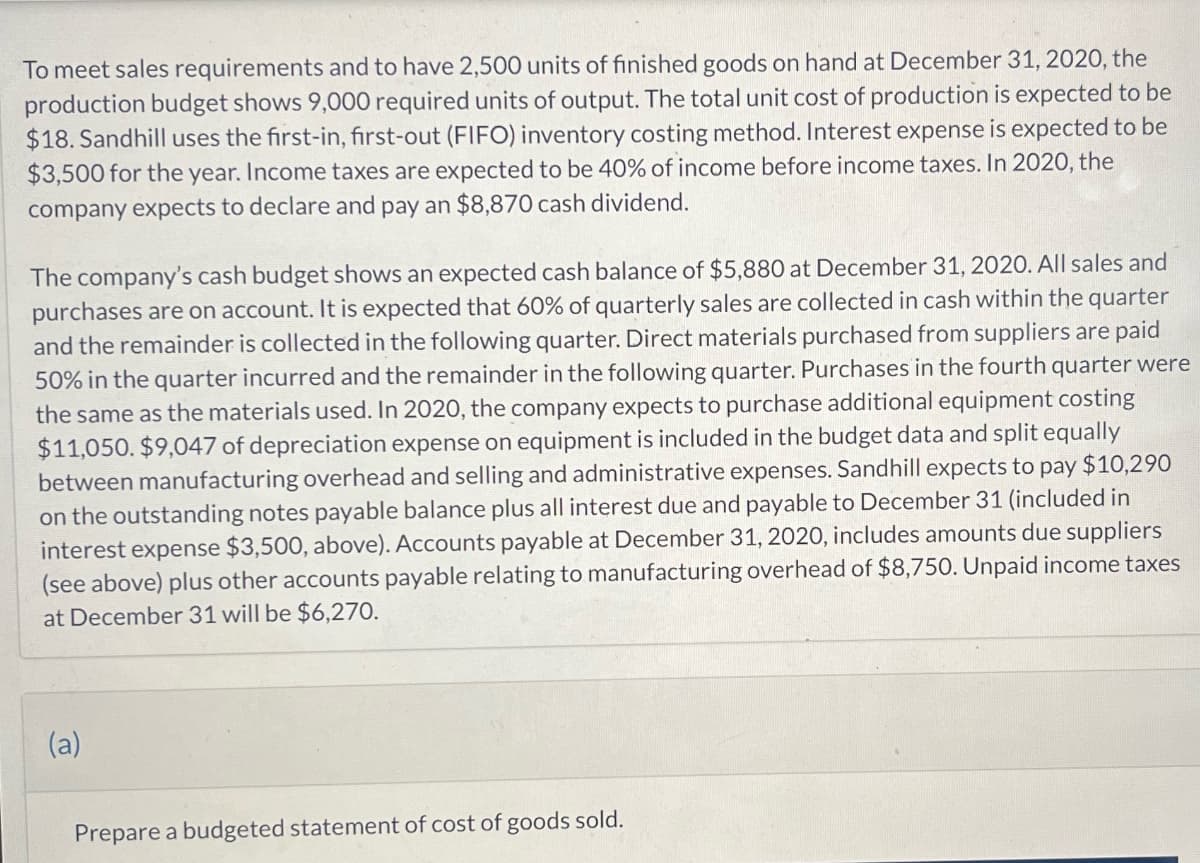

To meet sales requirements and to have 2,500 units of finished goods on hand at December 31, 2020, the production budget shows 9,000 required units of output. The total unit cost of production is expected to be $18. Sandhill uses the first-in, first-out (FIFO) inventory costing method. Interest expense is expected to be $3,500 for the year. Income taxes are expected to be 40% of income before income taxes. In 2020, the company expects to declare and pay an $8,870 cash dividend. The company's cash budget shows an expected cash balance of $5,880 at December 31, 2020. All sales and purchases are on account. It is expected that 60% of quarterly sales are collected in cash within the quarter and the remainder is collected in the following quarter. Direct materials purchased from suppliers are paid 50% in the quarter incurred and the remainder in the following quarter. Purchases in the fourth quarter were the same as the materials used. In 2020, the company expects to purchase additional equipment costing $11,050. $9,047 of depreciation expense on equipment is included in the budget data and split equally between manufacturing overhead and selling and administrative expenses. Sandhill expects to pay $10,290 on the outstanding notes payable balance plus all interest due and payable to December 31 (included in interest expense $3,500, above). Accounts payable at December 31, 2020, includes amounts due suppliers (see above) plus other accounts payable relating to manufacturing overhead of $8,750. Unpaid income taxes at December 31 will be $6,270. (a) Prepare a budgeted statement of cost of goods sold.

To meet sales requirements and to have 2,500 units of finished goods on hand at December 31, 2020, the production budget shows 9,000 required units of output. The total unit cost of production is expected to be $18. Sandhill uses the first-in, first-out (FIFO) inventory costing method. Interest expense is expected to be $3,500 for the year. Income taxes are expected to be 40% of income before income taxes. In 2020, the company expects to declare and pay an $8,870 cash dividend. The company's cash budget shows an expected cash balance of $5,880 at December 31, 2020. All sales and purchases are on account. It is expected that 60% of quarterly sales are collected in cash within the quarter and the remainder is collected in the following quarter. Direct materials purchased from suppliers are paid 50% in the quarter incurred and the remainder in the following quarter. Purchases in the fourth quarter were the same as the materials used. In 2020, the company expects to purchase additional equipment costing $11,050. $9,047 of depreciation expense on equipment is included in the budget data and split equally between manufacturing overhead and selling and administrative expenses. Sandhill expects to pay $10,290 on the outstanding notes payable balance plus all interest due and payable to December 31 (included in interest expense $3,500, above). Accounts payable at December 31, 2020, includes amounts due suppliers (see above) plus other accounts payable relating to manufacturing overhead of $8,750. Unpaid income taxes at December 31 will be $6,270. (a) Prepare a budgeted statement of cost of goods sold.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 17E: Crescent Company produces stuffed toy animals; one of these is Arabeau the Cow. Each Arabeau takes...

Related questions

Question

Transcribed Image Text:To meet sales requirements and to have 2,500 units of finished goods on hand at December 31, 2020, the

production budget shows 9,000 required units of output. The total unit cost of production is expected to be

$18. Sandhill uses the first-in, first-out (FIFO) inventory costing method. Interest expense is expected to be

$3,500 for the year. Income taxes are expected to be 40% of income before income taxes. In 2020, the

company expects to declare and pay an $8,870 cash dividend.

The company's cash budget shows an expected cash balance of $5,880 at December 31, 2020. All sales and

purchases are on account. It is expected that 60% of quarterly sales are collected in cash within the quarter

and the remainder is collected in the following quarter. Direct materials purchased from suppliers are paid

50% in the quarter incurred and the remainder in the following quarter. Purchases in the fourth quarter were

the same as the materials used. In 2020, the company expects to purchase additional equipment costing

$11,050. $9,047 of depreciation expense on equipment is included in the budget data and split equally

between manufacturing overhead and selling and administrative expenses. Sandhill expects to pay $10,290

on the outstanding notes payable balance plus all interest due and payable to December 31 (included in

interest expense $3,500, above). Accounts payable at December 31, 2020, includes amounts due suppliers

(see above) plus other accounts payable relating to manufacturing overhead of $8,750. Unpaid income taxes

at December 31 will be $6,270.

(a)

Prepare a budgeted statement of cost of goods sold.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning