Time Inconsistency of Monetary Policy (All notations are the same as used in the class) Suppose that the Central Bank of Avocado Republic is facing the following Phillips Curve: * = n - 0.4 (u - u,) The Central Bank announces a monetary policy consistent with 1% inflation. The natural rate of unemployment (un) is assumed to be 3%. a. Assume that market participants believe in the Central Bank and form the expected inflation equal to 1% (r = 1%) . If the Central Bank follows through with its announced policy, what are the actual inflation rate and the unemployment rate? %3D ;u = b. Assume that the Central Bank weighs more on unemployment than inflation. So, to achieve an unemployment rate at 1 percentage point below the natural rate, what rate of inflation is the Central Bank willing to accept? To achieve an unemployment rate at u = the Central Bank is willing to accept = Do you think people will still believe in the Central Bank's announced policy? (Yes or No)

Time Inconsistency of Monetary Policy (All notations are the same as used in the class) Suppose that the Central Bank of Avocado Republic is facing the following Phillips Curve: * = n - 0.4 (u - u,) The Central Bank announces a monetary policy consistent with 1% inflation. The natural rate of unemployment (un) is assumed to be 3%. a. Assume that market participants believe in the Central Bank and form the expected inflation equal to 1% (r = 1%) . If the Central Bank follows through with its announced policy, what are the actual inflation rate and the unemployment rate? %3D ;u = b. Assume that the Central Bank weighs more on unemployment than inflation. So, to achieve an unemployment rate at 1 percentage point below the natural rate, what rate of inflation is the Central Bank willing to accept? To achieve an unemployment rate at u = the Central Bank is willing to accept = Do you think people will still believe in the Central Bank's announced policy? (Yes or No)

Chapter17: The Philips Curve And Expetactions Theory

Section: Chapter Questions

Problem 12SQ

Related questions

Question

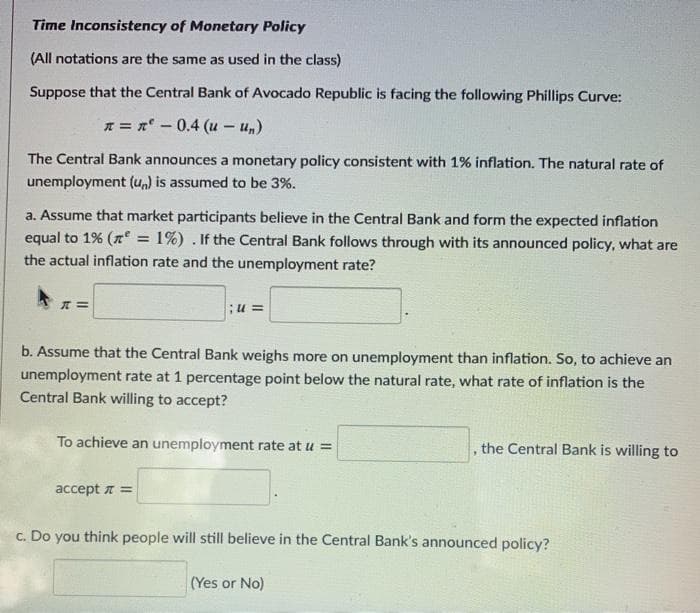

Transcribed Image Text:Time Inconsistency of Monetary Policy

(All notations are the same as used in the class)

Suppose that the Central Bank of Avocado Republic is facing the following Phillips Curve:

* = n-0.4 (u - u,)

The Central Bank announces a monetary policy consistent with 1% inflation. The natural rate of

unemployment (un) is assumed to be 3%.

a. Assume that market participants believe in the Central Bank and form the expected inflation

equal to 1% (n = 1%) . If the Central Bank follows through with its announced policy, what are

the actual inflation rate and the unemployment rate?

;u =

b. Assume that the Central Bank weighs more on unemployment than inflation. So, to achieve an

unemployment rate at 1 percentage point below the natural rate, what rate of inflation is the

Central Bank willing to accept?

To achieve an unemployment rate at u =

the Central Bank is willing to

accept a =

c. Do you think people will still believe in the Central Bank's announced policy?

(Yes or No)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning