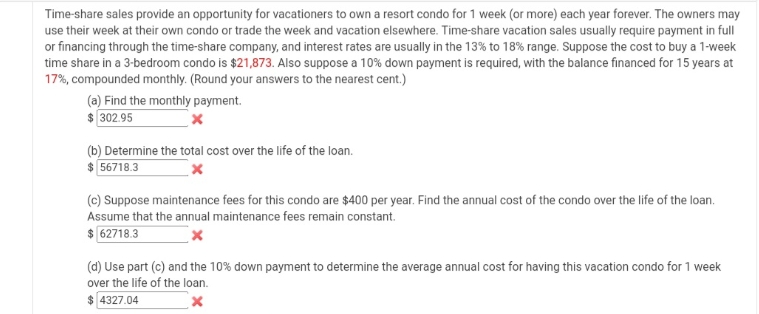

Time-share sales provide an opportunity for vacationers to own a resort condo for 1 week (or more) each year forever. The owners may use their week at their own condo or trade the week and vacation elsewhere. Time-share vacation sales usually require payment in full or financing through the time-share company, and interest rates are usually in the 13% to 18% range. Suppose the cost to buy a 1-week time share in a 3-bedroom condo is $21,873. Also suppose a 10% down payment is required, with the balance financed for 15 years at 17%, compounded monthly. (Round your answers to the nearest cent.) (a) Find the monthly payment. $302.95 x (b) Determine the total cost over the life of the loan. $ 56718.3 (c) Suppose maintenance fees for this condo are $400 per year. Find the annual cost of the condo over the life of the loan. Assume that the annual maintenance fees remain constant. $62718.3 X (d) Use part (c) and the 10% down payment to determine the average annual cost for having this vacation condo for 1 week over the life of the loan. $4327.04 X

Time-share sales provide an opportunity for vacationers to own a resort condo for 1 week (or more) each year forever. The owners may use their week at their own condo or trade the week and vacation elsewhere. Time-share vacation sales usually require payment in full or financing through the time-share company, and interest rates are usually in the 13% to 18% range. Suppose the cost to buy a 1-week time share in a 3-bedroom condo is $21,873. Also suppose a 10% down payment is required, with the balance financed for 15 years at 17%, compounded monthly. (Round your answers to the nearest cent.) (a) Find the monthly payment. $302.95 x (b) Determine the total cost over the life of the loan. $ 56718.3 (c) Suppose maintenance fees for this condo are $400 per year. Find the annual cost of the condo over the life of the loan. Assume that the annual maintenance fees remain constant. $62718.3 X (d) Use part (c) and the 10% down payment to determine the average annual cost for having this vacation condo for 1 week over the life of the loan. $4327.04 X

Chapter9: Obtaining Affordable Housing

Section: Chapter Questions

Problem 2DTM

Related questions

Question

solve asap all the question with complete explanation and get upvotes

Transcribed Image Text:Time-share sales provide an opportunity for vacationers to own a resort condo for 1 week (or more) each year forever. The owners may

use their week at their own condo or trade the week and vacation elsewhere. Time-share vacation sales usually require payment in full

or financing through the time-share company, and interest rates are usually in the 13% to 18% range. Suppose the cost to buy a 1-week

time share in a 3-bedroom condo is $21,873. Also suppose a 10% down payment is required, with the balance financed for 15 years at

17%, compounded monthly. (Round your answers to the nearest cent.)

(a) Find the monthly payment.

$ 302.95

(b) Determine the total cost over the life of the loan.

$ 56718.3

(c) Suppose maintenance fees for this condo are $400 per year. Find the annual cost of the condo over the life of the loan.

Assume that the annual maintenance fees remain constant.

$ 62718.3

(d) Use part (c) and the 10% down payment to determine the average annual cost for having this vacation condo for 1 week

over the life of the loan.

$ 4327.04

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning