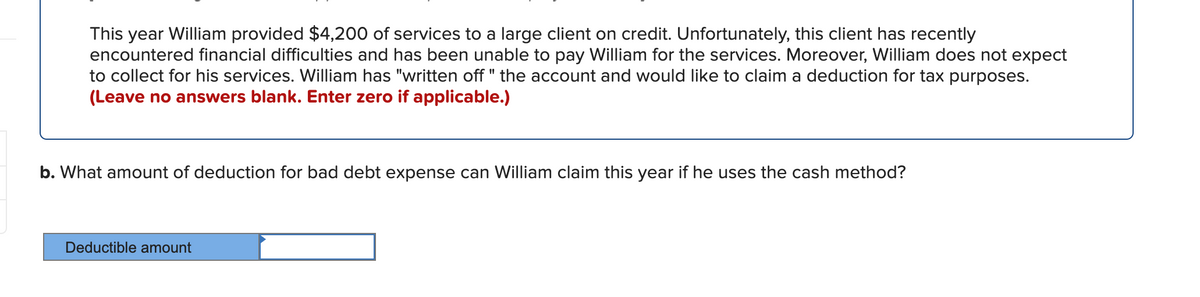

This year William provided $4,200 of services to a large client on credit. Unfortunately, this client has recently encountered financial difficulties and has been unable to pay William for the services. Moreover, William does not expect to collect for his services. William has "written off " the account and would like to claim a deduction for tax purposes. (Leave no answers blank. Enter zero if applicable.) b. What amount of deduction for bad debt expense can William claim this year if he uses the cash method? Deductible amount

This year William provided $4,200 of services to a large client on credit. Unfortunately, this client has recently encountered financial difficulties and has been unable to pay William for the services. Moreover, William does not expect to collect for his services. William has "written off " the account and would like to claim a deduction for tax purposes. (Leave no answers blank. Enter zero if applicable.) b. What amount of deduction for bad debt expense can William claim this year if he uses the cash method? Deductible amount

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter6: Losses And Loss Limitations

Section: Chapter Questions

Problem 2CE

Related questions

Question

Transcribed Image Text:This year William provided $4,200 of services to a large client on credit. Unfortunately, this client has recently

encountered financial difficulties and has been unable to pay William for the services. Moreover, William does not expect

to collect for his services. William has "written off " the account and would like to claim a deduction for tax purposes.

(Leave no answers blank. Enter zero if applicable.)

%3D

b. What amount of deduction for bad debt expense can William claim this year if he uses the cash method?

Deductible amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT