Investment cost Expected life Market (salvage) value³ Proposal A $9,000 6 years - $900 Annual receipts Annual expenses $7,000 $4,000 * A negative market value means that there is a net cost to dispose of an asset. To Find P Discrete Compounding; i=12% Single Payment Compound Amount Factor To Find F Present Worth Factor Compound Amount Uniform Series Sinking Present Fund Factor Worth Factor Factor To Find F To Find P To Find A Given P Given F Given A Given A Given F Capital Recovery Factor To Find A Given P N FIP PIF FIA PIA AIF AIP 1 1.1200 0.8929 1.0000 0.8929 1.0000 1.1200 2 1.2544 0.7972 2.1200 1.6901 0.4717 0.5917 3 1.4049 0.7118 3.3744 2.4018 0.2963 0.4163 456 00 o 1.5735 0.6355 4.7793 3.0373 0.2092 0.3292 5 1.7623 0.5674 6.3528 3.6048 0.1574 0.2774 1.9738 0.5066 8.1152 4.1114 0.1232 0.2432 7 2.2107 0.4523 10.0890 4.5638 0.0991 0.2191 8 2.4760 0.4039 12.2997 4.9676 0.0813 0.2013 9 2.7731 0.3606 14.7757 5.3282 0.0677 0.1877 5407 0570 0177O

Investment cost Expected life Market (salvage) value³ Proposal A $9,000 6 years - $900 Annual receipts Annual expenses $7,000 $4,000 * A negative market value means that there is a net cost to dispose of an asset. To Find P Discrete Compounding; i=12% Single Payment Compound Amount Factor To Find F Present Worth Factor Compound Amount Uniform Series Sinking Present Fund Factor Worth Factor Factor To Find F To Find P To Find A Given P Given F Given A Given A Given F Capital Recovery Factor To Find A Given P N FIP PIF FIA PIA AIF AIP 1 1.1200 0.8929 1.0000 0.8929 1.0000 1.1200 2 1.2544 0.7972 2.1200 1.6901 0.4717 0.5917 3 1.4049 0.7118 3.3744 2.4018 0.2963 0.4163 456 00 o 1.5735 0.6355 4.7793 3.0373 0.2092 0.3292 5 1.7623 0.5674 6.3528 3.6048 0.1574 0.2774 1.9738 0.5066 8.1152 4.1114 0.1232 0.2432 7 2.2107 0.4523 10.0890 4.5638 0.0991 0.2191 8 2.4760 0.4039 12.2997 4.9676 0.0813 0.2013 9 2.7731 0.3606 14.7757 5.3282 0.0677 0.1877 5407 0570 0177O

Essentials of Economics (MindTap Course List)

8th Edition

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter19: The Basic Tools Of Finance

Section: Chapter Questions

Problem 1CQQ

Related questions

Question

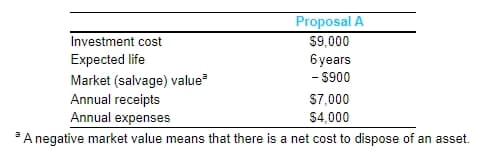

Determine the FW of the following engineering project when the MARR is 12% per year. Is the project acceptable?

Transcribed Image Text:Investment cost

Expected life

Market (salvage) value³

Proposal A

$9,000

6 years

- $900

Annual receipts

Annual expenses

$7,000

$4,000

* A negative market value means that there is a net cost to dispose of an asset.

Transcribed Image Text:To Find P

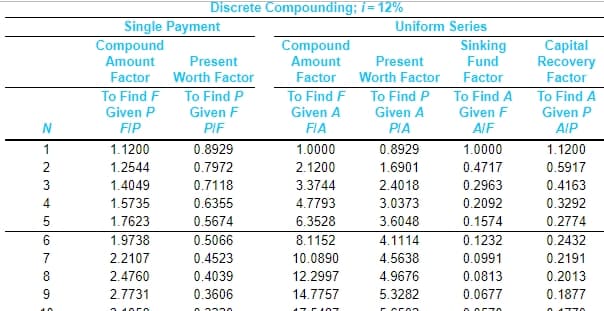

Discrete Compounding; i=12%

Single Payment

Compound

Amount

Factor

To Find F

Present

Worth Factor

Compound

Amount

Uniform Series

Sinking

Present

Fund

Factor

Worth Factor

Factor

To Find F

To Find P

To Find A

Given P

Given F

Given A

Given A

Given F

Capital

Recovery

Factor

To Find A

Given P

N

FIP

PIF

FIA

PIA

AIF

AIP

1

1.1200

0.8929

1.0000

0.8929

1.0000

1.1200

2

1.2544

0.7972

2.1200

1.6901

0.4717

0.5917

3

1.4049

0.7118

3.3744

2.4018

0.2963

0.4163

456 00 o

1.5735

0.6355

4.7793

3.0373

0.2092

0.3292

5

1.7623

0.5674

6.3528

3.6048

0.1574

0.2774

1.9738

0.5066

8.1152

4.1114

0.1232

0.2432

7

2.2107

0.4523

10.0890

4.5638

0.0991

0.2191

8

2.4760

0.4039

12.2997

4.9676

0.0813

0.2013

9

2.7731

0.3606

14.7757

5.3282

0.0677

0.1877

5407

0570

0177O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 1 steps with 1 images

Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning