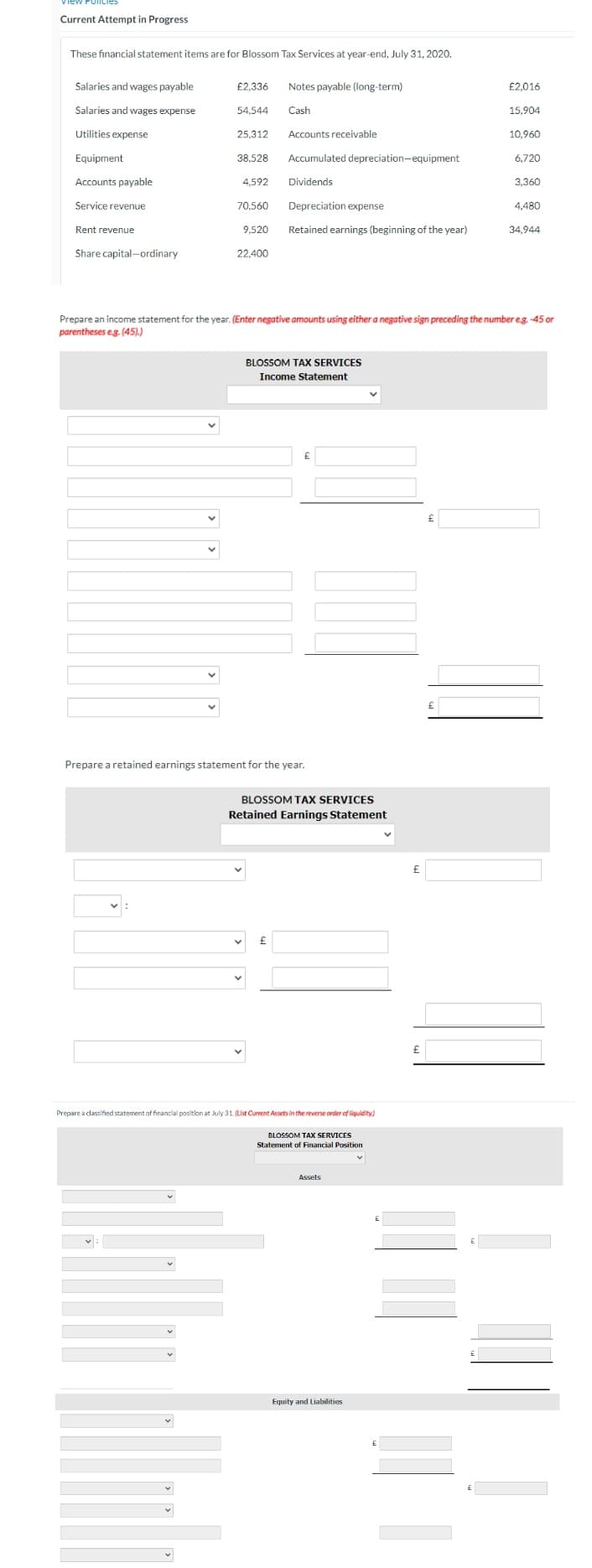

These financial statement items are for Blossom Tax Services at year-end, July 31, 2020. Salaries and wages payable Salaries and wages expense Utilities expense Equipment Accounts payable Service revenue Rent revenue Share capital-ordinary £2,336 Notes payable (long-term) 54,544 Cash 25,312 Accounts receivable 38,528 4,592 70,560 9,520 22,400 Accumulated depreciation-equipment Dividends Depreciation expense Retained earnings (beginning of the year) £2,016 15,904 10,960 6,720 3,360 4,480 34,944

These financial statement items are for Blossom Tax Services at year-end, July 31, 2020. Salaries and wages payable Salaries and wages expense Utilities expense Equipment Accounts payable Service revenue Rent revenue Share capital-ordinary £2,336 Notes payable (long-term) 54,544 Cash 25,312 Accounts receivable 38,528 4,592 70,560 9,520 22,400 Accumulated depreciation-equipment Dividends Depreciation expense Retained earnings (beginning of the year) £2,016 15,904 10,960 6,720 3,360 4,480 34,944

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 12E: Temporary and Permanent Differences Lin has just completed its first year of operations and has a...

Related questions

Question

Transcribed Image Text:Current Attempt in Progress

These financial statement items are for Blossom Tax Services at year-end, July 31, 2020.

Salaries and wages payable

Salaries and wages expense

Utilities expense

Equipment

Accounts payable

Service revenue

Rent revenue

Share capital-ordinary

£2,336

54,544

:

v

25,312

38.528

4,592

70,560

9.520

22.400

Notes payable (long-term)

Cash

Accounts receivable

Accumulated depreciation-equipment

Dividends

£

Depreciation expense

Retained earnings (beginning of the year)

BLOSSOM TAX SERVICES

Income Statement

Prepare a retained earnings statement for the year.

£

BLOSSOM TAX SERVICES

Retained Earnings Statement

Prepare an income statement for the year. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or

parentheses e.g. (45).)

Prepare a classified statement of financial position at July 31. (List Current Assets in the reverse order of liquidity)

BLOSSOM TAX SERVICES

Statement of Financial Position

Assets

Equity and Liabilities

v

£

£

£

£

£2,016

£

15.904

10,960

6,720

3,360

4,480

34,944

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning