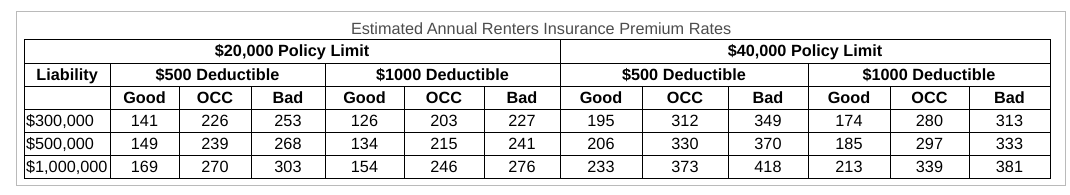

Tim Navholtz needs a $20,000 renters insurance policy and has selected the $500,000 liability with $1,000 deductible. The insurance company has determined his credit is excellent and has given him the "good" credit rate. If he adds an endorsement of $0.85/$100 to ensure $12,600 of jewelry, $20/year for the options of identity theft/protection and $75/year for sewer/sump pump backup protection for his basement, find his annual premium using the given table. Click the icon to see a hypothetical table of Estimated Annual Renters Insurance Premium Rates. The annual premium is $. (Simplify your answer. Type an integer or a decimal.)

Tim Navholtz needs a $20,000 renters insurance policy and has selected the $500,000 liability with $1,000 deductible. The insurance company has determined his credit is excellent and has given him the "good" credit rate. If he adds an endorsement of $0.85/$100 to ensure $12,600 of jewelry, $20/year for the options of identity theft/protection and $75/year for sewer/sump pump backup protection for his basement, find his annual premium using the given table. Click the icon to see a hypothetical table of Estimated Annual Renters Insurance Premium Rates. The annual premium is $. (Simplify your answer. Type an integer or a decimal.)

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

Tim Navholtz needs a $20,000 renters insurance policy and has selected the $500,000 liability with $1,000 deductible. The insurance company has determined his credit is excellent and has given him the "good" credit rate. If he adds an endorsement of $0.85/$100 to ensure $12,600 of jewelry, $20/year for the options of identity theft/protection and $75/year for sewer/sump pump backup protection for his basement, find his annual premium using the given table. Click the icon to see a hypothetical table of Estimated Annual Renters Insurance Premium Rates. The annual premium is $. (Simplify your answer. Type an integer or a decimal.)

Transcribed Image Text:Estimated Annual Renters Insurance Premium Rates

$20,000 Policy Limit

$40,000 Policy Limit

Liability

$500 Deductible

$1000 Deductible

$500 Deductible

$1000 Deductible

Good

ОСС

Bad

Good

ОСС

Bad

Good

ОСС

Bad

Good

ОСС

Bad

$300,000

$500,000

$1,000,000

141

226

253

126

203

227

195

312

349

174

280

313

149

239

268

134

215

241

206

330

370

185

297

333

169

270

303

154

246

276

233

373

418

213

339

381

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you