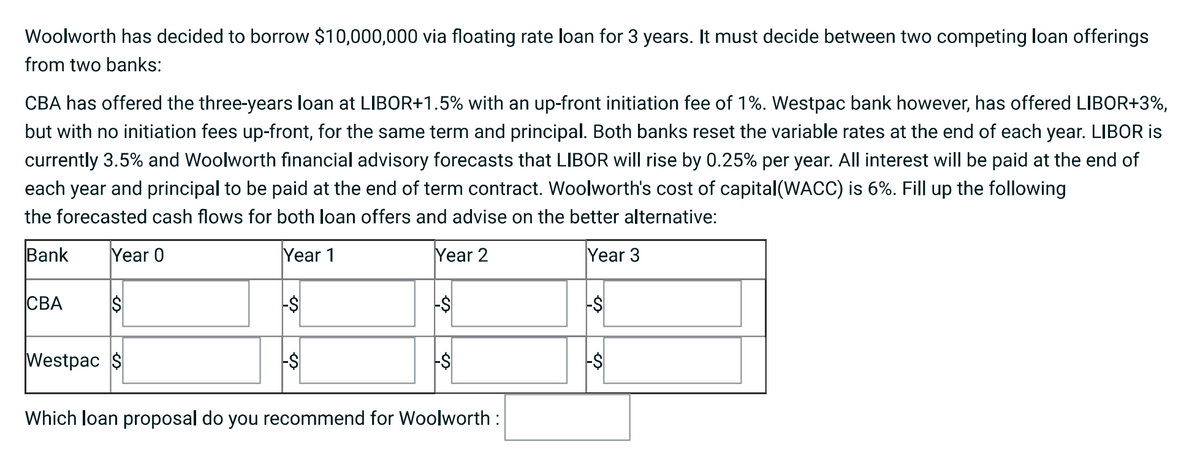

Woolworth has decided to borrow $10,000,000 via floating rate loan for 3 years. It must decide between two competing loan offerings from two banks: CBA has offered the three-years loan at LIBOR+1.5% with an up-front initiation fee of 1%. Westpac bank however, has offered LIBOR+3%, but with no initiation fees up-front, for the same term and principal. Both banks reset the variable rates at the end of each year. LIBOR is currently 3.5% and Woolworth financial advisory forecasts that LIBOR will rise by 0.25% per year. All interest will be paid at the end of each year and principal to be paid at the end of term contract. Woolworth's cost of capital(WACC) is 6%. Fill up the following the forecasted cash flows for both loan offers and advise on the better alternative: Bank Year 0 Year 1 Year 2 Year 3 CBA Westpac S Which loan proposal do you recommend for Woolworth :

Woolworth has decided to borrow $10,000,000 via floating rate loan for 3 years. It must decide between two competing loan offerings from two banks: CBA has offered the three-years loan at LIBOR+1.5% with an up-front initiation fee of 1%. Westpac bank however, has offered LIBOR+3%, but with no initiation fees up-front, for the same term and principal. Both banks reset the variable rates at the end of each year. LIBOR is currently 3.5% and Woolworth financial advisory forecasts that LIBOR will rise by 0.25% per year. All interest will be paid at the end of each year and principal to be paid at the end of term contract. Woolworth's cost of capital(WACC) is 6%. Fill up the following the forecasted cash flows for both loan offers and advise on the better alternative: Bank Year 0 Year 1 Year 2 Year 3 CBA Westpac S Which loan proposal do you recommend for Woolworth :

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 17P

Related questions

Question

Transcribed Image Text:Woolworth has decided to borrow $10,000,000 via floating rate loan for 3 years. It must decide between two competing loan offerings

from two banks:

CBA has offered the three-years loan at LIBOR+1.5% with an up-front initiation fee of 1%. Westpac bank however, has offered LIBOR+3%,

but with no initiation fees up-front, for the same term and principal. Both banks reset the variable rates at the end of each year. LIBOR is

currently 3.5% and Woolworth financial advisory forecasts that LIBOR will rise by 0.25% per year. All interest will be paid at the end of

each year and principal to be paid at the end of term contract. Woolworth's cost of capital(WACC) is 6%. Fill up the following

the forecasted cash flows for both loan offers and advise on the better alternative:

Bank

Year 0

Year 1

Year 2

Year 3

СВА

Westpac $

Which loan proposal do you recommend for Woolworth :

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning