They have been approached by a bank offering an invoice discounting facility. The facility is for a maximum drawdown of €2,000,000 and allows for an 80% advance rate on eligible invoices. The cost of the facility is a C27,000 pa fixed facility fee, and interest at 1.5%pa on drawn down amounts. For this offer to be a cost saving opportunity for Quickcash, what would be the minimum percentage of average trade debtors ruled as eligible for the facility?

They have been approached by a bank offering an invoice discounting facility. The facility is for a maximum drawdown of €2,000,000 and allows for an 80% advance rate on eligible invoices. The cost of the facility is a C27,000 pa fixed facility fee, and interest at 1.5%pa on drawn down amounts. For this offer to be a cost saving opportunity for Quickcash, what would be the minimum percentage of average trade debtors ruled as eligible for the facility?

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 24P

Related questions

Question

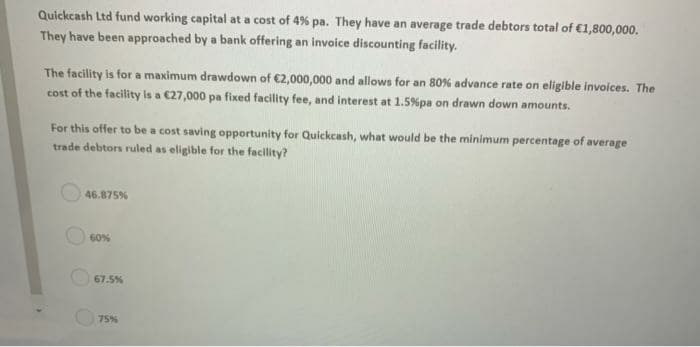

Transcribed Image Text:Quickcash Ltd fund working capital at a cost of 4% pa. They have an average trade debtors total of €1,800,000.

They have been approached by a bank offering an invoice discounting facility.

The facility is for a maximum drawdown of €2,000,000 and allows for an 80% advance rate on eligible invoices. The

cost of the facility is a C27,000 pa fixed facility fee, and interest at 1.5%pa on drawn down amounts.

For this offer to be a cost saving opportunity for Quickcash, what would be the minimum percentage of average

trade debtors ruled as eligible for the facility?

46.875%

60%

67.5%

75%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT