ties: rent liabilities e payable, 6%, due in 15 years al liabilities holders' equity:

ties: rent liabilities e payable, 6%, due in 15 years al liabilities holders' equity:

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 17E

Related questions

Question

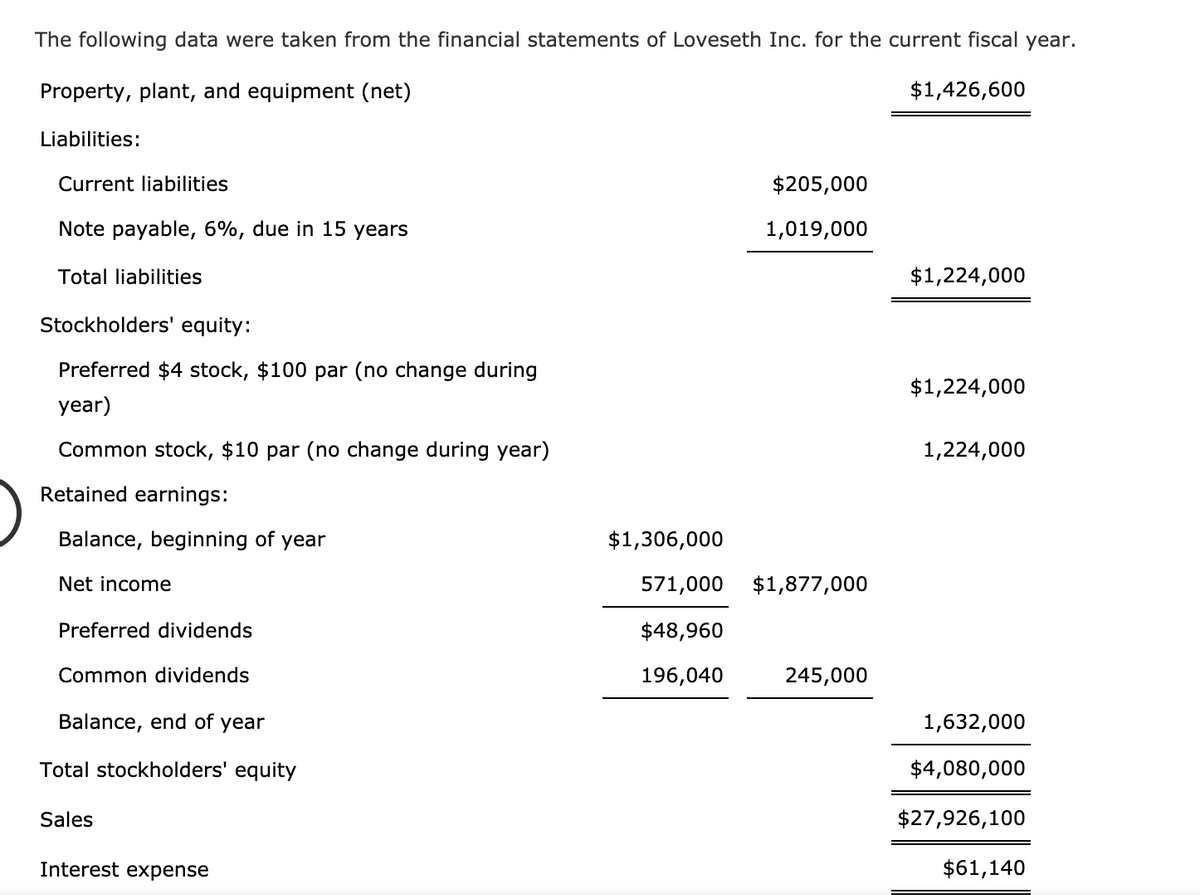

Transcribed Image Text:The following data were taken from the financial statements of Loveseth Inc. for the current fiscal year.

Property, plant, and equipment (net)

$1,426,600

Liabilities:

Current liabilities

$205,000

Note payable, 6%, due in 15 years

1,019,000

Total liabilities

$1,224,000

Stockholders' equity:

Preferred $4 stock, $100 par (no change during

$1,224,000

year)

Common stock, $10 par (no change during year)

1,224,000

Retained earnings:

Balance, beginning of

year

$1,306,000

Net income

571,000 $1,877,000

Preferred dividends

$48,960

Common dividends

196,040

245,000

Balance, end of year

1,632,000

Total stockholders' equity

$4,080,000

Sales

$27,926,100

Interest expense

$61,140

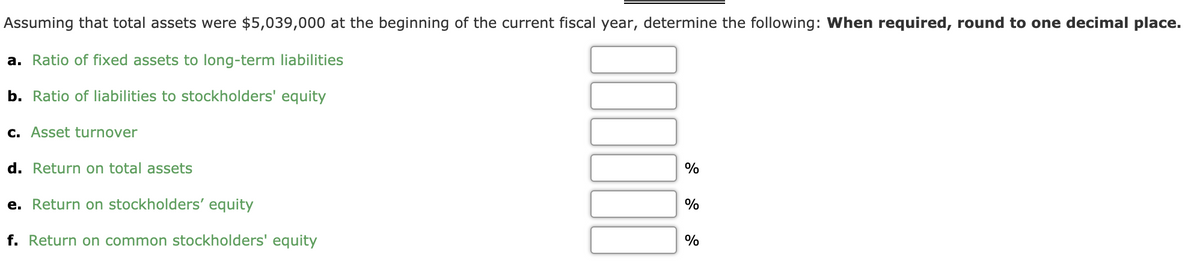

Transcribed Image Text:Assuming that total assets were $5,039,000 at the beginning of the current fiscal year, determine the following: When required, round to one decimal place.

a. Ratio of fixed assets to long-term liabilities

b. Ratio of liabilities to stockholders' equity

c. Asset turnover

d. Return on total assets

%

e. Return on stockholders' equity

%

f. Return on common stockholders' equity

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning