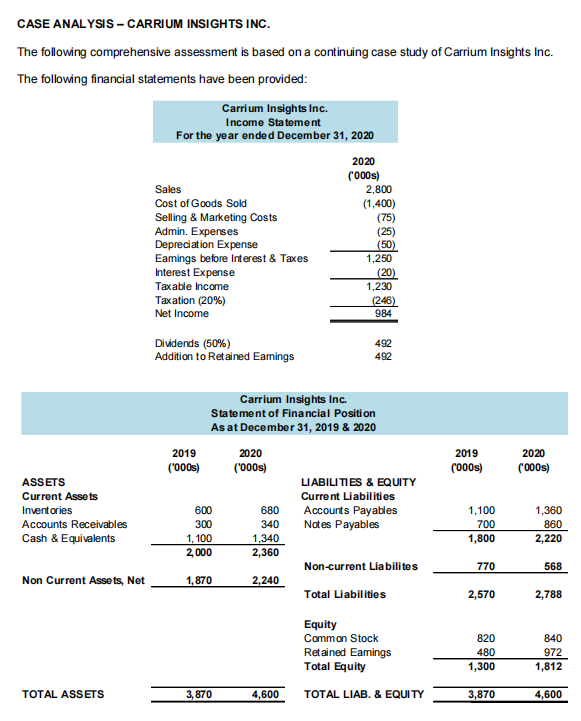

PART A As part of your analysis, you are required to investigate Carrium Insights Inc. cash flows and compute selected financial ratios using the financial statements provided Required:

Question 1

PART A

As part of your analysis, you are required to investigate Carrium Insights Inc.

Required:

(a) Calculate the following for 2020:

- Operating Cash Flow

- Net Capital Spending

- Change in Net

Working Capital - Cash Flow from Assets

- Cash Flow to Creditors

- Cash Flow to Stockholders

(b) A company’s asset utilization or turnover ratios are intended to display how efficiently or intensively a firm uses its assets to generate sales. Calculate the following turnover ratios for 2020:

- Inventory Turnover

- Days’ sales in inventory

- NWC Turnover

- Total Asset Turnover

PART B

The Finance Manager is trying to ensure that the company’s excess cash holdings are all invested in interest-bearing short-term instruments. Carrium’s bankers have provided details on enhanced savings accounts that is offered to business clients:

Option 1: Annual interest rate of 8%, compounded weekly;

Option 2: Annual interest rate of 8.25%, compounded monthly;

Option 3: Annual interest rate of 8.30%.

Required: Advise the Finance Manager on the best option.

Trending now

This is a popular solution!

Step by step

Solved in 5 steps