Case A Case B Case C Case D Current-Year 2015 YTD operating income (loss) Projected income (loss) for the balance of the More likely than not. Not more likely than not. Future income considered more likely than not . Prior-Year 2014 Statutory tax rate Annual operating income (loss). . Future income considered more likely than not Prior-Year 2013 Statutory tax rate Annual operating income (loss). Future income considered more likely than not $ (80,000) $(80,000) $ 50,000 $(20,000) year considered: 120,000 (80,000) (40,000) 30,000 20,000 80,000 25% 25% 25% 25% (30,000) 35,000 20,000 10,000 15,000 (40,000) 5,000 15% 15% 15% 10,000 (20,000) 30,000

Case A Case B Case C Case D Current-Year 2015 YTD operating income (loss) Projected income (loss) for the balance of the More likely than not. Not more likely than not. Future income considered more likely than not . Prior-Year 2014 Statutory tax rate Annual operating income (loss). . Future income considered more likely than not Prior-Year 2013 Statutory tax rate Annual operating income (loss). Future income considered more likely than not $ (80,000) $(80,000) $ 50,000 $(20,000) year considered: 120,000 (80,000) (40,000) 30,000 20,000 80,000 25% 25% 25% 25% (30,000) 35,000 20,000 10,000 15,000 (40,000) 5,000 15% 15% 15% 10,000 (20,000) 30,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 21E: Uncertain Tax Position At the end of the current year, Boyd Company claims a 200,000 tax credit on...

Related questions

Question

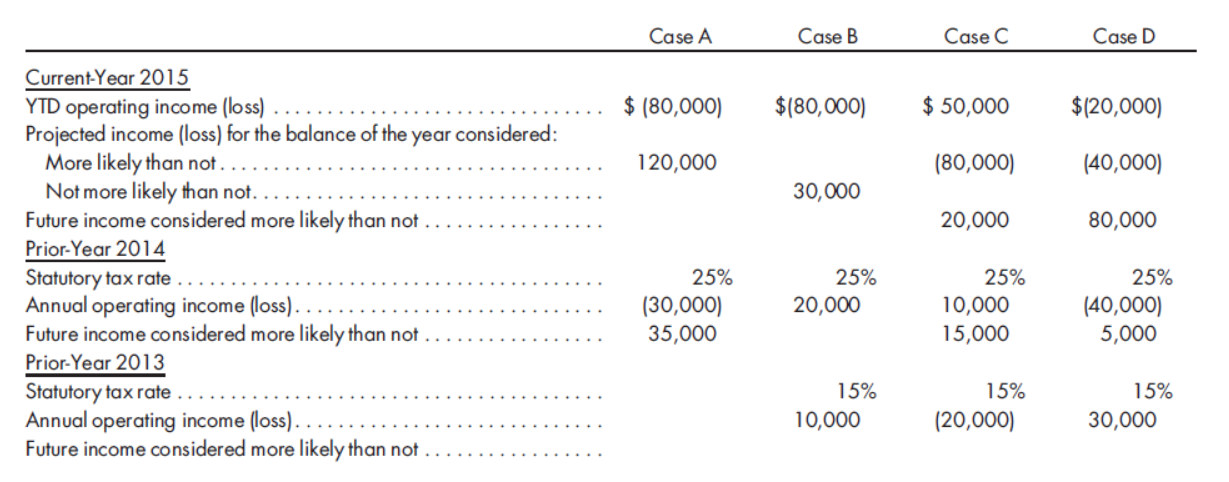

The current-year 2015 statutory tax rate is 30%. For each of the following cases, determine the 2015 year-to-date (YTD) tax benefit traceable to the YTD operating loss.

Transcribed Image Text:Case A

Case B

Case C

Case D

Current-Year 2015

YTD operating income (loss)

Projected income (loss) for the balance of the

More likely than not.

Not more likely than not.

Future income considered more likely than not .

Prior-Year 2014

Statutory tax rate

Annual operating income (loss). .

Future income considered more likely than not

Prior-Year 2013

Statutory tax rate

Annual operating income (loss).

Future income considered more likely than not

$ (80,000)

$(80,000)

$ 50,000

$(20,000)

year

considered:

120,000

(80,000)

(40,000)

30,000

20,000

80,000

25%

25%

25%

25%

(30,000)

35,000

20,000

10,000

15,000

(40,000)

5,000

15%

15%

15%

10,000

(20,000)

30,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT