The following data are accumulated by Geddes Company in evaluating the purchase of $120,000 of equipment, having a four-year useful fe Net Income Net Cash Flow Year 1 $49,500 $79,500 Year 2 29,000 59,000 Year 3 16,500 46,500 Year 4 6,500 36,500 This information has been collected in the Microsot Excel Online fle. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. K) open spreadsheet a. Auming that the desired rate of return is 15%, determine the net present value for the proposal. f required, round to the nearest dollac Net present value b. Would management be lky to look with favor on the proposal? the net present value indicates that the return on the proposal is than the minimum desired rate of returm of 15%

The following data are accumulated by Geddes Company in evaluating the purchase of $120,000 of equipment, having a four-year useful fe Net Income Net Cash Flow Year 1 $49,500 $79,500 Year 2 29,000 59,000 Year 3 16,500 46,500 Year 4 6,500 36,500 This information has been collected in the Microsot Excel Online fle. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. K) open spreadsheet a. Auming that the desired rate of return is 15%, determine the net present value for the proposal. f required, round to the nearest dollac Net present value b. Would management be lky to look with favor on the proposal? the net present value indicates that the return on the proposal is than the minimum desired rate of returm of 15%

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 9EA: Santa Rosa recently purchased a new boat to help ship product overseas. The following information is...

Related questions

Question

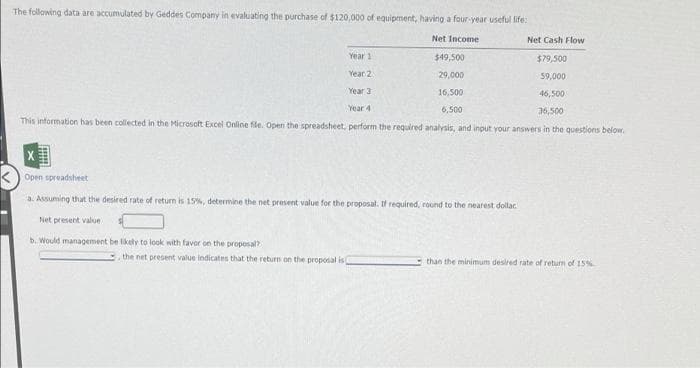

Transcribed Image Text:The following data are accumulated by Geddes Company in evaluating the purchase of $120,000 of equipment, having a four-year useful life:

Net Income

Net Cash Flow

Year 1

$49,500

$79,500

Year 2

29,000

59,000

Year 3

16,500

46,500

Year 4

6,500

36,500

This information has been collected in the Microsaft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below.

K) Open spreadsheet

a. Assuming that the desired rate of return is 15%, determine the net present value for the proposal. If required, round to the nearest dollac.

Net present value

b. Would management be likely to look with favor on the propesal?

the net present value indicates that the return on the proposal is

than the minimum desired rate of retum of 15%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning