Which of the following is correct when land costing $23,000 is sold for $31,000? The land was a component of property and equipment on the balance sheet.

Q: Megamind Inc. purchases equipment for $250000. They pay $50,000 cash and the supplier finances the…

A: Cash paid = $50,000 Finance portion = $250,000 - 50,000 = $200,000 Interest payment annually =…

Q: Parekoy Company acquires 150,000 of the 1,000,000 Marekoy Company’s common stock for P500,000 cash…

A: Non Controlling Interest: It is the ownership of the equity less than 50%, It is arises at the time…

Q: Brier Company, manufacturer of car seat covers, provided the following standard costs for its…

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for…

Q: Betta Jets, a toy wholesaler, is hoping to expand into manufacturing its own products. The business…

A: Workings:- Schedule of Cash Collection:- 70% in the month following sale 30% in 2 month following…

Q: Given below are the statements of financial position of H and its subsidiary of S as at 31st…

A: Consolidation is the process of merging the accounts of a subsidiary with the parent entity.…

Q: Use the trade discount system shown in the table to calculate the cost of 500 lbs of product if the…

A: Trade Discount = Retail Price × Discount Rate Cost Of Purchase = Retail Price — Trade Discount

Q: Imagine you have taken a once-prized and valuable possession to a consignment store. You tell the…

A: A retail store that specialized in a particular product or service in the retail consumer market…

Q: Electricity $.15 per kwh Phone $30 per line Monthly Gas $1 per 100 cubic ft Phone $.10 per int'l min…

A: The utility bills includes the expenses for electricity, water, telephone bill, etc. The expenses…

Q: Watts and Lyon are forming a partnership. Watts invests $40,500 and Lyon invests $49,500. The…

A: The partners working in partnership firm together shares the profits and losses on the basis of…

Q: On January 1, 2012, One Company issued P5,000,000, 8% serial bonds, to be repaid in the amount of…

A: Solution: Serial bonds are the bonds that are structured in such a way that a portion of bond…

Q: A computer, printer, and copier were purchased for a total price of Php 250,000 on August 1, 2013.…

A: Depreciation is considered as an expense charge on the value of the Asset. It can be calculated by…

Q: In WEAK’s books, what amounts are recognized for the following?

A: The answer is stated below:

Q: ABC Company, located in La Trinidad, Benguet, sold merchandise to Minda, a customer located in La…

A: Account terms a) FOB shipping point: -Purchaser is responsible for paying the freight charges. Since…

Q: On January 1, Aya, Becca, Celia, and Divina, formed Fab Trading, a local partnership, with capital…

A: The partnership Firm named Fab Trading consists of 4 partners - Aya,Becca,Celia and Divina The…

Q: Compute the net monetary result of A Ltd. As on 31.12.1998. The relevant data are given below:…

A: The net monetary result will be the difference between monetary assets (cash + debt) and monetary…

Q: Analyse the following transactions as per the accounting equation and calculate the equity for the…

A:

Q: give a long explanation on fractional depreciation?

A: Introduction:- Depreciation is a non cash expenses. Depreciation is charged on fixed asset over a…

Q: On December 31, 2012, Tree Company issued 5,000 of its 12% P1,000 face value bonds at 110. The bonds…

A: A bond is a financial instrument issued by needy company or govt. or organization for lending money…

Q: On May 5, 2021, Eblue Corporation exchanged 40,000 shares of its P25 par value treasury ordinary…

A: Number of shares exchanged = 40,000 The fair market value of shares at the time of exchange = P25…

Q: In July 2020, ABC Co. computed its equivalent unit costs under FIFO process costing as follows:…

A: The cost per unit is calculated as total cost divided by number of equivalent units.

Q: The balance in the retained earnings account of Indigo Corporation was P450,000 at December 31,…

A: Treasury stock: Shares which are bought back by the company from the open market but not retired…

Q: incorporators in the form of the company’s equipment and machinery that had a carrying amount on…

A: Carrying amount of company PPE = P5000000 Fair value less cost to sell on June 30 2020 =…

Q: inden Company is a wholesale distributor of premium European chocolates. The company’s balance sheet…

A: Cash budget is prepared to calculate the amount of expected cash balance after considering the…

Q: Prepare a statement showing the pricing of issues, on the basis of: (a) First In First Out (FIFO)…

A: FIFO- first in first out LIFO- Last in first out FIFO method issues the old units first to the…

Q: 2,833 units Number of units Sale price per unit $200 Variable costs per unit 80 Calculate:…

A: Introduction: Contribution margin per unit: Deduction of variable cost per unit from Sales price per…

Q: Van

A:

Q: how is this reposrted in the statement of cash flow using the direct method? conversion if bonds…

A: Answer : Is not shown

Q: On January 1, 2016, Indians Corporation bought a factory equipment for P924,000 salvage value was…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: Sales Less: Cancellation Sales, net of cancellations Year of expiration for subscriptions: 2020…

A: Unearned revenue refers to the amount received in advance from the customer for which services will…

Q: Dimples Company sells subscriptions to a specialized directory, which is issued semi-annually and…

A: The unearned subscription refers to the amount that is received from the customer for which services…

Q: what are the components of the cost of goods sold (also known as cost of revenues for healthcare…

A: Cost of goods sold is that cost which is incurred by an organization for generating the sales or…

Q: Revenue has the effect of: A.increasing assets and decreasing liabilities B.increasing assets and…

A: Accounting equations always have a dual effect on each transection.It is a basic method of recording…

Q: Figure 1. Dali Ltd. Dali Ltd. reported the following aged receivable listing at December 31, 2019:…

A: Allowance for doubtful accounts - Allowance for doubtful accounts is the provision made by the…

Q: own payment: 20% nstallment sales: P545, 000 in 2020, P785,000 in 2021, and P968,000 in 2022 Markup…

A: Realized gross profit on instalment basis is equal to the amount of cash collected X gross profit %…

Q: From the following data, determine the total actual costs incurred for direct material, direct…

A: Formula: Material price variance = (Standard price - Actual price)*Actual quantity purchased…

Q: final tax and income tax

A: Tax is a form of compulsory payment made to the government of the country. The amount that is…

Q: How much of the following amounts received in 2021 will be included in the tax return for the year…

A: Only Rental Income Earned in Year 2021 or Received For Year 2021 is included in Tax Return For 2021.…

Q: A manufacturing company, VMTC PLC, makes the product, blitz. Monthly sales for the first five…

A: Budgeting - Budgeting is the process of estimating future operations based on past performance. %…

Q: A certain machining job for a machine shop in Davao can be done on six existing lathes, on which the…

A: The size of order will be determined by calculating the per unit cost of each given order size on…

Q: The following information relates to Puregold Price Club Inc. (PPCI) for the year 2022. PPCI has a…

A: Unearned Revenue - Unearned Revenue is the revenue against which payment has been received by…

Q: Assume that a foreign company using IFRS is owned by a company using U.S. GAAP. Thus, IFRS balances…

A: a. Under IFRS Account title Debit Credit Cash 100,000 Bonds Payable 88,699…

Q: A business absorbs overheads on the basis of hours worked on a specific job. If the overhead…

A: The price to be charged includes both value i.e cost price and the mark-up value.

Q: On January 1, 2022, Nine Company sold 12% bonds with a face value of P500,000. The bonds mature in…

A: A bond is a long-term financing debt. Interest (called a coupon) is paid periodically on the bond to…

Q: account receivable an

A: Account Receivables Account receivable (classified as current assets) is the amount which the…

Q: Partnership net loss of P132,000 is to be divided between partners Doods and Elsie according to the…

A: Solution: In partnership, income is divided between partner in profit sharing ratio defined, if…

Q: What is the criteria to recognize revenue?

A: Introduction: Taxes, customs charges, earnings from state-owned firms, capital revenues, and foreign…

Q: Cblue Company owned 900,000 shares of Flight Company. On December 31, 2004, when the investment had…

A: The share means the smallest unit of the company's ownership. The shares are issued by the company…

Q: Account Balances Cash at Bank Accounts Receivable GST Collected Inventory as at 30 June, 2014 Motor…

A: Balance Sheet - This Statement shows the balance of assets liabilities and Equity as at the balance…

Q: Micro, Inc., started the year with net fixed assets of $76,175. At the end of the year, there was…

A: Net capital spending refers to those amounts of the company which is used to purchase the new…

Q: During 2014, Sigma Company earned service revenues amounting to $720,000, of which $605,000 was…

A: Solution: As per accrual system of accounting, revenue should be recognized when services are…

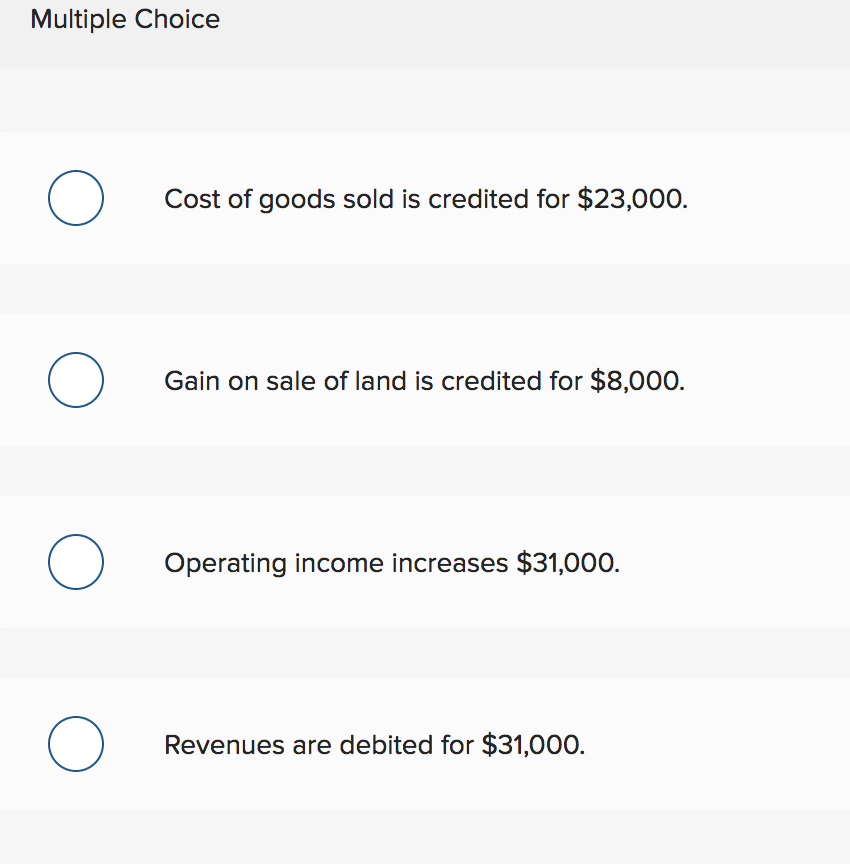

Which of the following is correct when land costing $23,000 is sold for $31,000? The land was a component of property and equipment on the balance sheet.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- During May, 2020, Samoul’s Supply Store generated revenues of $180,000. The company’s expenses were as follows: cost of goods sold of $72,000 and operating expenses of $12,000. The company also had rent revenue of $3,000 and a gain on the sale of a delivery truck of $6,000.Samoul’s income from operations for the month of May, 2020 is $117,000. $111,000. $96,000. $180,000.ABC Company provides you the following data: OMR Sales : 36,000 Cost of goods sold : 24,000 Administrative expenses : 3,500 Loss on sale of furniture : 120 Profit on sale of land : 500 The operating ratio isLisa Co. purchased goods $10,000 on credit payable after 3 months. What would be the effect of this transaction on the accounting equation? Assets will decrease by $10,000 and liabilities will decrease by $10,000 Assets will increase by $10,000 and liabilities will decrease by $10,000 Assets will increase by $10,000 and liabilities will increase by $10,000 Assets and liabilities balance will remain unchanged.

- Determine the Income and Expenses of this situation: The business is a trading business. For the period, it purchased goods for sale valued at ₱100,000.The goods were all sold for a total price of ₱120,000. For the sale only 10% was received as downpayment, 60% were later collected, and at the end of the year 30% are still for collection. How much isthe business income?Company XYZ, Inc. reported a total sales revenue of P15,000,000 of which 20% pertains to the cost of goods sold. In addition, operating expenses in the most reporting period were P240,000 in salaries, P750,000 in rent, P300,000 in utilities and P150,000 in depreciation. Interest expense for the period amounted to P2,500,000. Tax rate is 30%. Determine the interest coverage ratio using EBIT.Given the following information, prepare an income statement for Jonas Brothers Cough Drops. Note: Input all your answers as positive values. Selling and administrative expense $ 301,000 Depreciation expense 198,000 Sales 2,050,000 Interest expense 128,000 Cost of goods sold 521,000 Taxes 167,000

- Please answer all 3 parts accordingly: Joyner Company’s income statement for Year 2 follows: Sales $ 709,000 Cost of goods sold 76,000 Gross margin 633,000 Selling and administrative expenses 150,800 Net operating income 482,200 Nonoperating items: Gain on sale of equipment 5,000 Income before taxes 487,200 Income taxes 146,160 Net income $ 341,040 Its balance sheet amounts at the end of Years 1 and 2 are as follows: Year 2 Year 1 Assets Cash $ 313,940 $ 57,200 Accounts receivable 222,000 143,000 Inventory 319,000 279,000 Prepaid expenses 11,000 22,000 Total current assets 865,940 501,200 Property, plant, and equipment 640,000 508,000 Less accumulated depreciation 165,400 130,900 Net property, plant, and equipment 474,600 377,100 Loan to Hymans Company 48,000 0 Total assets $ 1,388,540 $ 878,300 Liabilities and Stockholders' Equity Accounts payable $ 315,000 $ 254,000 Accrued liabilities 43,000 51,000 Income…Use this information to Prepare a multiple-step income statement with earnings per sharedisclosure Denver Co. 12/31/2022 Debits CreditsPartial Trial Balance DataSales revenue 700,000Interest revenue 60,000Salary payable 15,000Gain on sale of land 110,000Patent 15,000Supply inventory 25,000Cost of goods sold 500,000Salary expenses 150,000Common stock 250,000Retained earnings 150,000Cash 250,000Office expense 100,000Denver's business segment, Division A, was sold at a pretax loss of 25,000 on July 1, 2022. Ithad earned a $13,000 pretax operating income from January 1, 2022 to the disposal date. Denverhad 50,000 shares of stock outstanding throughout the year. Income tax expense has not yet beenaccrued. The effective tax rate is 30%. dont give me handwritten answers thank youAssuming Net Sales is $180,000, Cost of Goods Sold is $79,000, Selling Expenses are $28,500, General Expenses are $22,800, and Interest Expense is $2,000, then Income from Operations is a.$101,000. b.$95,300. c.$72,500. d.$49,700. e.$27,700.

- Does anyone know how to prepare an income statement regarding this? Pls help ACCOUNT AMOUNT Revenue 500,000 Cost of Good Sold 300,000 Wage Expense 100,000 Rent Expense 30,000 Supplies Expense 20,000 Utilities Expense 10,000 Promotion Expense 50,000Multi Step Income Statement Using the following accounts, prepare a multi-step income statement at year end, May 31, 2021: Cost of Goods Sold, P84,000; General Expenses, P45,000; Interest Expense, P21,000; Interest Income, P9,000; Net Sales, P240,000; Selling Expenses, P55,500. Assume the name of the business.FDN Accounting Services purchased office supplies for P31,000 on terms 20% down payment and the balance 2/10 n/30. How much is the increase in the total assets of the business?