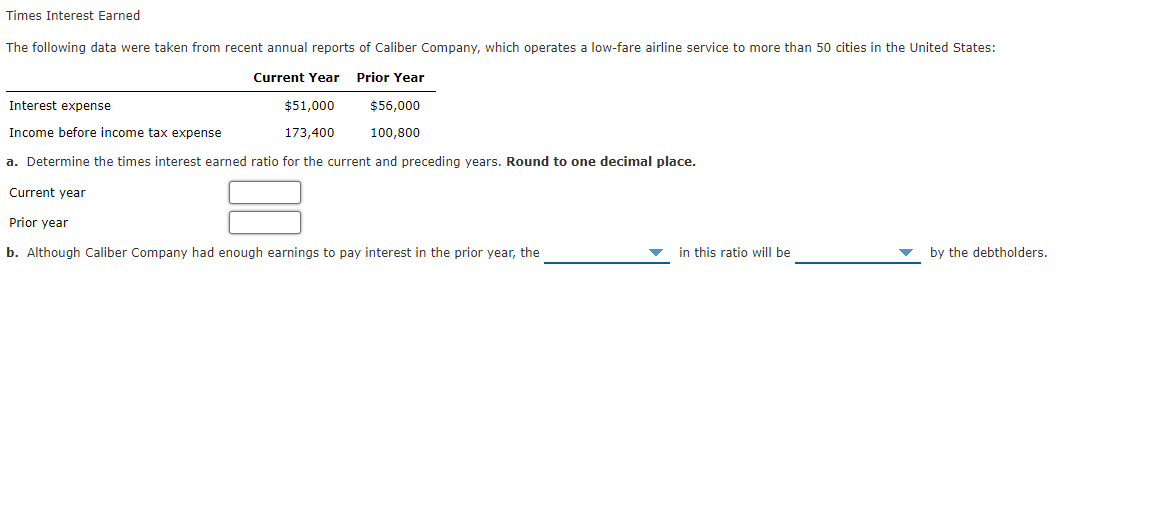

Times Interest Earned The following data were taken from recent annual reports of Caliber Company, which operates a low-fare airline service to more than 50 cities in the United States: Current Year Prior Year Interest expense $51,000 $56,000 Income before income tax expense 173,400 100,800 a. Determine the times interest earned ratio for the current and preceding years. Round to one decimal place. Current year Prior year b. Although Caliber Company had enough earnings to pay interest in the prior year, the in this ratio will be by the debtholders.

Times Interest Earned The following data were taken from recent annual reports of Caliber Company, which operates a low-fare airline service to more than 50 cities in the United States: Current Year Prior Year Interest expense $51,000 $56,000 Income before income tax expense 173,400 100,800 a. Determine the times interest earned ratio for the current and preceding years. Round to one decimal place. Current year Prior year b. Although Caliber Company had enough earnings to pay interest in the prior year, the in this ratio will be by the debtholders.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 61E: Recording Various Liabilities Glenview Hardware had the following transactions that produced...

Related questions

Question

Transcribed Image Text:Times Interest Earned

The following data were taken from recent annual reports of Caliber Company, which operates a low-fare airline service to more than 50 cities in the United States:

Current Year

Prior Year

Interest expense

$51,000

$56,000

Income before income tax expense

173,400

100,800

a. Determine the times interest earned ratio for the current and preceding years. Round to one decimal place.

Current year

Prior year

b. Although Caliber Company had enough earnings to pay interest in the prior year, the

in this ratio will be

by the debtholders.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub