000 None of these answers Is correct.

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter13: Investing In Mutual Funds, Etfs, And Real Estate

Section: Chapter Questions

Problem 9FPE

Related questions

Question

Transcribed Image Text:Theresa is considering starting a small business. She plans to purchase equipment costing $149,000. Rent on the building used by the business will be $26,000

per year while other operating costs will total $32,400 per year. A market research specialist estimates that Theresa's annual sales from the business will amount

to $96,000. Theresa plans to operate the business for 6 years. Disregarding the effects of taxes, what will be the amount of annual net cash flow generated by

the business?

Multiple Cholce

$37,600

$58,400

$96,000

None of these answers Is correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning