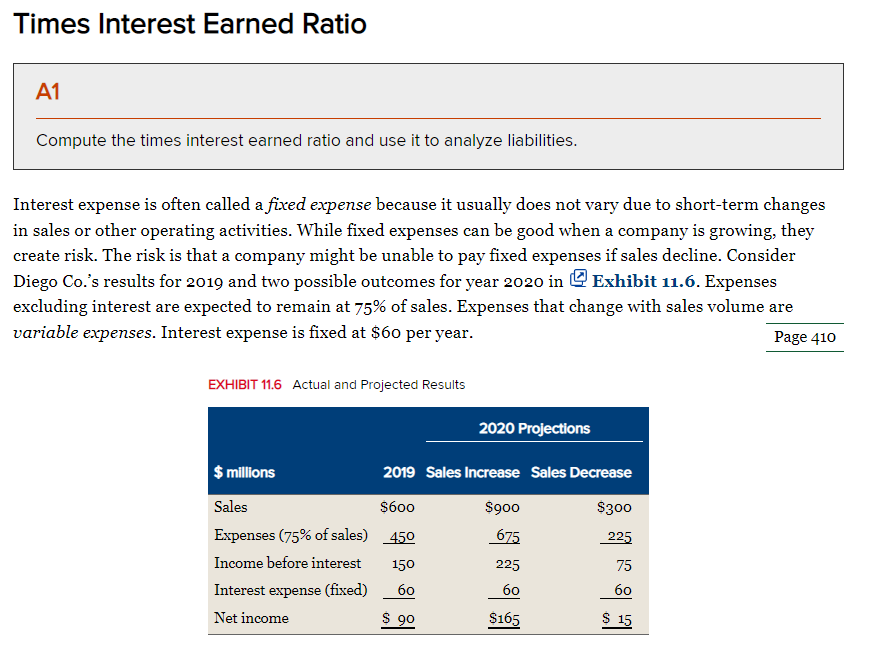

Times Interest Earned Ratio A1 Compute the times interest earned ratio and use it to analyze liabilities. Interest expense is often called a fixed expense because it usually does not vary due to short-term changes in sales or other operating activities. While fixed expenses can be good when a company is growing, they create risk. The risk is that a company might be unable to pay fixed expenses if sales decline. Consider Diego Co.'s results for 2019 and two possible outcomes for year 2020 in O Exhibit 11.6. Expenses excluding interest are expected to remain at 75% of sales. Expenses that change with sales volume are variable expenses. Interest expense is fixed at $60 per year. Page 410 EXHIBIT 11.6 Actual and Projected Results 2020 Projections $ millions 2019 Sales Increase Sales Decrease Sales $600 $900 $300 Expenses (75% of sales) 450 675 225 Income before interest 150 225 75 Interest expense (fixed) бо 60 60 Net income $ 90 $165 $ 15

Times Interest Earned Ratio A1 Compute the times interest earned ratio and use it to analyze liabilities. Interest expense is often called a fixed expense because it usually does not vary due to short-term changes in sales or other operating activities. While fixed expenses can be good when a company is growing, they create risk. The risk is that a company might be unable to pay fixed expenses if sales decline. Consider Diego Co.'s results for 2019 and two possible outcomes for year 2020 in O Exhibit 11.6. Expenses excluding interest are expected to remain at 75% of sales. Expenses that change with sales volume are variable expenses. Interest expense is fixed at $60 per year. Page 410 EXHIBIT 11.6 Actual and Projected Results 2020 Projections $ millions 2019 Sales Increase Sales Decrease Sales $600 $900 $300 Expenses (75% of sales) 450 675 225 Income before interest 150 225 75 Interest expense (fixed) бо 60 60 Net income $ 90 $165 $ 15

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter9: Corporate Valuation And Financial Planning

Section: Chapter Questions

Problem 3P: AFN Equation Refer to Problem 9-1. Return to the assumption that the company had 5 million in assets...

Related questions

Concept explainers

Mortgages

A mortgage is a formal agreement in which a bank or other financial institution lends cash at interest in return for assuming the title to the debtor's property, on the condition that the obligation is paid in full.

Mortgage

The term "mortgage" is a type of loan that a borrower takes to maintain his house or any form of assets and he agrees to return the amount in a particular period of time to the lender usually in a series of regular equally monthly, quarterly, or half-yearly payments.

Question

Compute the times interest ratio and use it to analyze liabilities.

Show work

Transcribed Image Text:Times Interest Earned Ratio

A1

Compute the times interest earned ratio and use it to analyze liabilities.

Interest expense is often called a fixed expense because it usually does not vary due to short-term changes

in sales or other operating activities. While fixed expenses can be good when a company is growing, they

create risk. The risk is that a company might be unable to pay fixed expenses if sales decline. Consider

Diego Co.'s results for 2019 and two possible outcomes for year 2020 in O Exhibit 11.6. Expenses

excluding interest are expected to remain at 75% of sales. Expenses that change with sales volume are

variable expenses. Interest expense is fixed at $6o per year.

Page 410

EXHIBIT 11.6 Actual and Projected Results

2020 Projections

$ illions

2019 Sales Increase Sales Decrease

Sales

$600

$900

$300

Expenses (75% of sales) 450

675

225

Income before interest

150

225

75

Interest expense (fixed)

60

бо

бо

Net income

$ 90

$165

$ 15

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning