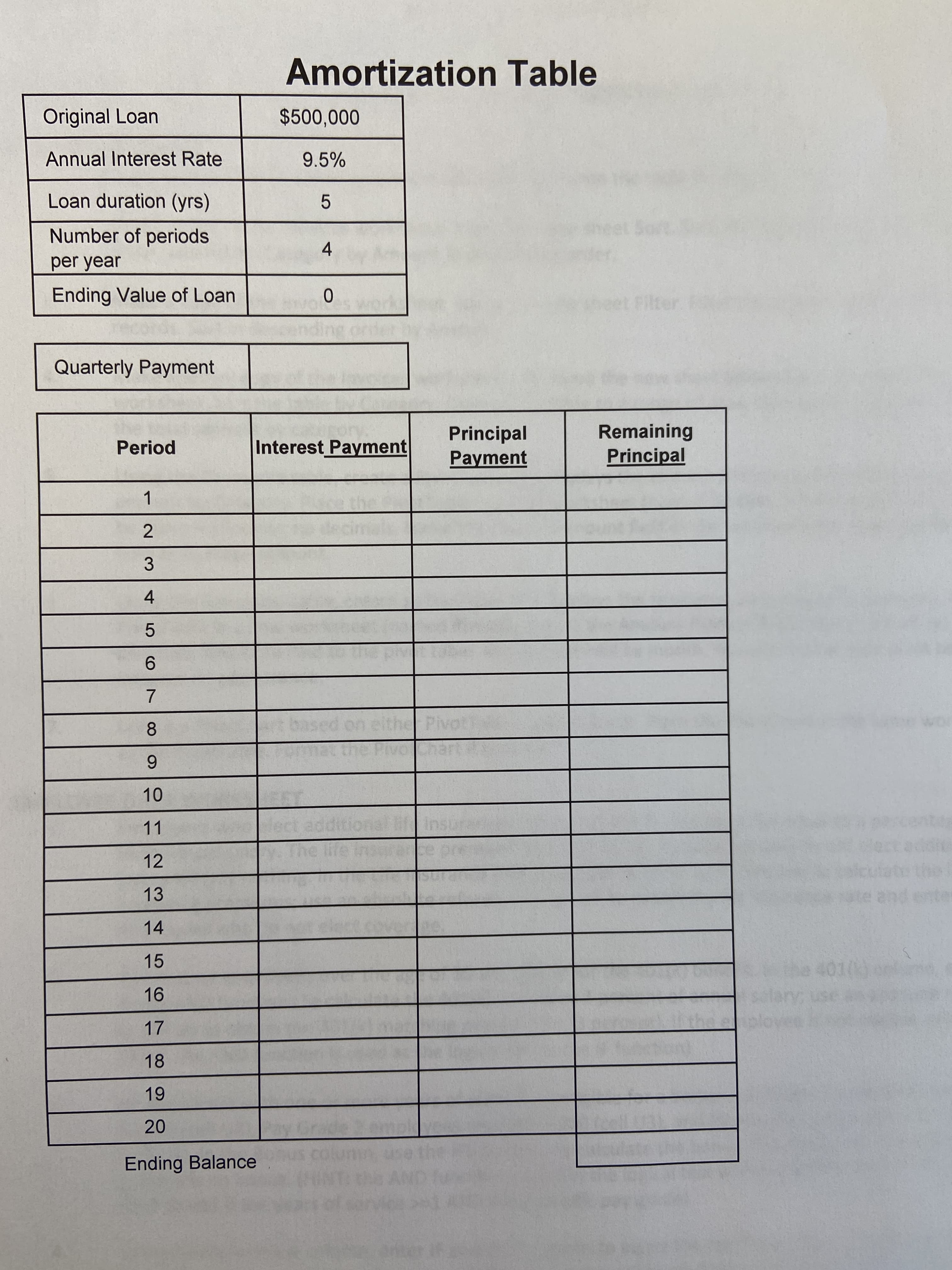

To pay for remodeling, the company will take out a $500,000 five-year loan at 9.5% interest, compounded quarterly. The terms of the loan have been entered in the Loan Analysis worksheet. In cell B8, calculate the quarterly payment on the loan based on the loan conditions already entered. Complete the amortization schedule in cells B11 through E30. Column B contains the interest payment for each quarter, and column C contains the principal payment. Column D contains the remaining principal at the start of each month. The initial principal remaining is $500,000. The subsequent remaining principal values are reduced by the principal payment made in the previous quarter. Calculate the ending balance in cell D31. Use the IPMT function in cell B11 to calculate the interest amount paid per period. Copy this formula to cell B30. Use the PPMT function in cell C11 to calculate the principal amount paid per period. Copy this formula to cell C30. Write a formula in cell D11 to indicate the beginning balance of the loan. Write a formula in cell D12 to calculate the remaining balance after each payment (only adjust for the principal). Copy this formula down the column to cell D31.

To pay for remodeling, the company will take out a $500,000 five-year loan at 9.5% interest, compounded quarterly. The terms of the loan have been entered in the Loan Analysis worksheet. In cell B8, calculate the quarterly payment on the loan based on the loan conditions already entered. Complete the amortization schedule in cells B11 through E30. Column B contains the interest payment for each quarter, and column C contains the principal payment. Column D contains the remaining principal at the start of each month. The initial principal remaining is $500,000. The subsequent remaining principal values are reduced by the principal payment made in the previous quarter. Calculate the ending balance in cell D31. Use the IPMT function in cell B11 to calculate the interest amount paid per period. Copy this formula to cell B30. Use the PPMT function in cell C11 to calculate the principal amount paid per period. Copy this formula to cell C30. Write a formula in cell D11 to indicate the beginning balance of the loan. Write a formula in cell D12 to calculate the remaining balance after each payment (only adjust for the principal). Copy this formula down the column to cell D31.

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 18P

Related questions

Question

To pay for remodeling, the company will take out a $500,000 five-year loan at 9.5% interest, compounded quarterly. The terms of the loan have been entered in the Loan Analysis worksheet.

- In cell B8, calculate the quarterly payment on the loan based on the loan conditions already entered.

- Complete the amortization schedule in cells B11 through E30. Column B contains the interest payment for each quarter, and column C contains the principal payment. Column D contains the remaining principal at the start of each month. The initial principal remaining is $500,000. The subsequent remaining principal values are reduced by the principal payment made in the previous quarter. Calculate the ending balance in cell D31.

- Use the IPMT function in cell B11 to calculate the interest amount paid per period. Copy this formula to cell B30.

- Use the PPMT function in cell C11 to calculate the principal amount paid per period. Copy this formula to cell C30.

- Write a formula in cell D11 to indicate the beginning balance of the loan.

- Write a formula in cell D12 to calculate the remaining balance after each payment (only adjust for the principal). Copy this formula down the column to cell D31.

Transcribed Image Text:Amortization Table

Original Loan

$500,000

Annual Interest Rate

9.5%

Loan duration (yrs)

5.

Number of periods

4

per year

Ending Value of Loan

Quarterly Payment

Principal

Payment

Remaining

Principal

Period

Interest Payment

1.

3

4

5.

9.

8

11

12

13

and

14

15

17

18

20

Ending Balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning